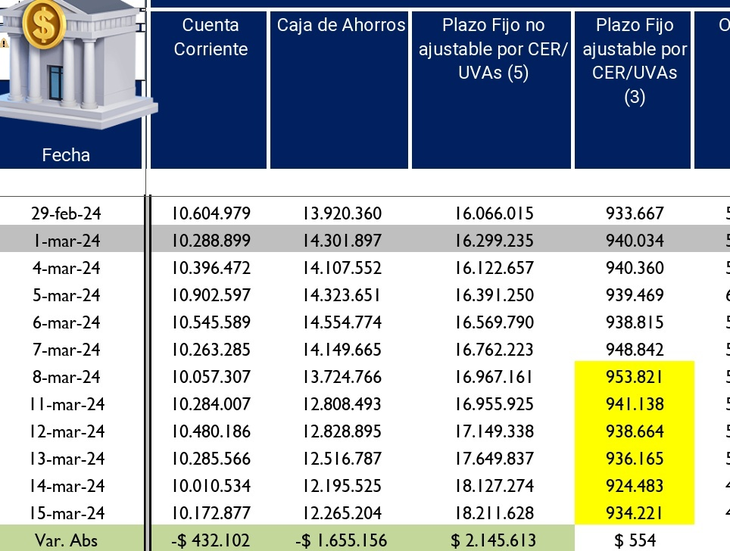

The UVA fixed terms began to register a decrease in flow and there are already withdrawals of 0.4 billion in current accounts, and 1.6 billion in savings accounts. Where do those pesos go?

The stock of UVA fixed terms began to reduce in nominal terms and there are already analysts who warn that this flow of pesos could put pressure on the dollar. There are two factors that worked as negative catalysts: on the one hand, the slowdown in inflation and, on the other, the extension of the minimum term to six months.

The content you want to access is exclusive to subscribers.

This type of investment reached a peak of $1.1 trillion in January and now it is 18% below, at $900,000 million. In fact, so far in March, there has been a withdrawal of 0.4 trillion pesos from current accounts and 1.6 trillion pesos from savings accounts.

image.png

An element that Analysts emphasize that it is not yet known what the inflation data for March will be.. Many expect it to be around 13% or below; and others do not rule out a higher number. It should be noted that these months, although it continues at very high levels, it was evident that there is a dynamic of deceleration: December (+25.5%), January (+20.6%), and February (+13.2%).

On the other hand, dollar rates continue to sideways. With the blue and the financiers below the $1,100, with the gap with the official dollar close to 20% and an illegal exchange rate that fell 14% last month. Although it did not become a profitable business, There are those who claim that it is an opportunity to dollarize at a low cost.

UVA fixed terms had a minimum term of 90 days, but given this migration the Central Bank extended it to 180 days. The measure was at the request of the banks, which argued that they did not have financial tools to respond to the returns offered by UVA fixed terms. In more than one meeting they even asked that they be eliminated.

Traditional fixed terms also fall

Traditional fixed-term deposits fell 22.3% in real terms in January, which shows the decision of savers to withdraw their money from banks because the interest rate paid was well below inflation. This was revealed by the monthly Bank Report published by the Central Bank of the Argentine Republic.

The savers’ decision was prompted after the Banks will pay an interest rate close to 9% in January, while inflation was 20%. Faced with the obvious loss of purchasing power, the owners of the fixed terms decided to withdraw their deposits and divert them towards other investments.

Source: Ambito