Due to tensions between China and the USA and Taiwan, the German economy wants to reduce its dependency on Beijing. Other Asian countries benefit from this – especially in the important chip industry.

This article is adapted from the business magazine Capital and is available here for ten days. Afterwards it will only be available to read at again. Capital belongs like that star to RTL Germany.

This week, three heads of state and government from the Southeast Asia region will meet in the Chancellery and in Bellevue Palace. Malaysia’s Prime Minister Anwar Ibrahim meets Federal President Frank-Walter Steinmeier. Head of State Ferdinand Marcos Jr. from the Philippines and Thailand’s Prime Minister Srettha Tavisin also pay their respects. All represent emerging technology locations and are promoting foreign investments in the wake of geopolitical crises. “The Indo-Pacific region is of great importance for Germany,” said Chancellor Olaf Scholz (SPD) after the meeting with Anwar. “We want to intensively deepen political and economic cooperation.”

The neighboring countries of the People’s Republic play a key role in the “derisking” strategy of Western industrialized nations – which is intended to reduce excessive dependencies on China as a supplier and buyer. This applies similarly to Taiwan, the global stronghold of chip production, against which China’s threats are not letting up. This industry, which is so indispensable for future technologies, shows how attention has been shifting towards those who benefit from the strategy for some time. There are growth opportunities for partners such as Malaysia, Indonesia, Singapore, Vietnam and the Philippines – which they are already reaching for in the competitive chip industry.

Technology war between the USA and China

A real run can be observed in Malaysia: In addition to Chinese companies, Korean, Japanese and Western chip manufacturers are coming to Penang province. The background is the technology war between the USA and China: Manufacturers of accessories for chip production can no longer deliver their cutting-edge technology to China due to US requirements, but they source components from there themselves, explains an industry expert. Therefore, they are putting pressure on Chinese suppliers to expand into other “neutral” countries.

The entire region with 700 million inhabitants on the threshold of China is acquiring a new geostrategic importance – both for US interests in the Indo-Pacific region and for European industries that need to ensure their supply of future technology for green energy or mobility.

Malaysia’s prime minister aims to strengthen the unstable economy through foreign investment – and wants to achieve this with good relations with the West without alienating China as an ally. Finally, President Xi Jinping promised the country more than $35 billion in 2023. At the same time, Malaysia, which was once considered the “Silicon Valley of the East” years ago, is now positioning itself as a willing alternative location for international corporations that do not want to turn their backs on China (“decoupling”) but want to secure their supply chains in multiple ways due to international tensions: also called the “China plus strategy”.

In Malaysia, the Penang region attracted around $12.8 billion in investments in 2023, the local authority said. The industry reports dozens of new arrivals in the northern province in 18 months, including Chinese companies such as xFusion, US providers Micron Technology ($1 billion announced investments) and Intel, as well as European competitors such as AMS Osram from Switzerland and AT&S from Austria. The German semiconductor manufacturer Infineon already has more employees in Malaysia than in Germany and – like Intel – wants to invest a further $7 billion there.

Malaysia was not previously known as a place of the future for chip manufacturing. Companies probably had parts assembled, tested and packaged there. But it is precisely advanced packaging techniques, in which components are assembled from several chiplets or wafer chips are packed into housings, that are becoming increasingly important in AI applications or networked automotive technology. At the same time, the government is increasing its ambitions in the area of high-end semiconductors. She wants to keep up with technical advances in automation and benefit from them. According to the Financial Times, the country is already the sixth largest chip exporter and accounts for 20 percent of US imports.

Singapore and Vietnam are vying for companies

According to experts, almost 60 percent of the popular “Assembly, Packaging and Testing” (APT) processes are concentrated in Taiwan. That is currently changing. Business Korea reported in January that Singapore had proposed benefits for land, water, electricity and employees, as well as tax and subsidy incentives, to attract a mega-factory owned by Taiwanese market leader TSMC and its subsidiary Vanguard International Semiconductor (VIS). According to “Nikkei Asia-News”, TSMC/VIS are planning a $2 billion investment to build a chip factory for car manufacturers – beyond their commitments in Japan, the USA and Germany.

Taiwan’s UMC, the world’s fourth-largest manufacturer, is also reportedly planning a new factory in Singapore. The third largest industry giant, Globalfoundries from the USA, completed a $5 billion project last September, while Micron, STM and AMD are present on a smaller scale.

One of the trump cards of the emerging Southeast Asian chip locations is the large supply of young talent – Southeast Asian universities are currently producing a large number of chip specialists with master’s and doctoral degrees. This includes Vietnam, which, unlike Malaysia or Singapore, does not yet have a complete “semiconductor ecosystem”.

