Since February, the compensatory interest rate of 15% per month has been in force for delays in the payment of taxes. Permanent plans will pay between 50%, 60% and 100% of that rate.

From February the new interest rates began to take effect for the permanent payment plans of the Federal Public Revenue Administration (AFIP) which are equivalent to 50% and 60% of the penalty applied by the agency when taxpayers are late without being registered in any of these facilities.

The content you want to access is exclusive to subscribers.

This is equivalent to a 7.63% monthly for a micro SME or SME, and 9.16% for medium-sized companies.

We must take into account two elements that also play in these cases. The first is that the general interest rate compensation is 15% monthly from the first day of February and that the governmentuspend until July 31 execution trials.

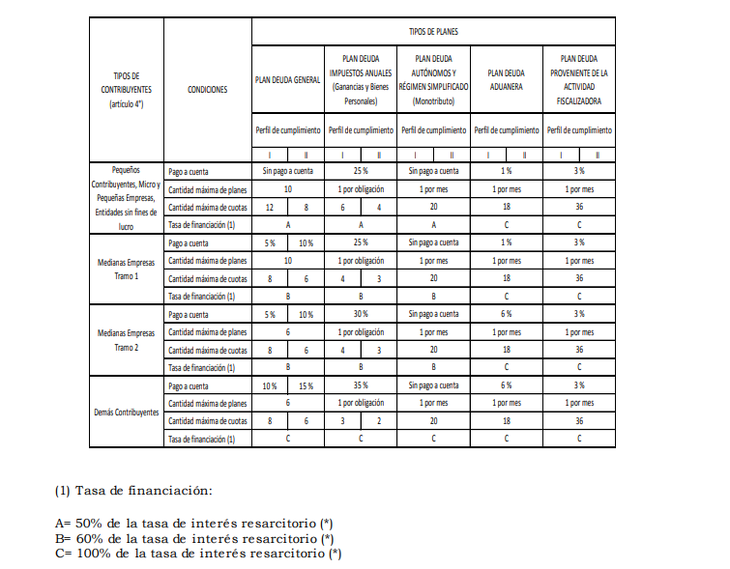

payment-plans.afip.box.png

So most companies that are very tight at the moment with the treasury will have these programs as a table that keeps them afloat until Congress analyzes the moratorium project againa from the government, along with money laundering, which was removed from the omnibus law to facilitate approval.

Presidential spokesperson Manuel Adorni confirmed at a press conference that the project will be presented again during the regular session, which is what companies are really waiting for.

How were the plans?

Options for micro and small businesses and non-profit entities

- For general debts: the rate is 7.63%; with 12 installments for those in category A and B of SIPER (compliance scoring) and 8 for those in C, D and E. No payment on account.

- Income and Personal Property Tax: rates of 7.63% with 6 or 4 installments depending on compliance profile and an advance payment of 25% of the amount owed.

- Self-employed and monotributistas: without payment on account, up to 20 installments at 7.63% monthly

- Customs debt: with 1% payment on account, 15% monthly rate, and 18 installments

- Supervision debt: 3% advance payment, 15% monthly rate and up to 36 installments

Medium-sized companies section I (according to SME law parameters)

- General debts: With SIPER A and B a payment on account of 5%, for the rest it is 10%. For the first up to 8 installments, for the second up to 6. Interest rate of 9.6% monthly.

- Earnings and Personal Assets: 25% advance payment for all profiles. Rate of 9.16% and in 4 or 3 installments.

- Self-employed and monotributistas: without payment on account, with 20 installments at 9.16% monthly

- Customs debt: With an advance payment of 1%, up to 18 installments and a rate of 15%, for all profiles.

- Debt for inspection: Advance payment of 3%, 36 installments at 15% monthly.

Medium-sized companies in section II

- General debt; advance payment of 5% or 10% according to SIPER, with 8 or 6 installments and a monthly rate of 9.16%.

- Earnings and Personal Assets: 30% advance, 9.16% rate and 4 or 3 installments according to SIPER profile.

- Self-employed and monotribute: No payment on account, 20 installments and rate of 9.16%

- Customs Debt: 6% advance, 18 installments and 15% monthly rate

- Debt for inspection: Advance payment of 3%, with a monthly rate of 15% and up to 36 installments.

Other taxpayers

- General debts: Payment on account of 10% or 15% according to SIPER, with up to 8 or 6 installments, and a rate of 15%.

- Earnings and Personal Assets: 35% advance payment, with 3 or 2 installments and a 15% monthly rate.

- Self-employed and monotributistas: without payment on account with 20 installments and 15% monthly interest.

- Customs debt: Advance payment of 6%, with 18 installments and 15% rate

- Debt for inspection: Advance payment of 3%, with 36 installments and 15% monthly interest.

Special Plans for micro, small, medium-sized companies, self-employed and monotributistas

- General debt: without payment on account, with 48 installments at 7.63% monthly

- Social security contributions: 24 installments, at 7.63% without payment on account

- Debt for withholdings and perceptions: without payment on account, with only 6 installments and rates of 7.63%.

For the rest of the taxpayers, the Special Plans have the same characteristics but with a 15% monthly rate.

Source: Ambito