He fiscal factor seems to be decisive for companies when defining investments as revealed by a private study, according to a report from the international consulting firm KPMG. This is reflected in the firm’s survey, according to which, 43% of participating companies He said that due to the effect of taxes on his profitability he had to divestMeanwhile he twenty% states that stopped operating in some provinces.

The report is from international consulting firm KPMG and warns that the Tax on Gross income that the provinces charge is the main factor from the tax point of view that influences the final price of the goods.

“For him For 43.1% of those surveyed, the Argentine fiscal framework forced them to disinvest, for 53.45% it was neutral and only 3.45% said that it allowed them to expand,” the report says.

He points out that “in the majority of respondents (96.55%) it is observed that the Argentine fiscal framework either forced them to disinvest or, in the best of cases, allowed them to ‘maintain’ the investments already made.”

“Only 3.45% stated that they had developed some expansion plan in terms of investment in 2023,” the survey revealed.

KPMG-TAX-2024.png

The study was carried out among 58 financial managers and tax specialists of companies medium and large companies throughout the country corresponding to the financial, construction, telecommunications, logistics, energy, agribusiness, manufacturing and commercial sectorsamong the most important.

“The survey was carried out in a framework where fiscal problems, the role and size of the State, and the reconsideration of the dimension of public spending have a great role in the Argentine political and economic debate,” he stated. Fernando Quiroga Lafargue, Corporate Tax partner at KPMG in Argentina.

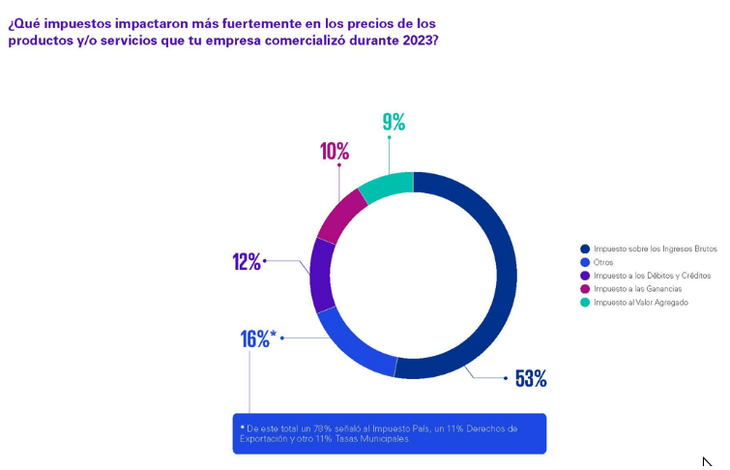

The report states that “For 53.45% of those consulted, Gross Income continues to be the tax that had the greatest impact on the prices of products and services in 2023, marking an increase compared to 2022, which was 51.79%.”

“Then continue ‘Others’ with 15.52%, discriminated against by 78% who pointed to the Country Tax11% Export Duties and 11% Municipal Rates.”

KPMG-GROSS-REVENUE.png

One step further down it is mentioned Tax on Debits and Credits with 12.07%; the Income Tax, with 10.34% and the Value Added Tax, with 8.62%.

“In the opinion of those surveyed, the Gross Income tax grows and is consolidated year after year in the absolute leadership of those who decisively increase prices and company services,” indicates the study.

The tax on Gross income that all the provinces and the City of Buenos Aires receive consists of a tax on billing that It is applied to each link in the chain.

assuming an activity taxed at 3% that has four links (producer, industry, wholesaler and retailer) to Final result is 13.4% tax on the final consumer. It is called a cascade tax and is different from VAT, which, although it is applied in billing, is only paid by the consumer.

Companies stop operating in provinces

Some companies They are already considering stopping operations in some provincial states. The survey indicates that last year 20.69% “had to restrict their business operations in some jurisdictions.”

“Among them, the cases of Misiones and Tucumán. Although the majority of opinions state that they have not restricted operations of sale of goods or provision of services before the excessive tax burden in some provinces, it is still significant that 20% say they have done so”, warn KPMG experts.

Among other issues, for example, the fiscal voracity of the provinces This means that a company that is not located in a province also has to pay Gross Income taxes. This is the case of a firm based in the City of Buenos Aires, if it sells to a client in an inland city.

Also recently Jujuy joined a modality already existing in Misiones, of collecting an advance payment of Gross Income on the route when a truck enters its territory, something that constitutes the closest thing to an internal customs.

Municipal taxes multiply

Recently, the Argentine Chamber of Commerce (CAC) presented a survey on the Safety and Hygiene fees (TISH) charged by 30 communes throughout the country.

The report indicates that in the last year there was “a significant increase in the tax burden exercised by the municipalities through the rate on the commercial sector, with a average increase of around 19.3% for municipalities that tax e the tax through a rate and 125% for those municipalities that tax through a fixed amount.”

The CAC estimate for wholesale and retail trade indicates that the TISH represents 0.54% of the companies’ turnover net of VAT.

Source: Ambito