Behind the repeal of the rental law by decree of necessity and urgency, and with a inflation which reached 25.5% monthly during the current Government and then decreased but remains in double digits, Currently, more than half of the contracts to rent homes (57.6%) are indexed by the Consumer Price Index (CPI)..

This emerges from the latest national survey of Grouped Tenants, what does it measure average rental price in CABA, Province of Buenos Aires and Santa Fe, as well as contract term, price update index and incidence of rent and expenses on family income.

Contract durations were shortened after the repeal of the law. Currently, those that last 3 years only represent 16% while in January they reached 24.8%. In counterpart, there was a growth in short rental contractswith a period of less than 1 year: These represent 33% of the cases. While, Agreements between 1 and 2 years are now the most frequent, in 42.2% of cases.

In addition, a notable growth is observed in contracts that have increases in shorter periods. Nine out of 10 contracts signed after the repeal of the rental law are updated every 6 months or less: 28.9% do it every 6 months, 21% every 4, 35.7% every 3, 2.7% every 2 and 3.2% monthly.

“We see since the validity of the DNU a clear flexibility in rental contracts which fundamentally translates into an increase in the transfer of tenant income to rentiers. Short contracts and quarterly increases due to inflation are generating a silent but dramatic housing and social crisis,” said the head of Inquilinos Agrupados, Gervasio Muñoz.

rental price update – tenants.jpg

Wages lagging behind inflation

To the changes in contract duration, more frequent increases and indexations tied to the CPI, we must add the macroeconomic situation of an Argentina with salaries that lose month after month in the face of inflationand therefore, they have less purchasing power and few savings possibilities.

The Government has already clarified that will not approve parities above the price variation, which implies that salaries will lose again in 2024 compared to inflation. Likewise, there are already reports that show that in a recessionary scenario unemployment will also increase.

In this sense, It will be a challenge for inflation-indexed contracts to continue to be maintained.. It should be noted that, according to the report, In March, tenants spent an average of 34.6% of family income between rent and expenses, without taking into account public services. However, for those who signed a contract after the entry into force of DNU 70/2023, the housing expense amounts to 42.1% of the family budget.

At the same time, 60.1% of tenant households surveyed responded that they currently have debt of some kindespecially with the banks issuing Credit cardsin 42.2% of cases.

How much does it cost to rent an apartment?

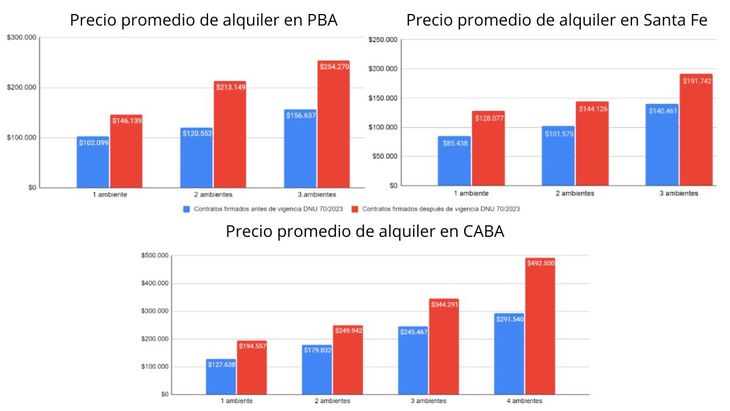

The tenant report also collects information on the average rental cost in both CABA like in Buenos Aires province and Santa Fe. The cost of a 2 room with a contract signed after the mega DNU was between $144,126 and $249,942 in March, being the cheapest Santa Fe and the most expensive CABA. Meanwhile, the contracts with rental law In March they had an average value of between $101,575 and $179,832.

Average rental price in CABA, PBA and Sta Fe.jpg

Tenants with contracts recently started in CABA pay approximately between 38% and 62% more for homes with similar characteristics than those who started before the end of December of last year, that is, within the framework of the rental law. In the case of the provinces of Buenos Aires and Santa Fe This difference is also notable: The average value of the March rent is between 31% and 60% higher in those cases that began after the entry into force of DNU 70/2023that is, without regulation.

Source: Ambito