The increase in withholdings on value-added products is one of the hottest points in the debate over the omnibus bill that the Government sent to Congress. In the different sectors of the industry they warn of the loss of employment and the fall in exports that could generate. They point out that, despite the increase in rates, less would be collected due to the closure of external markets. The governors of Córdoba and Santa Fe are pressing to withdraw the article but Javier Milei does not give in with the tax increase.

At this time, the battery of measures included in the project “Bases and Starting Points for the Freedom of Argentines” has an uncertain ending. The ruling party obtained a majority opinion but divergences predominate among the signatories. The counterpoints are precisely in the chapters that matter most to the Government: the decrease in spending due to the reduction in pensions and the increase in taxes via higher withholdings.

On this last point, the Government granted the reduction to 0% for some 30 regional economies but did not give in to the increase of up to 15% for industrialized products. In dialogue with Ámbito, the economist specializing in productive development, Leandro Mora Alfonsinconsidered: “The proposed increase in withholdings has a marked anti-industrial bias. The sector today pays an average of 2.2% in export duties, this bill plans to increase to 15% without strategic considerations.”

The Association of Argentine Component Manufacturers (AFAC) prepared a detailed report in which it warns that “an increase to 15% in withholdings would leave a large part of the auto parts export activity out of competition.” In that sense, he explained that “we go from a current situation of a marginal contribution of 4% to a situation of negative marginal contribution of 8%, making operations unviable.”

In the sector, which exports to 114 countries with an average value per ton of US$6,600, they assure that in the “very short term” About 5,000 jobs and exports worth about US$370 million are at serious risk.

AFAC box.jpeg

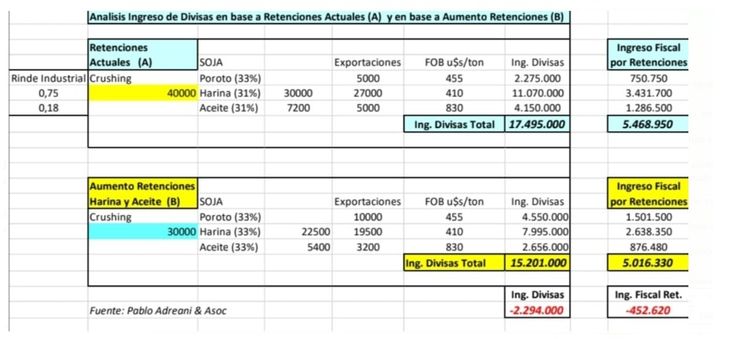

For its part, The agroindustry calculated the losses at US$2,294 million in terms of foreign currency income and US$452 million in terms of tax collection.. The report being studied in the offices of the sector’s chambers is signed by agricultural consultant Pablo Andreani and argues that “the measure of increasing withholdings on soybean oil and flour directly impacts the lower profitability of producers, therefore the lower price received when it sells its production, which reduces the oil industry’s purchasing capacity for the soy product by 10 u$s/ton, thus affecting the competitiveness of the entire agro-industrial export sector.”

Andreani agroindustria.jpeg

The Santa Fe Federation of Industries He also did his calculations. He put together a comparison with two scenarios, the first under the current export duty scheme and a second with the one proposed by the Government. In the latter they estimated that the Manufactures of agricultural origin could fall by 20% and those of industrial origin by 50%. They thus anticipate a drop of US$4,105 million in foreign sales and US$93 million in revenue.

Santa Fe Industries Federation.jpeg

For Mora Alfonsín, the new scheme gives incentives for primarization and less complexity to the export basket. Along the same lines, he expressed himself in his account of Tomas Karagozian, CEO of Tn&Platex: “Taking care of regional economies would mean taking care of the value chains of regional economies. We cannot impose 15% withholdings on industrialization against the world (which promotes it). Industrial sectors that generate dollars and a lot of federal employment will be affected,” he published.

This Thursday the Minister of Economy, Luis Caputo; Javier Milei’s economic deregulation advisor, Federico Sturzenegger; and the Secretary of Communication and Press, Eduardo Serenelini, received the leaders of the main business entities in the country: UIA, CAME, CAC, Sociedad Rural, among others. In that meeting they sought to put the chambers at the forefront of the legislative lobby to approve the omnibus bill. But businessmen consider that this same regulation will return like a boomerang on national production and export output.

Source: Ambito