Some economists consider that The Government got out of hand with the adjustment and that is the basis for which they believe that the exit from the recession can be rapid, in the shape of a “V”. In that sense, some private data lend credence to the idea that the economy is overadjusted.

According to the Argentine Institute of Fiscal Analysis (IARAF) “the fiscal adjustment of the first quarter was equivalent, in annual terms, “at 6 percentage points of GDP”. It is worth remembering that if the conditions are maintained in December, the cut would be one point higher than necessary according to the program that presented by Luis Caputo, which marked a reduction of 5 percentage points of GDP.

“In January The adjustment had been equivalent to 8 percentage points and in the first two months to 7 percentage points of GDP. Fiscal balance requires an annual effort of 5 percentage points of GDP,” the IARAF clarifies.

iaraf-1ertrim-annualized.png

With these data, the consulting firm run by the economist Nadin Argañaraz maintains that a projection exercise can be done until December of the first quarter data to have an idea of how much the primary surplus would be in the year.

“In the quarter, total income fell by 4.5% in real terms and primary spending fell by 35% in real terms. For its part, debt interest spending increased by a real 4.9%,” explained the IARAF.

In that sense, the study says that “the equivalent annual improvement in the primary result is 6.2 points percentages of GDP, which would mean going from un primary deficit from -2.7% of GDP in 2023 to a surplus of 3.5% of GDP in 2024”

“He Annualized interest expense is 1.8% of GDP. Therefore, the annualized financial result is positive by 1.7% of GDP (it was negative 4.4% of GDP in 2023),” the study details.

He IARAF clarified that the annualized data does not mean a fiscal projection for 2024, but rather an estimate equivalent of the fiscal behavior of the first quarter of the year.

Retirements supported 35% of the adjustment

The consultant indicated that “in the first quarter of the year, national public spending paid fell by $8.3 billion with respect to 2023 to the first quarter of 2023.”

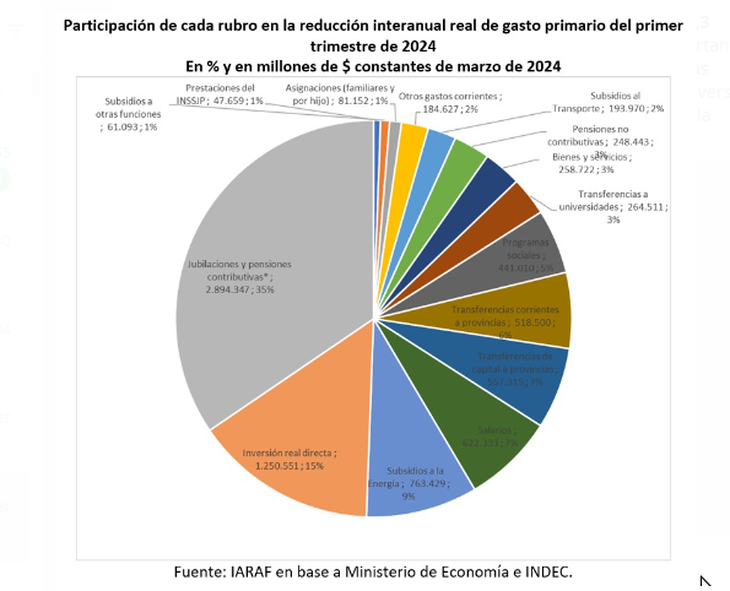

“It is important to analyze the distribution of the public spending cut. It is appreciated that Retirements and pensions supported 35% of the total reduction, real direct investment 15%, transfers to provinces 13%, energy subsidies 9% and salaries 7%, among the most important,” details the IARAF study.

iaraf-1ertrimestre.png

On the other hand, it is noted that “in eIn the first quarter of the year, 15 of the 16 expenses decreased year-on-year in real terms, resulting in a real decrease of 35%.” The exception was spending on universal allocations for social protection with an increase of 10.6%

The GThe items that fell the most were: capital transfers to provinces, with 98.4%, real direct investment, 82.5% and current transfers to provinces 76.3%.

First quarter result

As reported by President Javier Milei on national television,The total income of the national public sector in March had a negative real interannual variation of 8.6%.

The IARAF said that “tax revenues decreased by 8.6% and non-tax revenues fell slightly in real terms.”

“On the sideprimary spending, this decreased by 28.6% real year-on-year. As a result, last year’s primary deficit was transformed into a primary surplus of $625 billion,” highlights the IARAF. The report states that “interest expense fell 31% in real terms compared to the same month last year.”

For that reason, the fiscal deficit became a fiscal surplus of $276,000 million, but the report clarifies that “The entire change in the fiscal result was explained by a real reduction in spending.”

Source: Ambito