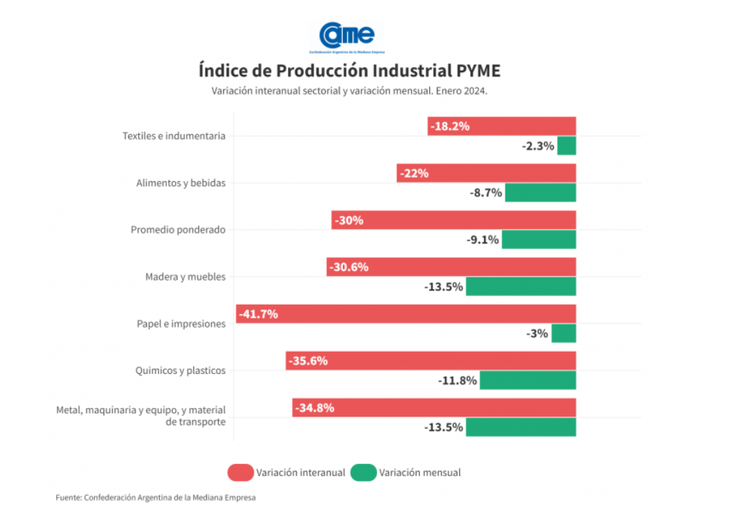

The SME manufacturing industry The year began with a sharp drop. In January, there was a 30% decrease in the sector’s turnover measured at constant prices compared to the same month last year. It is the second consecutive month that factory activity has slowed down, confirming a worrying trend. In the seasonally adjusted monthly comparison, it is also registered a decrease of 9.1%.

The companies operated with 70.8% of their installed capacity, showing a decline of 2.3 percentage points compared to December. The industrial sector is strongly feeling the deterioration in people’s purchasing power and loss of competitiveness in world markets, which affects companies with an export profile. Likewise, reducing production is usually a gradual process, since it involves decisions about investments, employment and other factors.

CAME4.png

On the other hand, the lower demand for raw materials and inputs caused will decrease considerably the number of industries that They report stock replenishment problems. The number of firms facing difficulties in replenishing their stocks fell to 38.8%, compared to the 53.4% recorded in December 2023.

In summary, the SME industries they prepare for a complex panorama in the coming months. The Industrial profitability is being threatened by various factors: The drop in consumption, as a result of weakened purchasing power, added to persistent inflation and the imminent increase in rates for public services such as electricity, generate a climate of anxiety and risk for industrial activity.

SME industry: how each sector did in January

All manufacturing sectors of the SME segment had sharp falls in the annual comparisonbut the most affected were “Paper and Printing” (-41.7%) and “Chemicals and plastics” (-35.6%).

industrypyme4.png

Food and drinks

The sector registered a decrease of 22% annually at constant prices in January and 8.7% in the monthly comparison. The industries operated with 75.9% of its installed capacity, detecting low levels of investment, constant price increases, delays in product deliveries and some job terminations due to lack of activity. There is concern in the sector due to the drop in exports and the loss of some markets.

Clothing and textile

The item fell 18.2% annually in January and also registered a decline of 2.3% compared to December. The firms worked with only 68.2% of its installed capacity, low levels for the sectorwhich is explained by the brake on production orders. The SMEs consulted indicated that they had absorbed cost increases so as not to pass them on to the sales price, seeing a very recessive market, but even so, little was sold.

Wood and Furniture

In January, there was a decline of 30.6% annually, always at constant prices, and 13.5% in the monthly comparison. During the month, the sector operated with only 70.4% of the installed capacity, 1.2 points below December and far from the 77% registered in November. The freindeer in the construction activity and the loss of purchasing power of the family income, They paralyzed the dynamics in the first month of the year. Given the scenario, some companies took the opportunity to give their employees vacations or carry out repairs that were delayed.

Metallic, machinery, equipment and transport material

The sector had a contraction of 34.8% annually, at constant prices, and 13.5% in month-on-month contrast. SMEs operated at 67% of their installed capacity, almost 4 points below December.

There were fewer problems getting steel than in December, but more difficulties to sell. Faced with the low levels of activity, some companies took the opportunity to carry out the year’s technical shutdowns and give vacations at the plants.

Chemicals and plastics

In January, the sector experienced a significant decline of 35.6% annually at constant prices, and 11.8% in the monthly comparison. During this month, industries operated with 71% of their installed capacity, slightly above December (70.6%).

The companies measured They reported increases in logistics costs, energy costs, and other services. In turn, difficulties in the supply of certain raw materials forced some industries to give simultaneous vacations to personnel in the machinery area.

Paper, cardboard, publishing and printing

The sector experienced a collapse of 41.7% annually at constant prices, being the sector with the greatest decline. In monthly terms, a contraction was also observed, but milder (-3%). Companies worked with 74.5% of their installed capacity, 2.2 points less than in December.

Was fewer obstacles to replenish supplies and spare parts, but more complications to sustain staff in the face of the abrupt drop in demand. There is concern about the cost increases in this activity that the new electricity rates will imply.

Source: Ambito