Last December, Nvidia boss Jensen Huang is said to have promised communist Prime Minister Pham Minh Chinh that he would make Vietnam the company’s second home. According to industry reports, the government wants to inaugurate the first production facility for semiconductor end products by 2030 and provide incentives for this. Intel and Renesas from Japan (formerly Hitachi) and Samsung (South Korea) already have assembly plants. It is said that the few dozen semiconductor manufacturers could be joined by many more from the USA if Vietnam had a better supply of green energy.

Thailand and Philippines as promising locations

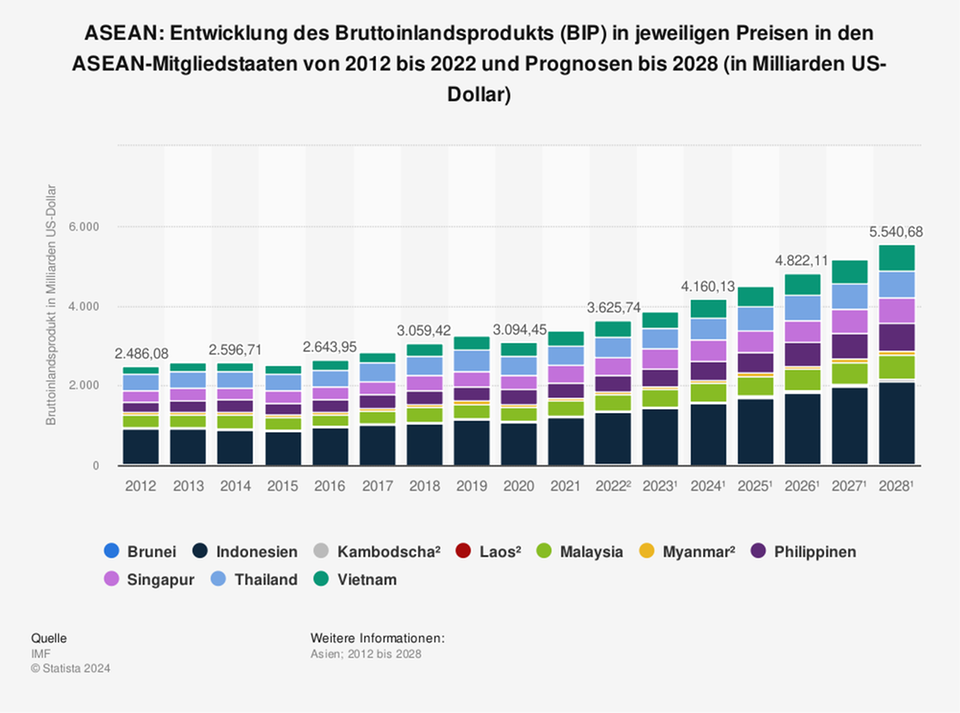

Together, the members of the Economic Community of Southeast Asian Countries (Asean) had a global export share of more than 22 percent in the semiconductor supply chain as early as 2022, according to a study by EY. Thailand is also named as a promising location in the areas of development, design and software as well as backend manufacturing.

Thailand’s government has been trying to attract the semiconductor industry with tax rebates combined with local spending on research and development. South Korea’s semiconductor giant Samsung already has six factories in the country. Thailand is already a sought-after location for electronic products and components, and in addition to Samsung, Japanese companies such as Sony, Toshiba and Kyocera have chips manufactured there, while Western representatives such as NXP and the US providers Western Digital and Microchip Technology are also on site.

The Philippine electronics industry should also not be underestimated, as the government wants it to also benefit from the global excess demand for chips. Before the Corona crisis, the industry played a central role as a growth engine and export driver. According to the industry association (SEIPI), 73 percent of the industry belongs to the semiconductor sector. Here too, companies have specialized heavily in the packaging of semiconductor products. Infineon is represented with a backend manufacturing facility, which the group is currently handing over to the leading contract manufacturer ASE.

Since President Marcos Junior took office almost two years ago, the island state has been orienting itself away from China and towards the West. The US announced a new partnership with the Philippines in November to develop common interests in chip production. The European Union (EU) also has numerous partnership agreements in the region and wants to provide funds amounting to 10 billion euros for investments in the Asean network by 2027. However, a free trade agreement with Thailand, Malaysia and the Philippines as well as with Indonesia, which is rich in raw materials, is still being worked on – the negotiations are proving difficult. The Asian partners want the EU to be more responsive to their ideas in terms of scope and scope.

Source: Stern