The sketch that the ruling party presented to the governors renews the scales of the Simplified Regime for Small Taxpayers.

He tax reform package promoted by the ruling party, proposes important changes in the Monotribute. Specifically, the executive’s proposal seeks to update the scales in quarterly form. Prior to this, the retirement and social work contribution of those who are part of the Simplified Regime for Small Taxpayers. In addition, it adds an additional contribution, “at the taxpayer’s option” to the National Regime of Social Works.

The content you want to access is exclusive to subscribers.

He increase in scales will be quarterly through CPI which measures the National Institute of Statistics and Censuses (INDEC) starting in April.

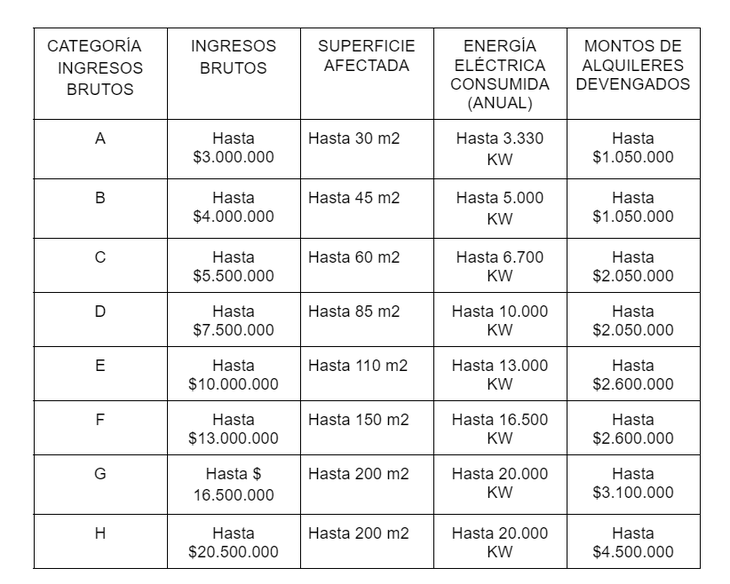

Monotribute: new scales

GROSS INCOME CHART.PNG

Monotax: increase in retirement contributions and social works

Within the new scales proposed by the new project, updates contributions by 10% to the Argentine Integrated Pension System (SIPA) of all categories except TO that raises it to $9,800.

Likewise, it increases to $13,800 the contribution of National Regime of Social Works of categories A, B and Cof which ten 10% will be allocated to Solidarity Redistribution Fund. Meanwhile, the other categories will be left with the following contribution:

- Category D $16,400

- Category E $19,000

- Category F $22,000

- Category G $25,000

- Category H $29,000

- Category I $33,000

- Category J $38,000

- Category K $44,000

Monotribute: aadditional charge for social works

At the same time, it proposes a “additional contribution” of $13,800“at the option of the taxpayer”, at National Regime of Social Works. He 10% of that contribution will be allocated to Solidarity Redistribution Fund.

Monotax: exempt from new contributions

In the case of those registered in the National Registry of Local Development and Social Economy Effectors of the Ministry of Human Capitalincluded in the Category Awill be exempt from the increase in the retirement contribution, while in the contribution to social works and the additional, they will have a decrease of 50%.

Source: Ambito