Learn how to access information about the receipt, debt and annual payment of the Real Estate Tax from the Buenos Aires Collection Agency.

The Collection Agency Province of Buenos Aires (ARBA) demands those taxpayers let them pay the real estate tax for the property of property. Payment can be made in a single annual fee or in several fees distributed throughout the year, like other taxes such as lighting, sweeping and cleaning in some districts.

The content you want to access is exclusive to subscribers.

How to know my ARBA real estate tax debt

Allows you to consult the debt in the Tax Real Estate. He Procedure It can be done by anyone who has the item number.

Province: due to the fiscal revaluation, the real estate tax increases by an average of 56%

Requirements

- Object Identification: Match/Match Number.

Step by step from the web:

- Enter the website of ARBA.

- Click on the ” buttonStart process“.

- Enter the property identification number (Partido/Partida), press “Send” and then “Continue“. Once this step is completed, the debts to be paid will appear.

How do I see my ARBA real estate ticket?

Through the Web of ARBAit is allowed to issue and print the ticket for the payment of Basic Real Estate Tax and the installments of the payment plans constituted by this tax.

image.png

As a first step, it is necessary to have the identification of the object: Match Party or CUIT/CUIL/DNI.

Steps to follow:

- Click on the button “Start process” or click to access Download the Ballot.

- Enter the Item Number, Validation Codepress the “Send” button and finally print the receipt or the electronic payment code.

How to pay my ARBA debt

In case you owe any of the ARBA taxesyou will be able to regularize your situation two ways. The first is through the physical offices of the institutionwhile the second is through the online page. For each of the options, we suggest you know the following:

The deadline to pay the last installment of the automobile tax with a discount expires

You can pay with electronic payment methods.

To complete the procedure in person at the physical offices, you must attend during customer service hours and have the identity document, CUIL or CUIT, on hand, which allows the advisor to verify the identity of the taxpayer.

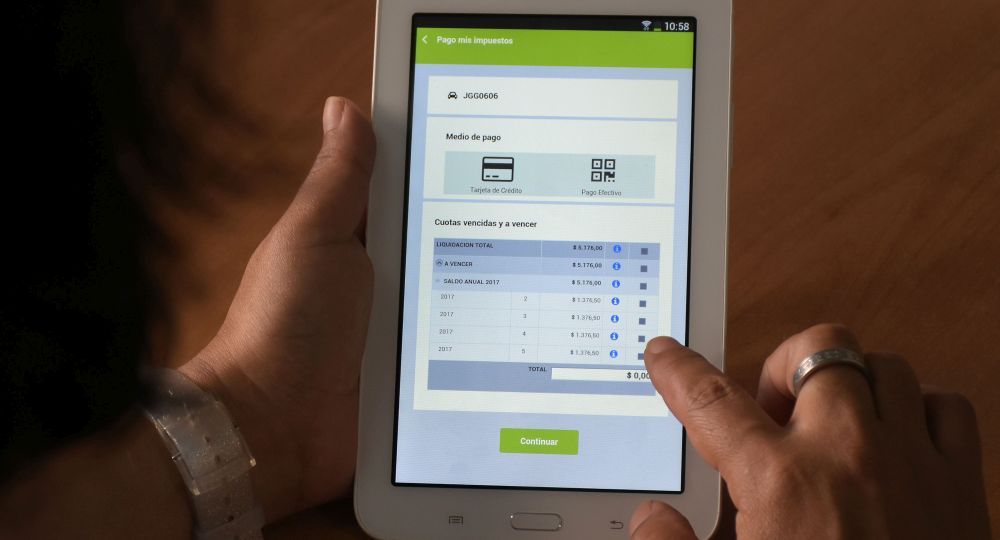

On the ARBA online platform, the query about patent debt must be done by completing the following steps:

- Enter the ARBA page. There, to access the patent, click on the button “Consult” located at the top right.

- Then, select the section of “Check your debt”.

- To finish, you only have to choose the type of query that you want to carry out, and then incorporate the data as CUIL/CUIT or, if applicable, the domain number.

- Press the enter button and thus obtain the result.

Source: Ambito