The collapse of traditional fixed terms exceeds 50% compared to the same month last year.

Since mid-December, the Central Bank Directory lowered the interest rate and left it at 110% annual nominal, which implies a monthly effective yield of 9%. In this framework, in the month of January the deposits fixed term showed a contraction in real terms, continuing the trend that began in mid-2023 according to the authority’s latest Monetary Report.

The content you want to access is exclusive to subscribers.

In January, the monthly contraction was 17.8% at constant prices and, in this way, they would be 57.6% below the record for the same month of the previous year. As a percentage of GDP, these loans would have been 4.2% in the first month of the year, which would imply a decrease of 0.7 pp compared to the previous month.

Preference for liquidity: FCIs grew

The contraction of fixed-term deposits was generalized by type of depositor, although it was more marked in the case of legal entities. By amount stratum, there was also a general decrease. However, the largest drop was concentrated in the segment of more than $20 million and was partly explained by the behavior of the Financial Services Providers (PSF), whose main actors are the Common Money Investment Funds (FCI MM). In addition to fixed-term placements, FCI MM they continued dismantling passive repo positions with the BCRA. On the other hand, interest-bearing demand balances remained at high levels.

In effect, these placements presented a average monthly expansion of 40.0% at constant prices, which was mainly explained by the carryover effect of the previous month. Thus, a greater preference for liquid and remunerated assets.

deposits4.PNG

UVA fixed term: they advance for the second consecutive month

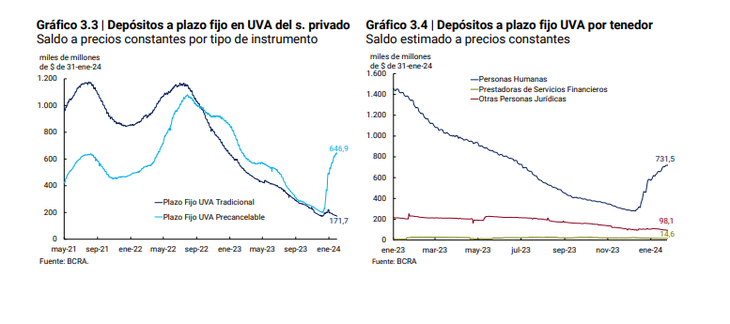

The deposit segment fixed term adjustable by CER registered an expansion for the second consecutive month, with a monthly growth of 53% be in real terms. Growth was driven by placements with early cancellation options; Meanwhile, placements at traditional UVA showed a slight decrease.

Distinguishing by type of holder, the increase was fundamentally due to the dynamics of placements of natural persons, which represent 87% of the total. However, the balance of the UVA deposits reached $818,637 million at the end of January, which is equivalent to 5.5% of the total term instruments denominated in domestic currency

termfijouva.PNG

However, the broad monetary aggregate, private M33, at constant prices and adjusted for seasonality would have exhibited a monthly drop of 7.6%. In the interannual comparison, this aggregate would have registered a decrease of 41.2% and as a percentage of GDP it would have been 13.2%, 0.7 pp per below the previous month’s record.

Source: Ambito