The social network of former US President Donald Trump is off to a brilliant start on the stock market. Then the price collapses. What’s going on there?

This article is adapted from the business magazine Capital and is available here for ten days. Afterwards it will only be available to read at again. Capital belongs like that star to RTL Germany.

Such a swing is rarely seen on the stock market: the share price of former US President Donald Trump’s media company has shown volatility of almost 250 percent in the past ten days. For comparison: the volatility of Apple shares is around 27 percent.

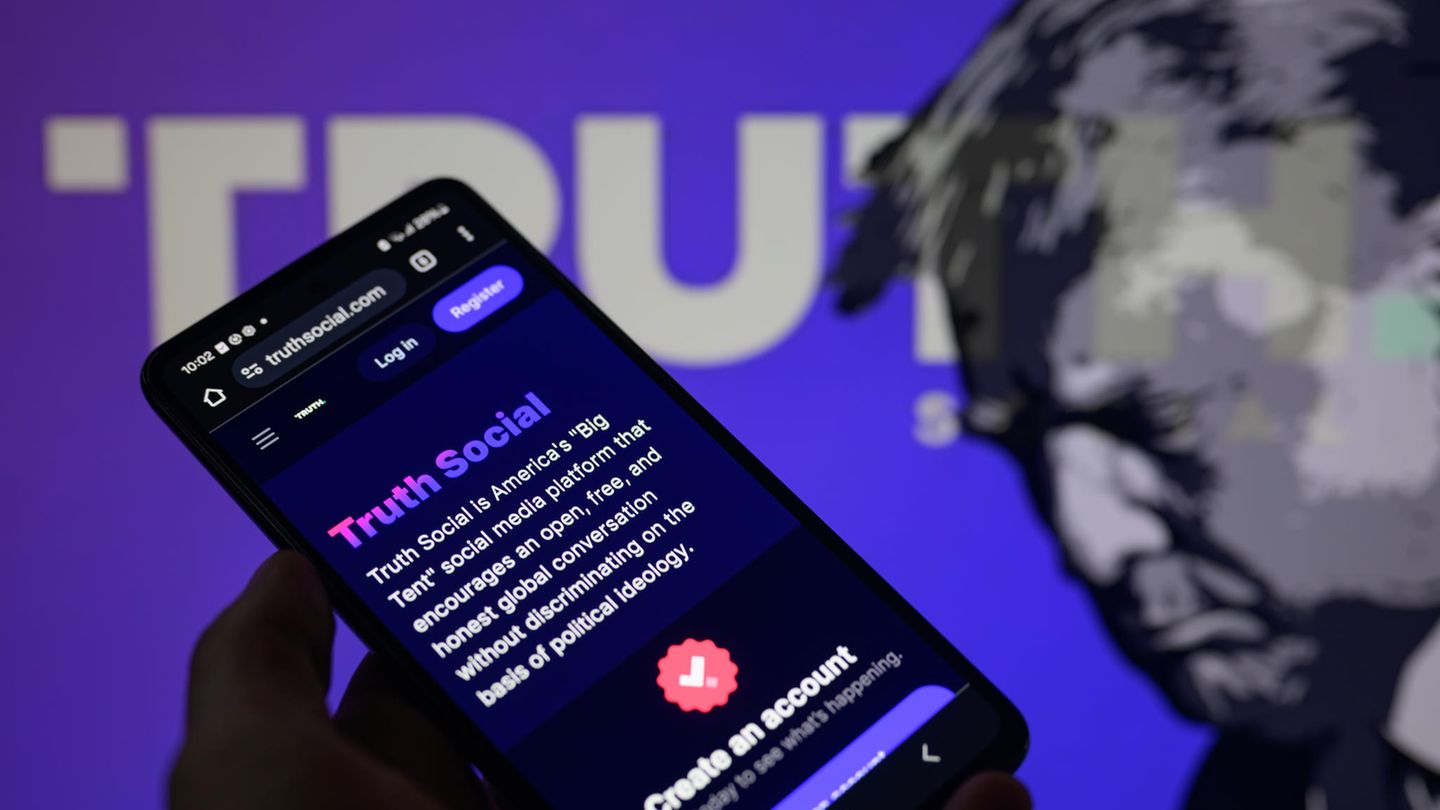

Shortly after the IPO last week, madness broke out on Wall Street. The price of Trump Media & Technology has on the first day of trading increased by 40 percent at its peak. The valuation was just under $9 billion. The company is home to the “Truth Social” platform, Trump’s answer to the ban on other platforms such as Twitter, Facebook and Instagram. At the end of last year it only had a few users: the number of monthly active users was 500,000. Twitter has many millions. But Trump supporters want to use the shares to carry their presidential candidate through the election campaign.

The figures for last year that have now been published do not even begin to explain the hype of the first few days. With sales of around $4 million, Trump’s network made a loss of a good $58 million. That was better than 2022, when sales were $1.4 million and profits were $50.5 million thanks only to a tax credit.

It’s no surprise that investors, mainly hedge funds and asset managers, have pulled out en masse. They have pushed the price down by around 30 percent, and the market capitalization is now just under $7 billion.

But the numbers don’t help much if you want to understand the strong fluctuations in the stock. Most investors, such as US billionaire Jeff Yass’s Susquehanna International Group, have been investing for much longer.

IPO planned since 2021

Trump fans and opponents are investing – and have been for a long time. Trump Media & Technology has been trying to go public for two and a half years. In September 2021, the company Digital World Acquisition took a SPAC public. This is an empty shell that collects money from investors to buy a company. Trump Media & Technology announced its intention to merge with the SPAC back in October.

That already caused hysteria back then: the price shot up by 300 percent after the announcement, and investors gave the SPAC around $1 billion. This success was already a sign of today’s billion dollar valuation. At the same time – as is often the case when Trump’s name is mentioned – investigations began. Background: There is said to have been a meeting between Digital World Acquisition and the Trump company at the beginning of the year. SPACs must go public without a plan for a merger.

In the meantime, the price was around $80, only to fall to just under $16 at the beginning of the year. Since then it has climbed again and despite the slump by almost 180 percent. Although the merger between the shell and the Trump company only succeeded on Monday.

Before a merger, investors must vote whether they agree to the merger. One reason, for example, why Yass got involved. Although he supports the Republicans, he has so far donated to Trump’s opponent. For him, the investment was probably a means to prevent Trump. However, that didn’t work. After the IPO, his company sold all of its shares – and withdrew a three-digit million sum.

Trump has now reduced his shares from 90 percent to 60 percent. But they are still worth billions of dollars, at least on paper. Money that Trump urgently needs to be able to pay tax evasion fines and legal bills and to finance his election campaign. But he can’t get there yet: Trump has to comply with the legally required holding period of six months before he can monetize the money. However, he can already use it as security, for example to take on debts.

Source: Stern