The salary crisis deepens, dragged down by Javier Milei’s adjustment plan. The first official data from January showed that acquisitive power of salaries in the formal sector had its biggest drop in two decades, since the exit of convertibility. The inflationary flash that followed the December megadevaluation outweighed the joint negotiation. So, in just two monthsthe first of the libertarian management, salaries lost almost a fifth of their purchasing power. A deterioration at record speed that explains the collapse in consumption and the worsening of the recessive scenario.

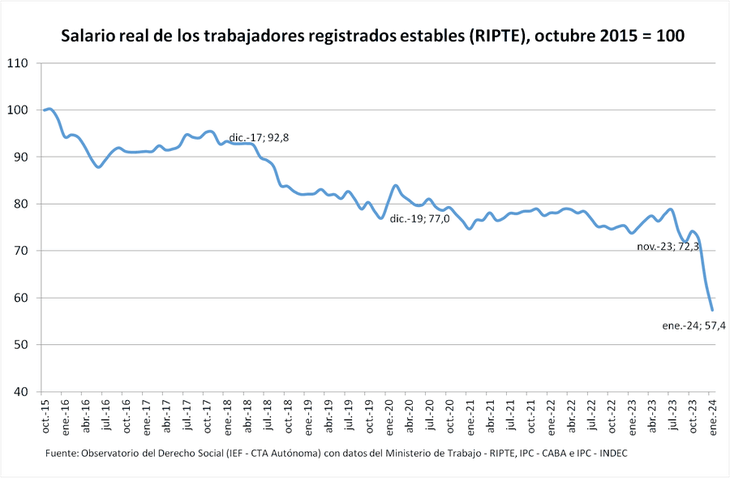

In the last few hours, the Ministry of Labor published the index of the Average Taxable Remuneration of Stable Workers (RIPTE), a salary indicator that is used as a calculation basis for the retirement mobility formula and for compensation for work accidents. Measured in real terms, it showed a year-on-year collapse of 22.2%. This is the steepest fall since March 2003, when the impact of the exchange rate jump of one-to-one disarmament and the 2001-2022 crisis was still strongly felt.

Although the real salary was already in decline, what is rarely seen is that The bulk of this fall was concentrated in the first two months of Milei’s government.. In January, the reopening of joint ventures (especially in the unions with greater capacity to push for a significant recomposition) in search of recovering part of what was lost in the nominal race against prices led to a monthly increase in the RIPTE of 14.7% . Did not reach. “It is the highest increase in the entire series but it continues to lag behind inflation,” explained Luis Campos, coordinator of the Social Law Observatory of the Autonomous CTA. That month the consumer price index (CPI) marked 20.6%, which implied a loss of purchasing power of 4.9%.

However, this monthly decrease is based on the 13.7% that salaries had lost in December due to the initial inflationary surge generated by the 118% exchange rate jump carried out by Luis Caputo and Santiago Bausili in combination with the total liberalization of the policy. of prices. On the whole, The purchasing capacity of formal employees sank 17.9% in just two months, a decline that is close to the 20.9% that real wages fell during the four years of Mauricio Macri.

According to calculations of Salvador Vitellihead of research at Romano Group, the worsening of the deterioration in income led to the January RIPTE, measured in constant currency, returning to the May 2005 levelthat is, 19 years ago.

image.png

The truth is that the purchasing power of workers drags now six consecutive years of decline and is heading to stitch the seventh. After the strong recovery experienced between 2003 and 2013, which allowed us to emerge from the well of the 2001-2002 crisis with a recovery of workers’ participation in the distribution of income, the outbreak of the debt crisis of the Macri government began a downward slope. A decline that slowed down in the four years of Alberto Fernández but did not stop and was precipitated as soon as Milei’s adjustment plan began.

This course leaves a striking balance. According to the real salary series prepared by Campos from the RIPTE and the inflation indices of the INDEC and the Buenos Aires Statistics Directorate, The purchasing power of formal employees in January of this year was 42.6% lower than in October 2015.

image.png

According to the RIPTE index, the average gross salary was $555,269 in January, which in net terms is equivalent to around $460,000. So, an average formal salary was 23% below the cost of the total basic basket for a typical household of four members (which in January was $596,823), that is, the possibility of preventing your family from being in a situation of poverty.

The outlook for this year, marked by very high inflation and the drop in activity with loss of employment, does not predict a quick recovery in income. This is how it was projected by the Capital Foundationthe consulting firm founded by Martín Redrado, which predicts a double-digit drop for all sectors in 2024. Despite the activation of shorter joint negotiations, estimates that the purchasing power of formal employees in the private sector will lose another 10.5% year-on-year.

Outside this segment, the salary crisis projected by the foundation is even more acute. For the state, affected by the adjustment of public spending, it anticipates a drop of 21.3% year-on-year. For the informal sector, it foresees a drop of 25%.

Wages and recessionary impact

This deterioration in wages, in combination with the adjustment via liquefaction of retirements and pensions, is the other side of the worsening of the recessive scenario. According to calculations by the Argentine Institute of Fiscal Analysis (IARAF), in the first two months of the year the real cut in primary spending was 33.6% year-on-year. Of the total adjustment, retirements and pensions contributed 43% and state salaries, 5%. The impact of the blender on assets is such that “a retiree with the minimum will end March with a loss of purchasing power of 43% compared to the same period in 2023,” the IARAF warned.

The collapse of income is the flip side of the paralysis of consumption. For example, the Argentine Confederation of Medium Enterprises (CAME) reported a drop in retail sales in SMEs of 25.5% year-on-year in February.

In turn, this worsens the deterioration of activity. The INDEC reported this Wednesday a 12.4% year-on-year drop in industrial activity during January and a 21.7% drop in construction, affected by the stoppage of public works. And the leading indicators for February show a continuation of the falls: the patenting of motorcycles (13.7% year-on-year) and that of cars (18.7%), the manufacture of vehicles (19%), the sale of inputs for the construction according to the Construya Index (29%) and DGI VAT collection (12.6%).

Source: Ambito