The National Government sent a DNU to establish a new retirement formula that replaces the previous formula that adjusted for collection and RIPTE for a new connection to the inflationwith a delay of two months, for “alleviate the losses of the old formula”.

In the last 15 years, there were three formulas in force. From 2008 to 2017 a formula that adjusted in equal parts for RIPTE (formal salaries) and by tax collection, from 2018 to 2019 a formula with quarterly increases that adjusted 70% for inflation and 30% for salaries, and from 2020 to 2023 the formula in force until 2017 was returned with a quarterly adjustment instead semiannual as the original adjustment.

Retirement.jpeg

Beyond that collection-salary formula (2008-2017/2020-2023) generated greater increases than the 2019-2020 formula, which included the CPI, in 10 of the 16 years from 2008 to 2023, different considerations need to be made.

No formula is a panacea nor is it magic. The evolution of retirements was different with the same formula in different periods. The minimum retirement had strong growth in real terms until 2015 (except 2010 and 2014) and fell in 2022 and 2023. The formula in force in 2018 and 2019 including the CPI caused a 19% drop in retirementspartly due to the impact of the last quarter of 2018 when Macri did not adjust the retirements in that quarter when combining the formulas.

Retirements have stagnated since 2013 and have not stopped their decline in real terms since 2017, with different formulas. In this period there was a very favorable quarter (the first quarter of 2020). Being in charge of Anses, I firmly requested from the Ministry of Economy to restore the fall of 2018-2019. and the political decision was favorable, when minimum pensions rose by 13.8% against an inflation of 8.8% and 90% of retirees beat inflation.

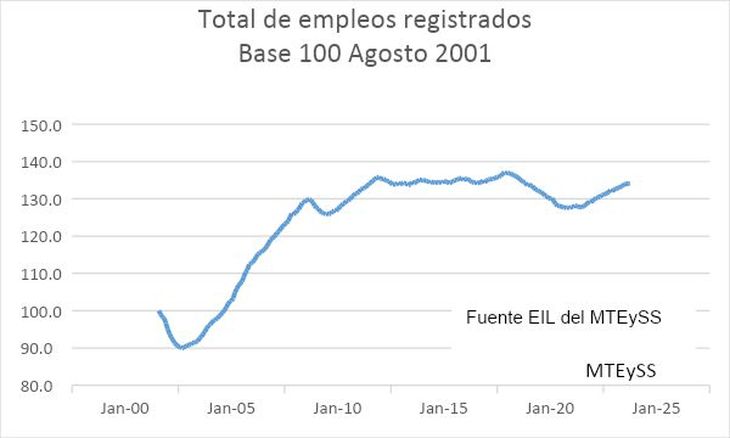

Although different explanations can be tried for the cause of the decline in recent years, the fact that the evolution of retirements cannot be different from that of the real economy. In fact, it is interesting to see the relationship between retirements and the evolution of registered private employment, which stagnated from 2012 and fell from 2017 to 2020 with a partial recomposition since 2021.

Retirement Graphic.jpeg

It is clear then that the evolution of the retirement system and pension benefits cannot be separated from general economic evolution. There can only be good retirements with a sustainable and equitable system and both factors can only be present with a development model.

A model of development that increases productivity and formal employment outside of considerations of fiscal sustainability and other variables such as the impact of technology on employment and demographic issues that affect the relationship between contributors and beneficiaries.

It requires a discussion of the pension system as a whole that does not imply patches or partial reforms (historical reparation, moratoriums, PUAM) and that not only involves mobility but also how a retirement regime is designed and financed within the framework of an efficient and fair social security system.

Social security system that includes people who may be excluded from the labor market or lose their job due to economic cycle reasons, and other structural changes such as technological change. The IMF predicts that in emerging countries the introduction of artificial intelligence will impact 25% additional unemployment in the next 10 years.

One of the crucial factors to preserve pensions is to prevent unemployment from increasingaffecting not only the salaries that determine retirement income but even the possibility of having enough years of contributions to access a decent retirement.

Also, we must not only discuss the level of pension and social security spending but also see how it is financed. A progressive tax reform is necessary to finance a social security system that meets the objectives of economic and social policy.l, growth and equity.

We must also seriously discuss other issues that make up the general regime, such as taking the complete work history for the retirement calculation, retirement age including the gender issuetaking into account changes in life expectancy, changes in the labor market and the differences between unhealthy activities and work modalities that are more favorable to the worker.

Of course, we must analyze the equity between the different provincial regimes in relation to the national regime within the framework of the Nation-Provinces discussion and the different special regimes (judges, diplomats, presidents) outside the general regime, where reforms are also needed to guarantee sustainability and equity.

Also The public distribution pillar must be strengthened with stimuli for long-term voluntary private pension savings to guarantee greater income in the post-employment stage.

As we see, the pension issue must be evaluated comprehensively, without patches, dogmatism or delays, but also not appealing to unilateral measures without consensus to build an efficient and supportive model that exceeds each government period. This comprehensiveness includes the fiscal issue and the very design of economic policies, elements without which there are no formulas that can guarantee good retirements.

Source: Ambito