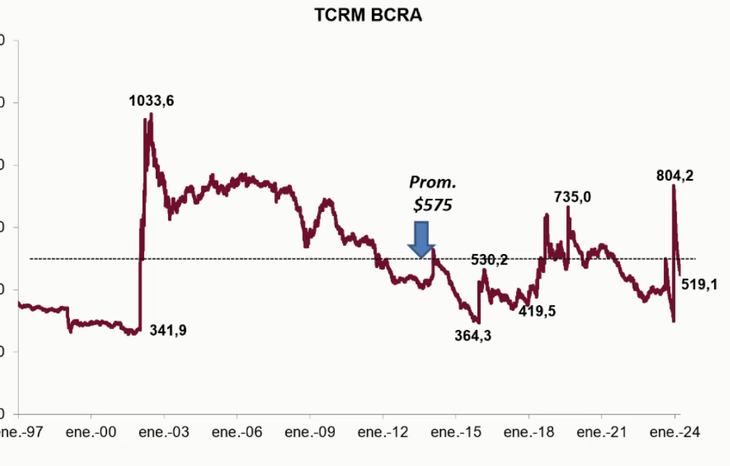

The race between inflation and the peso devaluation rate of 2% monthly that the Central Bank (BCRA) has been carrying out since the exchange rate jump occurred last December It was finished in April. The $800 of the Multilateral Real Exchange Rate (TCRM) at that time, now equal to $479even below the historical equilibrium exchange rate.

BCRA data show that on April 11, the indicator that measures whether the economy “is expensive” or “cheap” in dollars was located in 96.6 points. On December 13, when the Minister of Economy Luis Caputo announced the “discrete jump” in the price of the official dollar was 161.3 points.

The TCRM is an index prepared daily by the entity directed by Santiago Bausili and It is built with the price of the goods that the country exchanges with its 12 main trading partners, including China, Brazil, the United States and the European Union.. The point of perfect balance is 100 points. At that level, the value of the dollar serves both to export and to import.

Dollar: what is the equilibrium price in Argentina

In Argentina it can be said that the equilibrium dollar should be a little above 100 points taking into account that 50% of the exportable supply is made up of food and manufactures of agricultural origin. Consequently, it would be $575, according to Cohen Argentina estimates.

tcrm.png

It is about favoring liquidation because when the economy starts up imports grow. When Caputo took the official dollar to $800, the TCRM became 161.3, which means that, at 96.3 points, it is equivalent to $479.10.

Strictly speaking, the exchange rate It began to technically go into delay on April 1, when the index stood at 99.8 points. It should be remembered that the indicator has no relationship with quotes in the financial markets, where the value is located at $1,000. But if It has to do with economic activity.

Martín Polo, economist at Cohen Argentinawarned in a talk with investors that all governments in recent years have said the same thing: “That they do not need to devalue, that the exchange rate is fine, until they devalue.”

Denying the late dollar, a common catchphrase

“Obviously Caputo is not going to say that the exchange rate is behind“But if Argentina does not begin to accommodate this variable, it will have problems and this will be a signal for clenched teeth from the point of view of the exporter and the temptation of the importer to launch into that type of exchange,” Polo explained. .

cohen-tcrm-historico.png

The analyst said that ““The government’s argument is that, with the reform that Argentina is going to implement, it does not need an exchange rate of $575”. “It’s not to run away, but yes, to see it out of the corner of your eye, because of the persistence of this process of appreciation and how hard it is to get out of it”he warned.

In that sense, Cohen’s manager maintained that ““No one says there is a delay until reality prevails.” For now, Economists believe that the government will maintain the devaluation rate of 2% monthlydespite the fact that inflation is still running higher.

In this way, they anticipate that the price of the North American ticket will continue to fall. The consultant Salvador Distéfano points out in this regard that, “by the end of the month, the wholesale dollar could be at $868.40 and, by the end of May, at $885.6.”

“If the dollar bill falls to these values, It will be indifferent to sell in the market or directly at the bank counter, something that is not prohibited. If that happens, the BCRA could increase reserves and monetize the economy,” said Di Stéfano.

For his part, Emmanuel Álvarez Agis, head of PxQ, said in a talk for investors that “there is no technical reason to refute that the parallel could remain below the official one.” in a couple of months, if the Government maintains the current devaluation rate.

This is because, although the Government is going to normalize the flow of payment for imports from April, on the other hand, dollars from the gross harvest are going to enter, for less than 80% of the total estimated for this year, will generate a supply of currency for the Cash with Settlement (CCL) that will put pressure to continue compressing the gap.

Source: Ambito