In the case of retirees with the minimum, who collect a bonus, the loss will be 28% between both quarters. To reach the losses described, an inflation of 14.3% is assumed for March.

The retired nationals are going through a period of great loss of purchasing power of their pensions. During this month, assets are rising 27.18%. With this increase included, the retirement benefits will end the first quarter of the year with a loss of purchasing power of 42% compared to the same quarter of 2023, according to a report from the Argentine Institute of Fiscal Analysis (IARAF).

The content you want to access is exclusive to subscribers.

In the case of retirees with the minimum, who collect a bonus, the loss will be 28% between both quarters. To arrive at the losses described, Inflation of 14.3% is assumed for March.

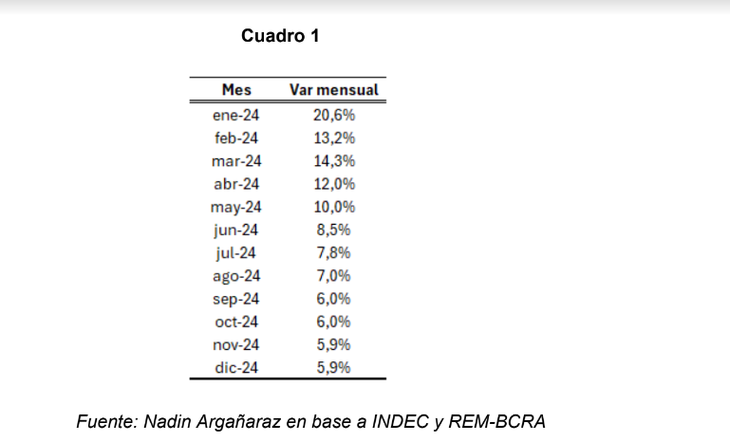

It is possible that the change in the mobility rule comes about by decree of necessity and urgency. It is speculated that in April salaries will rise by 12.5% for the only time. In turn, they will rise due to February inflation of 13.2%. Starting in May they will rise in line with March inflation and so on.

Given this possibility, this work calculates the impact of a proposal of this style, both on retirees with the minimum and on other retirees who, by not receiving the minimum, are not collecting bonuses.

A key aspect to elucidate is what will happen to the value of the bond. For April it is set at $70,000. It would be reasonable that starting in May the bond would also rise in line with inflation. For the calculations presented, the latter situation was considered.

iaraf.png

Retirees: what is the impact of the bonus for minimum retirements

The impact of the proposed mix on the minimum retirements with bonuses. If the case of a retiree with the minimum who collects bonuses is considered, and that the bonus starting in May is also updated by inflation, during the month of May he would collect in the currency of this month of March 2024 about $238,397, $156,772 for the there is another $81,625 bonus. This can be seen in the graph.

That May income would be equivalent to 75% of the average income that this retiree had in 2017, when it was $319,885. As when incorporating the updating of assets due to inflation, retirement no longer has room to grow in real termsincome would be frozen at a level 25% lower than in 2017.

Under the assumption that inflation follows a decreasing trend, Retirements would register an improvement in the following months of 2024 and 2025. Specifically, if inflation continues to decline and reaches 1.9% in December 2025, retirees’ assets will improve. The numbers allow us to affirm that in this case the total income of this retiree would be $281,928 ($185,398 of assets plus $96,529 of the bonus) in December 2025. That is, it would increase by 18% compared to the income for the month of May 2024.

Under this optimistic inflation scenarioin the month of December 2025 the total income of this retiree would be equivalent to 88% of the income he had in 2017. That is to say, the change in the rule would mean that as of December 2025, there would be a loss of purchasing power of 12% compared to 2017.

Source: Ambito