For decades, Western companies pumped a lot of money into China. But the risk is now too great for most people. Small and medium-sized companies in particular are increasingly shying away from new investments in China.

This article is a take on Capital+, Capital’s premium digital offering. For you as star It is available exclusively to PLUS subscribers here for ten days. It will then be available again exclusively for Capital+ subscribers at . The business magazine Capital is like that star to RTL Germany.

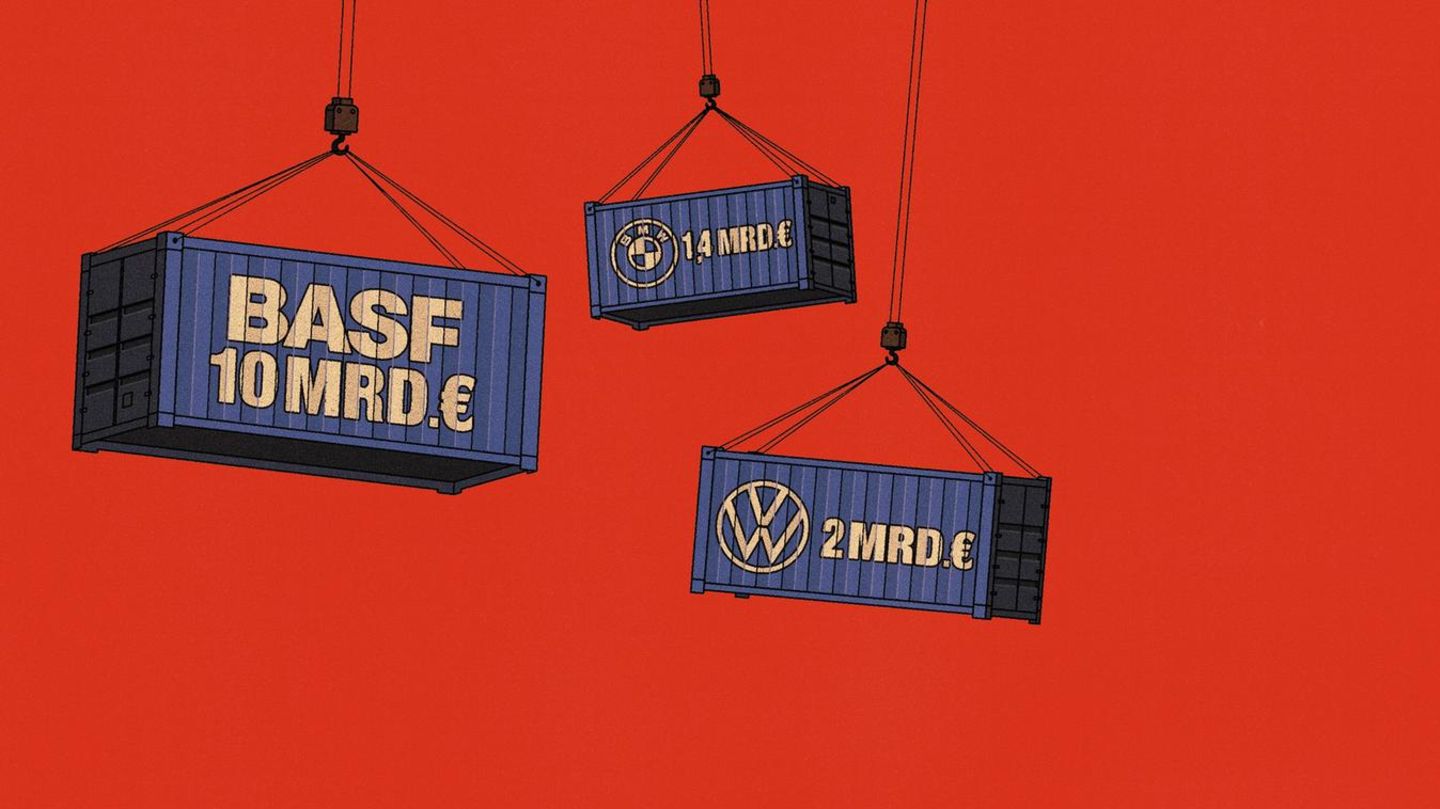

BMW and BASF are among the few Western companies that still please Xi Jinping. The chemical company is building a massive chemical plant in Zhanjiang, southern China, for 10 billion euros. In June, BASF managers pulled out 15 shovels with red decorative bows at the symbolic groundbreaking ceremony for the next major construction phase. At the same time, the car manufacturer is expanding its high-voltage battery factory in Shenyang, northeast China, for 1.4 billion euros.

The statistics for direct investments from abroad are politically highly sensitive in China, and large-scale German projects like this are currently just keeping them afloat. Overall, however, one has to say: companies from the West hardly invest any money in China anymore. In the third quarter of 2023, for the first time in 25 years, more foreign capital flowed out of the People’s Republic than was newly invested there. And the overall balance for 2023 also looks disastrous: direct investment from abroad collapsed to $15 billion, after being $344 billion in 2021.

“The risk-reward calculation is tilted against China,” says Thilo Hanemann, partner at the global research institute Rhodium Group in Washington. Many factors come together: further increased political risks, rising costs, growing numbers of competitors and weak growth prospects. More and more companies from the USA and Europe are complaining about legal uncertainty in China – for example due to the new “espionage law”, which makes every acquisition of legal information a risk. According to a recent survey, 54 percent of all German companies that are already in China expect the investment environment to deteriorate further.

Small and medium-sized companies in particular are increasingly shying away from new investments in China. There are only a few large corporations left that are still going all out: from 2018 to 2021, BASF, BMW, Daimler and Volkswagen alone accounted for 34 percent of all European direct investments, as China experts from the Rhodium Group calculated. In the past two years, this share is likely to have increased even further, according to the Federal Ministry of Economics. Minister Robert Habeck considers this development to be “no longer healthy”; His company therefore recently limited state guarantees for business in China – and imposed a guarantee cap for large corporations.

Access to all STERN PLUS content and articles from the print magazine

Ad-free & can be canceled at any time

Already registered?

Login here

Source: Stern