Interest rates below inflation were the main cause of the decline in fixed terms. And the UVA?

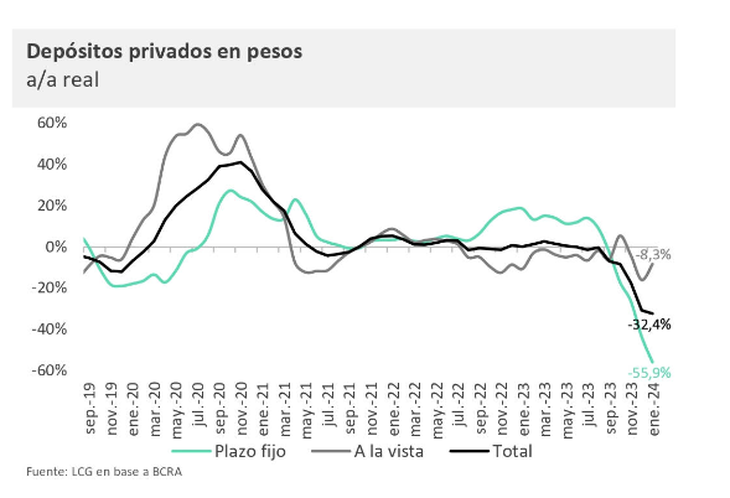

The Fixed deadlines They fell 19% real monthly in January, continuing with the dynamics of the previous month. The interest rates below inflation are the main cause, according to a study prepared by the consulting firm LCG. In annual terms, term loans fall 55.9% in real terms.

The content you want to access is exclusive to subscribers.

In contrast, the deposits in foreign currency They continued their growth from December 2023: 1.9% monthly in January (representing more than US$295 million, reaching US$16 billion.

One thing to keep in mind according to the consultant is that The renewal rate of fixed terms decreased. Currently the rate is 97%. This places it 10 pp above the December renewal rate, which is influenced by the dismantling of fixed terms by companies for payment of bonuses, but also 5 pp above November.

Finally, during January private deposits decreased at the speed at which they fell with a real variation of 2.9% monthly vs -12.4% m/m real in December. Compared to a year ago, the drop is 32.4% in real terms.

deposits.png

Fixed deadlines: a migration to the money market is expected

According to LCG analysts, “a process of demonetization of the economy continues, also encouraged by an expansionary monetary policy bias of negative rates. As we said in the previous report, in this context of high inflation, which discourages possession of money without remuneration, “It is expected that by 2024, demand deposits will continue to evolve below the price level of the economy and that they will gradually migrate to remunerated accounts through the transfer of funds to FCI Money Market.”

Fixed terms: what is the expectation regarding the dollar

“With respect to time deposits, the reference monthly rate continues at 9%. This places it below inflation projections and implicit expectations of depreciation of alternative dollars, implying a negative return. On the other hand, tied deposits Inflation was affected by the extension of the minimum term to 180 days. However, the drop in the previous months has been so great that it is possible that it will slow down, due to captive agents in pesos who have difficulty accessing other savings methods,” they concluded.

In a talk with this medium, the economist Gustavo BerI think that “in the current political and economic context, financial and free dollars could once again be close to inflation”. “They would just slide below the CPI in a climate of better expectations and more attractive alternatives for placements in pesos, currently under the ‘liquefaction’ process”he expressed.

Because of these “negative rates” for savers, Andrés Reschini from F2 Financial Solutions he said: “If we continue with negative rates, it is expected that at least the parallel dollar will follow a path similar to inflation.”

Source: Ambito