At current values has to achieve a surplus of about $12.96 billion, of which he could already add $3.24 billion. Most of the goal must be achieved before Junebecause then the seasonality of tax collection spending will work against it.

According to estimates of the Argentine Institute of Fiscal Analysis (IARAF), In the first two months of 2024, the Government was able to obtain an accumulated primary surplus of 0.5% of GDP. Regarding the financial surplus, the positive result was $856,000 million equivalent to 0.13% of GDP.

On average and in theory to achieve the objective, the Minister of Economy, Luis Caputo, ought obtain an average primary surplus per month of 0.15% of GDPor almost some $900,000 million monthly at current values.

But it must be taken into account that there is more positive seasonality in the first six months of the year, because tax collection improves due to the withholdings on exports that are collected with the liquidation of the gross harvest.

surplus-bimestre-2024-ppi.png

Caamaño: “Maybe less primary surplus is needed this year”

In this regard, the economist Gabriel Caamaño, director of consulting firm Ledesma, clarified, in dialogue with Ambitthat “Caputo talks about fiscal balance, assuming that the financial deficit due to interest payments was 2 pointsbut now is issuing new Treasury bonds (debt exchange) at zero coupon, which means that this year interest payments will not impact spending.”

Caamaño considered in this sense that based on this policy of the Treasury Palace “to achieve fiscal balance, less primary surplus will probably be required.maybe with 1 point it could be achieved”.

The economist considered that to achieve this, then, the adjustment has to become sustainable. “It must be taken into account that the PAIS Tax in the first two months was almost $1 trillion and there is about $500,000 million in floating debt,” he detailed.

Both would add 0.25 points of GDP, which is almost half of the surplus. But if you take into account that the COUNTRY TAX It will be repealed when the exchange market is unified and the floating debt has to be paid, To keep the result strong, subsidies need to be reduced.

floating-debt.png

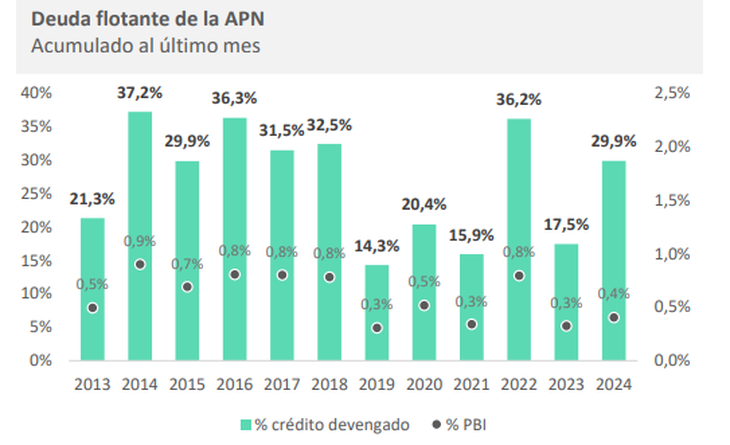

Caamaño links the increase in the State’s floating debt with non-payment to CAMMESA, the administrator of the wholesale electricity market. The firm just finished collecting November bills, and has late payments for December and January. Possibly February will accrue in the next few days. “All governments play the game of owing CAMMESA,” he pointed.

The consultant LCG points out in this sense that “the surplus occurred even when the Government reduced the stock of floating debt by almost half. for the commitments accrued so far in 2024.” “In January I had only paid 46% of the accrued expense, and with February closed that percentage rose to 70%.”. Nevertheless, The floating debt amounts to $2.9 trillion, equivalent to 0.4% of GDP. “This is an amount similar to the surplus achieved,” LCG warned.

While Sergio Chouza, from the Sarandí consultancy, proposes a surplus of half a point in his base scenario for this year only in 2024. He states that “it is not consistent that in the first two months the adjustment was explained only by liquefaction.” “This is an adjustment thanks to inflation because the adjustment of items is made below it and that “It is not consistent if in parallel the hypothesis of accelerated disinflation is met,” he warned.

The view of the market

While, Personal Investment Portfolio (PPI) he stressed that “It is the first time that a primary surplus has been obtained in February since 2019 and a financial one since 2012″, in addition to being “both are the largest since 2008.”

“Thus, it is the first time since 2011 that the first two months of the year is a surplus in both metrics. Definitely, “The result confirms that the Government is doing what is necessary to achieve financial balance in 2024,” he said.

PPI added that “given the seasonality of income and expenses, “Large surpluses must be obtained in the first months of the year to offset the typical deficits of the second half”.

He also maintained that “The adjustment shown was based on the ‘blender’ rather than the ‘chainsaw’.”. “Only current transfers to provinces and capital expenditure presented a nominal cut in their items,” the brokerage company states.

That is why he indicated that the question is: “How sustainable is the fiscal adjustment of the first two months, which is based mainly on a strong real drop in social benefits, especially in retirements and pensions.”

“To make a sustainable fiscal adjustment, The Government will need to obtain political support in Congress, approving the fiscal package of the omnibus law and the proposed new pension formula. Without achieving this, the only structural adjustment available is an increase in rates that reduces economic subsidies,” PPI explained.

Source: Ambito