The apparent consumption of beef would have totaled 499.7 thousand tons r/c/h in January-March of the current year and would have been 17.6% lower than that registered in the same quarter of last year (-106.9 thousand tons r/ c/h), marking the lowest record in the last three decades. This is how he considered it CICCRA (Chamber of Industry and Commerce of Meat and Derivatives) in a recent report.

In January-March 2024, the beef meat processing industry produced 745 thousand tons r/c/h of beef, that is, 7.6% less than in the first quarter of 2023. Put in absolute terms, 61.2 thousand tons less r/c/h were produced.

However, considering that beef exports remained around 85 thousand tons r/c/h in March, in the first three months of the year 245.2 thousand tons r/c/h would have been exported, which would represent an increase of 22.9% year-on-year (+45.7 thousand tons r/c/h).

meat34.PNG

The beef meat processing industry produced 745 thousand tons r/c/h of beef.

Along these lines, per capita consumption of beef would have been equivalent to 42.6 kilos/year in March 2024, being 18.5% below that verified in March 2023. Meanwhile, the moving average of the last twelve months of apparent beef consumption remained at 50.0 kg/inhabitant/year in the third month of the year, that is 4.2% below the average from a year ago.

Meat consumption: what impact did prices have on the fall?

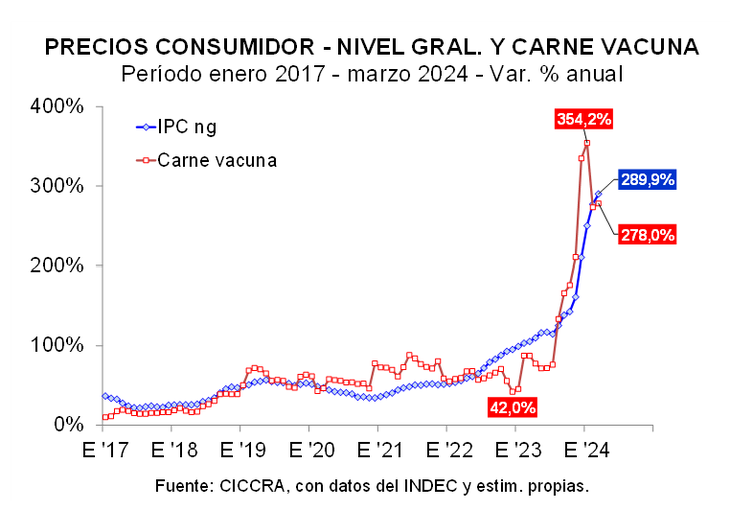

He general consumer price level of Greater Buenos Aires slowed down again in March 2024 (third consecutive month). In relation to February, the increase was 11.5%. But, as the monthly increase continued to be higher than that of the same month last yearor, the comparison with March 2023 showed an increase of 289.9% (last month it had been 277.1%). In this context, the food and non-alcoholic beverages chapter also rose at a slower pace than in January and February, and on this occasion it equaled that of the general level (+11.5% monthly; +11.7% in food and +10, 2% in non-alcoholic beverages). Despite this, in comparison with March of last year accumulated a greater increase than the average, since it was 314.1%.

The ‘meat and meat products’ category had a monthly increase of 9.8%, that is, 0.7 percentage points greater than that of February, but it continued to be one of those that minor increases recorded, leaving seasonal ones out of the analysis. In the case of beef cuts the increase was 9.5%, while in the case of chicken it reached 13.1%.

carneinfla.PNG

The ‘meat and meat products’ category had a monthly increase of 9.8%, that is, 0.7 percentage points higher than that of February

Meat consumption: What were the most expensive cuts?

Between the beef cutsthe monthly increases were 11.9% for the shoulder, 10.2% for the rump, 10.1% for common minced meat, 9.0% for the buttock and 6.2% for the roast. The hamburger box had an increase of only 4.6% monthly.

Meanwhile, between March 2023 and March 2024 on average the value of beef cuts rose 278.0%. The increase still remained below the rate of increase in standing property, which was 306.4% annually. When disaggregating by main cuts it appears that The average price of common minced meat increased four-fold in the last twelve months. Next were the shoulder (287.5%), the rump (271.6%), the buttock (271.1%) and the roast (258.4%). In the case of hamburgers, the increase was 276.2% annually. And the value of chicken registered an increase of 287.0% annually.

Source: Ambito