Argentina and Brazil took diametrically opposite economic policy courses. While Javier Milei carries out a policy of adjusting spending and reducing the presence of the State in different areasLula da Silva promotes a robust public sector that defines priorities and is committed to directing resources from the State to strategic sectors to promote economic growth.

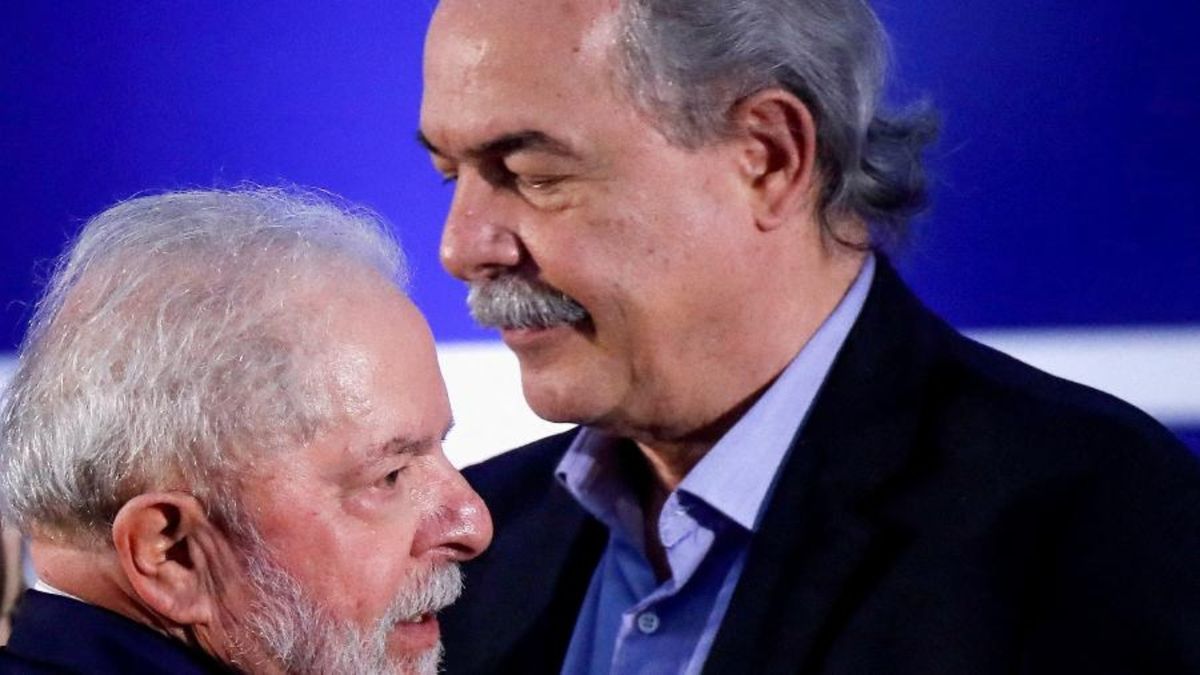

In this scheme, the National Bank for Economic and Social Development of Brazil (BNDES) will play a fundamental role., which is the most important in its segment in all of America. Your president, Aloizio Mercadante spoke with Ámbito and gave exclusive details of the ambitious plan to promote the industry: The Brazilian government will grant subsidized loans for 271 billion reais, non-refundable contributions for 21 billion and will also make capital investments for another 8 billion.

Meanwhile, Milei dismantles industrial policy programs. Bet on “debureaucratization” and commercial opening. Local industrialists observe with concern the strong phenomenon of attracting investments from Brazil, which in recent months has accumulated more than US$13 billion in the automotive sector alone. Mercadante assures that the main economies of the world are adopting industrialist policies and that “the Washington Consensus no longer generates consensus even in Washington”. Without dogmas, the tax reform that simplified the system and that obtained a broad political and business consensus also stands out.

Journalist: What role does development banking play in Brazil at this moment?

Aloizio Mercadante: The BNDES is the largest development bank in America. In 2023 its assets totaled 7% of GDP and its emissions 1.1% of GDP. Today it is a smaller bank than it was after the great international crisis of 2008, when BNDES assets and releases reached 15% and 4% of GDP, respectively. Our objective is to return to the historical level of the last 30 years, with emissions equivalent to 2% of GDP. This will be done with projects capable of transforming the Brazilian economy and that promote a new industry, the energy transition, digital and ecological transformation.

Q: How important is industrial policy at this time?

A.M: The world’s main economies have adopted relevant industrial policies. The Washington Consensus is no longer a consensus even in Washington; The United States has intensified its use of industrial protection and subsidies. The European Union, China, South Korea and Japan have, since 2018, announced industrial policies worth $12 trillion, using public investments, subsidies, public credit, tax credits and non-reimbursable resources.

Q: What are Lula’s plans for industrial policy?

A.M: In February we launched the Nova Indústria Brasil program, which aims to recover and modernize our productive park. To this end, BNDES and FINEP, the Brazilian innovation financing agency, will make available until 2026 271 billion reais in the form of credit, 21 billion reais in the form of non-refundable resources and 8 billion reais in investments. of capital.

Q: Do you think these incentives are promoting investments in Brazil?

A.M: Without a doubt. Our greatest challenge now is to be able to promote a reversal of the downward trend in our investment rate, which was a result of the poor conduct of economic policy by previous governments. But Brazil today has enormous credibility with international investors. It is no coincidence that our country’s risk has been reduced by more than 80 basis points since the beginning of the Lula government. This is the most concrete sign that there is a perception of control and sustainability in fiscal indicators by investors. This credibility allows us to attract capital for the development of our country. Just as an example: Brazil’s National Treasury managed to raise around $2 billion by the end of 2023 through sustainable sovereign bonds, which are bonds with favorable interest rates for Brazil and whose resources are allocated to investments in programs social and green agenda.

Q: Do you think that this year Brazil’s economy will grow again?

A.M: When Lula’s Government began in 2023, the market did not believe in the growth potential of our economy and pointed to an increase of 0.8%. We closed 2023 with growth of 2.9% thanks to the resumption of several public policies. The Government once again prioritized social transfers, especially with the resumption and valorization of Bolsa Familia. The minimum wage, after years of being frozen, once again recorded real gains, public banks regained participation in the credit market after eight years, and public investments in infrastructure and industrial projects have resumed. In 2024, we hope that with the reduction of interest rates and the promotion of investment programs by the Lula Government, in particular with the New PAC and the New Industrial Policy, the economy will have greater growth.

Q: What is the objective of the fiscal reforms that Lula’s government is carrying out?

A.M: The approval of the tax reform is a historic achievement in Brazil, the country waited 30 years for this measure that is now being implemented by Lula’s Government and was achieved with extensive dialogue in Congress and the support of the business community. Without increasing the tax burden, the reform creates a value-added tax, unifies taxes, reduces rates, reduces the fiscal war between states and municipalities and provides exemptions for essential products in the basic food basket. Tax reform simplifies, reduces bureaucracy, eliminates cumulative taxes, creates a more favorable environment for investment and makes the economy more productive, more competitive and fairer. In parallel, the Ministry of Finance has been proposing an innovative and progressive agenda to tax the super rich. As Lula says, the objective of his government is to put the poor in the budget and the rich in income taxes.

Source: Ambito