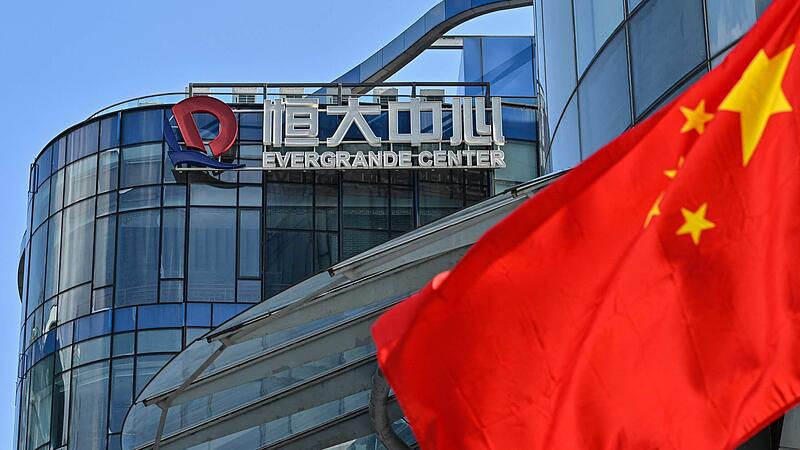

The rating agencies have downgraded the creditworthiness of the Chinese real estate company Evergrande. The crisis is affecting the entire real estate industry in China. The also struggling Kaisa group has now hired external consultants to help save the company.

With its rapid expansion, Evergrande has amassed more than $ 300 billion in debt. At least that much is in the books. But beyond that, there should be further obligations of over 150 billion dollars. With the boom in the Chinese real estate market and the common practice in China of building pre-paid apartments, it was easy to get loans.

Government pulls the reins

The Beijing government has tightened the reins on real estate companies. She wants to reduce debt and take stronger action against speculation with apartments.

The Evergrande crisis is no longer purely Chinese. On the one hand there is the amount of debt, on the other hand there is also the fear of contagion and a domino effect. The whole financial system in China is closely interwoven with the long booming real estate sector.

In addition, the Evergrande case is drawing wider circles: the Fitch rating agency is also warning about its smaller competitor Kaisa, and the Aoyuan Group recently reported financial problems. The rating agency S&P expects that there will be more defaults on Chinese property developers in the coming months. China’s government seems to want to make an example of Evergrande. Central bank chief Yi Gang signaled that the state would not help with financial aid.

The direct risk of contagion from a Chinese real estate crisis for the global financial system is rated by experts as manageable. Evergrande has the most foreign bonds outstanding of any Chinese real estate developer, at $ 19.2 billion. The sum is comparatively small, said Horst Löchel, head of the Sino-German Center at the Frankfurt School of Finance & Management. “That is not enough for international turmoil in the financial system.”

The Chinese real estate sector, however, represents around 30 percent of the economic output of the People’s Republic. If the real estate sector is reduced by the government, this will have a negative impact on the country’s economy with corresponding consequences for the global economy. After all, China is the second most important global economy after the US.

Source: Nachrichten