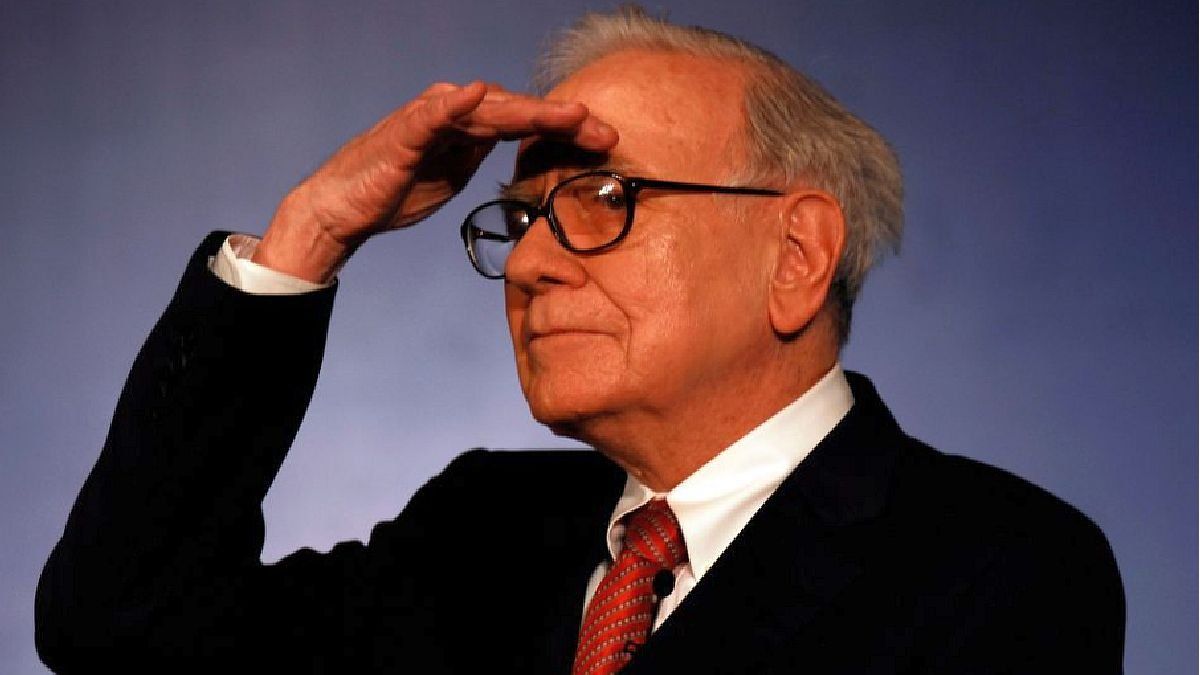

Warren Buffett continues to offer keys long-term investment following his annual letter to Berkshire Hathaway shareholders. One of the most resonant data was the mythical investor’s explanation of which shares he would hold “indefinitely.”

“I would like to describe two other investments that we hope to hold indefinitely. Like Coca-Cola and AMEX (American Express), These commitments are not huge relative to our resources. However, they are worth it and we were able to increase both positions during 2023,” he noted.

Occidental Petroleum

The first company is the oil company Occidental Petroleum. “At the end of the year, Berkshire owned 27.8% of Occidental Petroleum’s common stock and also owned warrants that, for more than five years, give us the option to materially increase our property at a fixed price“he explained.

“While we very much like our ownership, as well as the option, Berkshire has no interest in purchasing or managing Occidental. We especially like its vast oil and gas reserves in the United States, as well as its leadership in carbon capture initiatives, although the economic viability of this technique has not yet been demonstrated. Both activities are of great interest to our country,” he indicated.

“Not long ago,” Buffett recalled, “the United States was woefully dependent on foreign oil.” However, he added that fracking production “became viable in 2011 and our energy dependence ended,” so “OPEC no longer has an advantage.”

Thus, he highlighted that “the Occidental itself has an annual oil production in the United States that each year comes close to equaling the entire inventory of the Strategic Petroleum Reserve (SPR)”.

In this scenario, he assessed that “under the leadership of Vicki Hollub, Occidental is doing the right thing for both its country and its owners. No one knows how they will affect oil prices over the next month, year or decade. But Vicki He does know how to separate the oil from the rock, and that is a rare talent, valuable to his shareholders and to his country“.

oil-energy.jpg

Berkshire weighs US oil and gas company

Depositphotos

Bet on Japanese companies

Berkshire’s other big bet is “its passive and long-term participation in five very large Japanese companieseach of which operates in a highly diversified manner, somewhat similar to the way Berkshire is managed.”

Buffett that “we increased our holdings in all five last year after Greg Abel and I took a trip to Tokyo to talk to their managers. “Berkshire now owns about 9% of each of the five and has committed to each company that it will not buy shares that take our holdings beyond 9.9%.”

These five companies are Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomofollowing shareholder-friendly policies that are far superior to those typically practiced in the US. “Since we began our Japanese purchases, each of the five has reduced the number of its shares outstanding at attractive prices,” he said.

“An additional benefit for Berkshire is the possibility that our investment will generate opportunities to partner around the world with five large, well-managed and respected companies. His interests are much broader than ours. And, for their part, Japanese CEOs have peace of mind knowing that Berkshire will always possess enormous liquid resources that can be instantly available to such partnerships, whatever their size,” the CEO concluded.

Source: Ambito