According to the latest economic data on activity, consumption and tax collection The situation in Argentina is not outstanding, as the Government sometimes tries to show. Much less do they seem to indicate that overcoming the crisis is just around the corner.

In fact, one of the indicators that best shows the state of the macroeconomy is the tax collection and, this year, it is worse than expected.

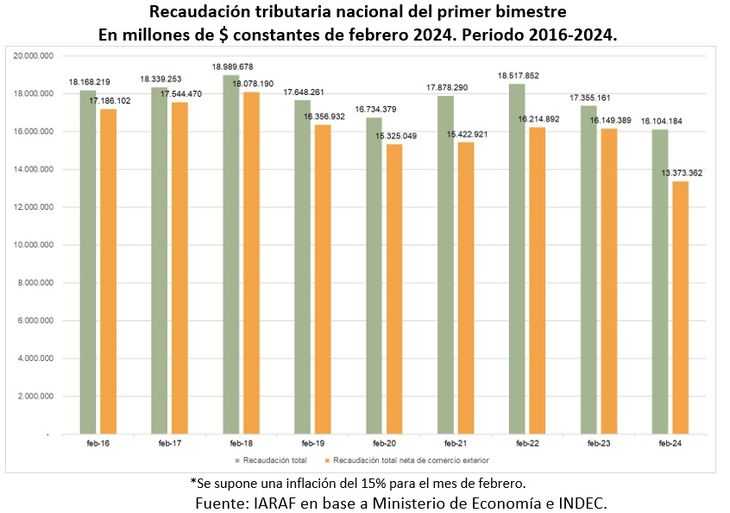

According to a study by Argentine Institute of Fiscal Analysis (IARAF)the national tax resources for the first two months of 2024 present the worst performance in the last 9 years. This is a consequence of the sharp decline in economic activity, which cannot be compensated for by improved exports.

“Considering the total national tax collection of the first two months of the last 9 years, January-February 2024 is in last place. By excluding taxes linked to foreign tradethe result is repeated,” says the IARAF.

iaraf.reca-february.jpeg

Last Friday, an hour before the president Javier Milei will speak before the Legislative Assembly, the Federal Administration of Public Revenues (AFIP) released the tax revenue data for the second month of 2024. In that period, $7.24 billion was raised, with a real decrease of 11% compared to the same period in 2023. The accumulated amount was $14.9 billion, with a decrease of 7% year-on-year.

The report says that, By excluding taxes linked to foreign trade between January and February, the accumulated collection “would decrease by 17% in real terms.” The data shows that there is a collapse in taxes related to internal activity.

“In terms of real interannual variation, in these two months, The taxes with the greatest drop would have been Personal Property (64.7%), Fuels (60.8%) and Profits (38.7%). Those that increased the most would have been the PAIS tax (292.4%), export duties (126.6%) and import duties (26%). For its part, VAT collection would have grown by 6.8%.

reca-bimestre-historico.jpeg

One fact to keep in mind is that the VAT still had positive behavior in January, but it was one step away from becoming negative. If we take only the tax component of the VAT, it rose 238% in nominal terms, against an annual inflation that reached 288%.

It must be taken into account that VAT is the result of the previous month’s billing. In this case, from January. That month, According to data from the Argentine Confederation of Medium Enterprises (CAME), retail sales experienced a significant decrease of 28.5% compared to the same period of the previous year, as measured at constant prices.”

In February, according to CAME, billing fell another 25.5% and accumulated a decline of 27% in the first two months. Everything anticipates that the VAT for March will also show a severe retraction.

The SME manufacturing industry also started the year with a sharp drop. In January, there was a 30% decrease in the sector’s turnover, measured at constant prices, compared to the same month last year, according to CAME.

Caputo’s plan

If the Minister of Economy, Luis Caputo, I thought about compensating for the drop in domestic activity with greater tax collection from foreign trade, that would not be happening. Withholdings in the first two months are contributing $925,749 million, with an increase of 713.7% compared to the previous year. Import tariffs generated $544,101 million so far, with an increase of 358%, while the COUNTRY Tax left $1 billion, with a year-on-year improvement of more than 1000%. All that improvement would not be enough to compensate for the other.

That is where It seems essential for the government to approve the restitution of the Income Tax for high salaries. In the fiscal package that the government planned to send to Deputies before the omnibus law fell, the project only had one article that proposed restoring the tax as it was before it was repealed.

In light of the president’s speech in the Assembly and his call for the May Pact, Economic conditions do not leave room for the National Government to dispense with Congress to deepen its fiscal adjustment.

Source: Ambito