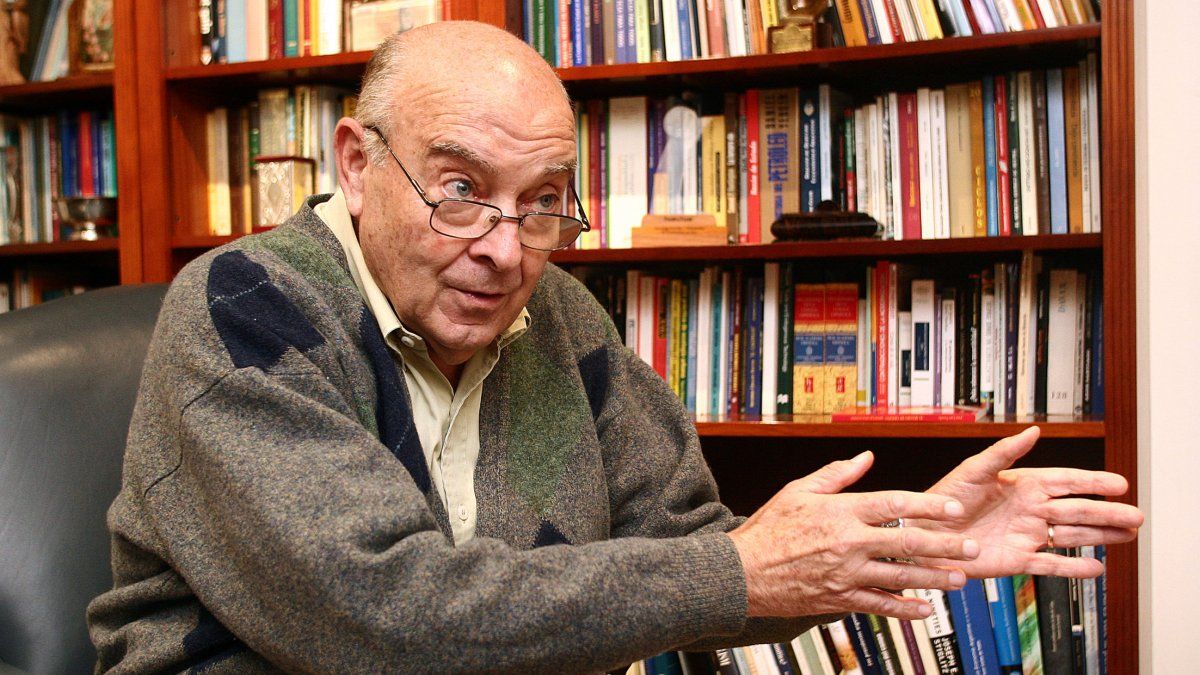

The former Minister of Economy (1991-1996) and (2001), Sunday Cavallopredicted an appreciation of the dollar Cash with Settlement (CCL)and encouraged a exit from the exchange rate and the current regulations for importsestimating that this parallel price would not go much higher than the $1,300.

How much could the dollar reach if the stocks are lifted?

“If the Government decided to remove the obstacles to the participation of companies, operators and people in the Cash with Settlement and replaced it with a free market, possibly the exchange rate in that market would go to $1,300 to give a figure, instead of the $1,100 that is now,” the economist considered during a virtual seminar with clients of Cocos Capital.

In that sense, he added: “I know there are people who say no, that it would go much higher, but there is always a limit that free markets have and that is that if the exchange rate rises a lot in a free market, capital inflow is also encouragednot just the exit.”

For the economist, if Milei removed the restrictions in force in the CCL marketthe gap with the official dollar would widen, but this problem would be resolved by accelerating the pace crawling pegwhich would allow the currency to converge in $1,300. “Around that level it would stabilize, so as to also be able to eliminate the COUNTRY tax and be able to go unifying commercial exchange rates“, Cavallo stated and predicted that by the end of the year, if the strategy were followed, “the exchange rate would hardly be very different from $1,300-1,400 per dollar.”

“The key is that once the exchange market is unified and liberalized, from then on there will really be a monetary exchange rule and the functioning of the system, which ensures a drastic drop in the inflation rate.”he concluded.

Cavallo questioned the “V” rebound after the recession

Furthermore, the former Minister of Economy questioned the reactivation of the economy behind the recession of this 2024. Cavallo emphasized the “strong obstacles” that still govern foreign tradewhich would be the ones who would prevent a “V” bounce.

“Until I know reunify and liberalize the exchange market and the strong obstacles that exist today to the foreign trade from Argentina, I do not see that there is a significant reactivation of the economy”said the economist. He even highlighted that the “recessive climate with a tendency to be depressive, that is, a prolonged recession,” could continue.

“After it has been unified the market and that a stabilization planonly at that moment can we talk about a sharp reduction in the inflation ratelike the one that occurred due to the regime of convertibility in ’91which at the same time would come hand in hand with a vigorous reactivation,” Cavallo predicted.

inflation prices.jpg

Ambit

Can inflation reach single digits in April?

Regarding inflation in particular, the former Minister of Economy pointed out that based on the online monitoring carried out by his son, Alberto Cavallo, from the consulting firm PriceStatsit is observed that prices “show a downward trend, although less than that published by INDEC”, which suggests a possible stabilization.

Based on those prices, Cavallo predicted that the national CPI will be 9.5% in April and that “starting in May, inflation could stabilize between 6-7% monthly.”.

Finally, the economist suggested that the Government give in to its search for a fiscal surplus in 2024 and warned about the worrying situation of tax collection, highlighting the falls of up to 38% for him stamp tax, VAT and checkamong others.

“It seems to me that stating that the deficit has to be zero, including all interest, interest payments, and debt, is an overly ambitious objective and perhaps impossible to achieve,” he noted.

Source: Ambito