In the interior of the country, for every $1,000 reduction in subsidies, the Nation reduces its spending by $1,000 and obtains extra income of $146, the provinces $183 and the municipalities $21.

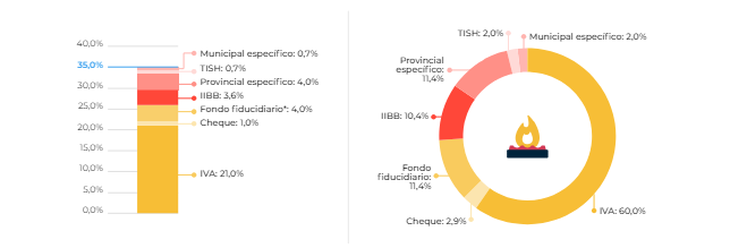

In our country, the provision of the service residential natural gas It is subject to the imposition of direct and indirect taxes by the three levels of government: national, provincial and municipal. Also, the national government maintains a subsidy that reduces the net value of the service to the end user. According to a recent IARAF report, the tax weight on the bill reaches up to 35% and VAT is the one with the greatest impact on the total bill.

The content you want to access is exclusive to subscribers.

When reviewing the tax incidence in the interior of the country, it is 35%. This burden is greater given that a specific provincial tax is paid that weighs in the order of 11% of the total indirect incidence. VAT represents 60%, Gross Income and Trust Fund represent 10% and 11%, respectively.

In the Federal Capital, the tax burden on the net value of the service, which depends on the fixed charge and consumption per cubic meters, is 30%. Of the total charge, VAT represents 69%.

Gas bill: Tax incidence in the interior of the country

VAT1.PNG

Gas bill: tax incidence in CABA

VAT2.PNG

Gas rates: how the subsidy reduction impacts

According to the IARAF, it was proven that the net final impact of a reduction in gas subsidies is greater than a mere reduction in national public spending.

“In the interior of the country, for every $1,000 reduction in subsidies, the Nation reduces its spending by $1,000 and obtains extra income of $146, the provinces $183 and the municipalities $21. That is, for every $1,000 reduction in subsidies, the final consumer “is reflected an increase of $1,350 in its bill in the interior of the country. For its part, in CABA, the Nation obtains income of $146 and the City $157,” the report explained.

“In conclusion, it creates the possibility for different levels of government to offer tax burden reductions or exemptionsso that their income maintains the level prior to the reduction of subsidies and that the impact of the increase in the cost of service is lower for the final consumer.

Source: Ambito