According to analysts and investors, several factors explain such performance, such as the reopening of Japan after the pandemic, accommodative monetary policy, high equity risk premiums and improved corporate governance reforms.

But it is more interesting to note that the big players in the world market continue to bet on Japanese stocks, such as the emblematic founder of the fund Berkshire Hathaway, Warren Buffettwhich recently listed a series of stocks that it does not plan to ever get rid of, including several Japanese ones such as mitsubishi, Mitsui and Sumitomo, to the largest investment fund in the world, BlackRock.

The fund led by Larry Fink believes that the rally in Japanese stocks still has more room, unlike some past experiences, because both the macroeconomic and business prospects will drive the next bullish phase.

They explain from BlackRock: The growth in corporate profits that they expected from 2023 is materializing, and although they see that the markets do not fully value positive signs such as corporate reforms, they believe that the Bank of Japan will cautiously reduce its ultra-loose monetary policy to avoid disturbing the coming out of decades without inflation, so they remain overweight in Japanese stocks.

It is worth remembering that the Nikkei index has been trading at all-time highs since 1989 when stocks soared until the crisis broke out. housing bubble. “These events led to decades of low or no inflation and virtually flat growth,” they point out.

markets-tokyo-nikkei-shares-stock-markets-investments-finance

The Nikkei index of the Tokyo Stock Exchange has risen almost 17% so far this year and 29% since it began a new rally last November.

Reuters

What drives the Japanese rally in the Stock Market

When explaining what is driving the Japanese rally, strategists at BlackRock They highlight the weakness of the yen that helped boost the value of corporate profits earned abroad, which they expect to continue. In this regard, the stability of the dollar is not affecting the returns on Japanese stocks in that currency as much, and the excess return that investors receive for the risk of holding Japanese stocks instead of bonds seems attractive. Of course, it’s not just businesses that benefit from a weak yen, as higher inflation is allowing companies to raise prices and protect margins, while wage growth helps continue to drive consumer spending.

The other factor is the monetary policy of the Bank of Japan (BoJ). In this sense, they maintain that March will be crucial for Japanese markets, as the annual union wage negotiations will take place at the same time as the next BoJ monetary policy meeting. The talks are expected to help signal whether inflation has taken hold. They are betting that the BoJ will end its negative interest rate policy in the coming months, although it will need more evidence of sustained inflation before raising rates further.

For their part, the experts of the global fund manager WisdomTree They consider that in the last 12 months, Japan has benefited from the influx of global investors who are diversifying their investments in Asia, hand in hand with geopolitical tensions and slowing growth that have caused a rotation from China to Japan.

They also detail three more specific catalysts that explain the Japanese stock market rally: the increase in investments and salaries; the renewal of the Nippon Individual Savings Account (NISA) and ongoing reform initiatives.

First of all, the end of deflation It is a catalyst exclusive to Japan, where Japanese companies now have more money available and there is a lack of workers, which motivates them to invest in automation in the long term. Japan is experiencing demographic problems, with a labor shortage that is the worst in 30 years. To counter this, companies need to improve their productivity by investing in technology. But demographics also drive wage inflation, which saw a 3.6% wage increase in the last joint negotiations in 2023, the highest level in 30 years, and 2024 could record a new rise.

fumio kishida.jpg

Prime Minister Fumio Kishida pushes reforms that also encourage markets.

The reforms promoted by the Government and the monetary policy of the Bank of Japan

On the other hand, the prime minister, Fumio Kishida, attempts to unlock family wealth of nearly $14 trillion tied up in cash deposits. To this end, the government is carrying out reforms, such as the introduction of 401(k) plans in the US in the ’70s, through a program of Nippon Individual Savings Account (NISA) which offers tax advantages among other benefits.

Added to this are the corporate reform initiatives underway in Japan that have already impacted shareholder remuneration and are improving business results, boosting valuations and creating a virtuous circle.

Regarding Japanese monetary policy, WisdomTree believes it is likely to remain until the second quarter and then the BoJ will abandon negative interest rates in the second quarter, taking into account wage negotiations. Thus, the yen could appreciate in the second half of 2024, as interest rate differentials between the US and Japan narrow, which would not be so good for corporate profits. However, they believe that the strong yen may not be an obstacle for Japanese equities, as the market is betting on greater vitality in the economy with rising wages and improved capital spending.

BlackRock It also considers the impact of corporate governance reforms that pressure companies to improve profitability and return money to shareholders. In this sense, they explain that the reforms to improve the return on capital of listed companies have raised it to 9% and that although it is still half of the US metric, they believe that the reforms can help reduce the gap. The tax free stock investment plan with the aim of stimulating the flows of national investors towards Japanese stocks as a tool against inflation.

For all this BlackRock remains overweight in Japanese stocks and believes they can surpass their all-time highs.

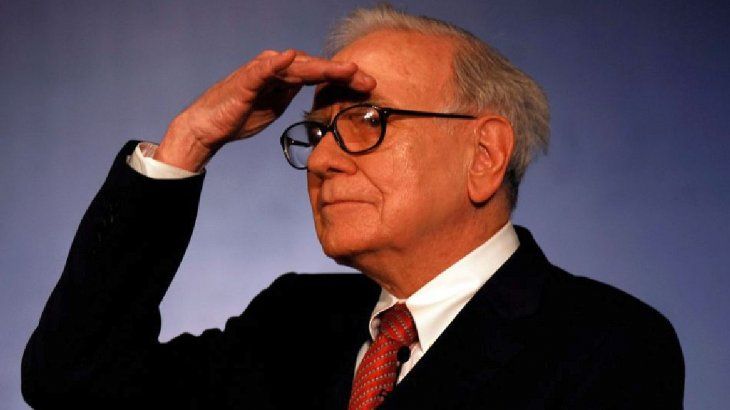

Warren Buffett 3.jpg

Warren Buffett, one of the great players in the world market who continues to bet on Japanese stocks.

Buffett bets on large Japanese companies

In this context, days ago, Warren Buffett declared to its investors that it plans to hold several listed companies indefinitely, in addition to Coca Cola and American Expressand mentioned the large Japanese companies Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomobehind the American oil company Occidental Petroleum.

Buffett explained that one of his bets is his passive, long-term stake in five very large Japanese companies, each of which operates in a highly diversified manner, somewhat similar to the way Berkshire is run.

For the so-called Oracle of Omaha, these five companies follow shareholder-friendly policies that are far superior to those typically practiced in the US. “Since we began our Japanese purchases, each of the five has reduced the number of their shares in circulation at attractive prices,” he explained.

Source: Ambito