There are analysts believe that The Government may be walking into an alley with its current policy of delaying the exchange rate which can be expensive to leave. According to what they propose, if the Minister of Economy, Luis Caputo wants to maintain the current level of the value of the dollar or even lower, the Milei administration will have to speed up structural reforms that make the new parity sustainable because otherwise it will be forced to devalue again.

This is stated in a study by the Argentine Institute for Social Development (IDESA), the consulting firm run by the economist Jorge Colina. “The crossroads have arisen. Keeping the price of the dollar contained contributes to lowering inflation. But, to achieve this, access to dollars must be repressed which implies repressing economic activity,” it is warned.

On the other hand, the consulting firm points out that “for economic activity to be reactivated, it is necessary to increase imports of goods and services and allow the mobility of capital to and from abroad so that investment is revitalized.”

idesa-dolar.png

“The thing is that eliminating the exchange rate generates uncertainty about what may happen to the price of the dollar and how this can impact inflation,” indicates the study.

The dollar is delayed

Data from the consulting firm recall that in December the monthly inflation rate was 26% and in April it is expected to be 10%. “The official dollar was $1,325 at current prices and in April it is $870. The parallel dollar was 1,987 at current prices and in April it is $1,000,” the report adds.

IDESA says that ““These data show that the official dollar fell in real terms by 35% and the parallel dollar by 50%,” so that “inflation is falling hand in hand with a associated strong exchange rate appreciation to decisions that the Government has been making.”

The consultant points out that “the dilemma seems without solution” since “if the exchange rate policy is made more flexible, the decline in inflation is put at risk and if exchange controls are maintained, the reactivation is put at risk.

“To get out of the dilemma we have to think less about the exchange market and more about structural transformations that the Government has been announcing and that, for now, cannot find a way to implement them,” the report adds.

The solution is not to devalue

In that sense, he maintains that ““The solution is not to accelerate the devaluation of the official exchange rate but to accelerate the implementation of the May Pact” that the Government seeks to sign with the opposition next month in Córdoba.

Prior to that, In the roadmap, Milei said he wanted the new Bases law and the fiscal package to be approved, which can ensure the fiscal situation, which for today is very good, but requires strong changes to make it permanent.

Meanwhile, some believe that the solution would be through the unification of the exchange rate, which implies the lifting of the stocks. Walter Morales, CEO of Wise Capital, warned that “if the release of the official exchange rate is in the second semester, it seems likely that at some point the monthly devaluations will accelerate.” from the Central Bank, an entity that remains firm in the policy of 2% monthly regardless of inflation.

Morales suggests that If the crawling is not accelerated “then a very big jump would be necessary to unify” and that in the consulting firm there is a tendency to think that the Government “is going to gradually remove restrictions to release the CCL first and then the official one.”

However, he admits that “the Government might want to surprise with the timing, to get ahead of the market” by taking into account the broker profile of Minister Caputo, who operates on market expectations.

The Real Exchange Rate (ERR), according to Wise Capital, has been appreciating. December’s $800 is $1,480 in today’s values and in recent days that has accelerated due to the rise of the dollar globally. The RER is already at the pre-Massa devaluation level at $350.

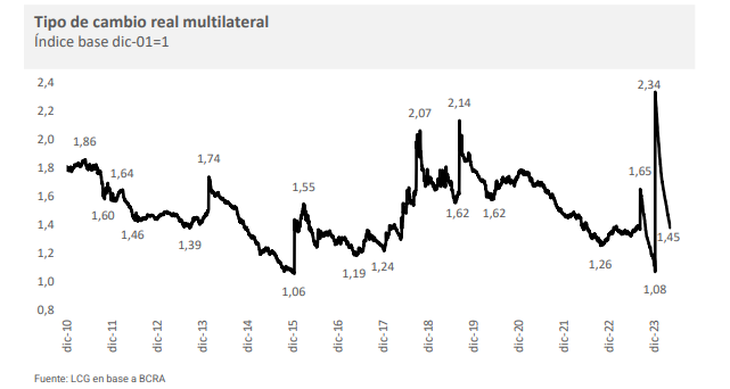

“Milei repeats that he will not touch the 2% crawling and, if so, For June the TCR will be like the minimum of 2016-2017, the lowest with the unified post-Convertibility Exchange Rate”, warns Morales.

There is still room to appreciate the peso

tcrm.lcgd.png

The consulting firm LCG affirms that there is still room for Caputo to continue lowering the dollar. “The paradox of a renewed backward dollar, together with salaries that are at a minimum, seems to be broken, a little at least, concluding that there is still some exchange rate margin,” says LCG.

The consulting firm says that the external balance of the first two months of the year, which generated a significant amount of dollars to the point that net reserves have returned to positive levels, “is not due so much to this situation as to the effects of the recession and the prolonged payment scheme for imports.”

““It does not seem that we are going through (until next June) cost schemes as high as at the end of 2015 or 2017,” points out LCG.

The study says that “There are many products that are more expensive than abroad.but from this analysis it seems that this appears dimmed in a set of tradable companiesfundamentally due to the fall in salaries in dollars.”

“Thus, the message ‘more expensive coffee capsules and toothpaste than in Paris show a lack of competitiveness’ does not have to be 100% true taking into account the variety of relative prices and the different impact on the cost matrix of companies”, justifies the work.

Source: Ambito