Just as in the case of the first gap (official versus financial dollar) it is desirable that it tend to disappear, because it is a signal for a unification of the exchange rate, in the second (income vs. expenditure), the behavior should be reversed: The best thing for the economic plan is for it to expand, for income to exceed expenses.

anotherbrecha-cohen.png

He gap between expenses and income started this year very strong, with a positive difference in favor of income of 40%which allowed the Minister of Economy, Luis Caputo, to achieve a fiscal surplus of magnitudes never seen before.

In that sense, President Javier Milei He acknowledged this Sunday in a radio interview that all the good numbers of the first stage of 2024 are going to turn around in the second section, something to be expected due to the seasonality of spending.

This responds, as Milei himself admitted, to the fact that the surplus achieved in the first quarter has a high component of postponement of payment of invoices received by the State. Above all, in the case of the Wholesale Electricity Market (MEM), whose management company, CAMMESA, accumulates extraordinary debt.

“The payments of Cammesa will be done in the middle of the year, in the month of June”anticipated the president, who said that the disbursement will be able to be met because, “throughout what are the first five months, we are generating a lot of financial surplus to compensate for the Cammesa items and the payment of bonuses.”

In that sense, he acknowledged: “When those numbers come, operationally we are going to be in deficit. but, with what was accumulated before, the accounts remain balanced.

The doubts of the market

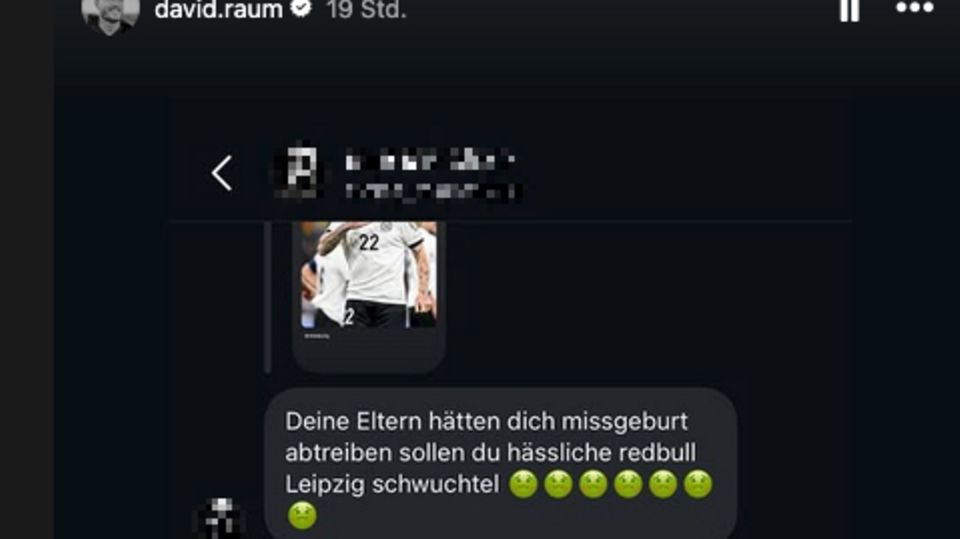

As pointed out Martín Polo, Chief Strategist of Cohen Argentinainvestors have to “analyze the difference between how much income grows compared to how much expenses grow.”

“Although the fact that this differential is positive can be negative for economic activity, for public accounts it is good because income falls less than expenses,” he explained in a talk.

However, when analyzing the behavior of spending and income, he pointed out that The adjustment carried out by the Government “has signs of fatigue.”

A complex future for the surplus

“From a difference of 40% in January, between what expenses and income fall, we are now at 20 points,” he explained. Likewise, Polo added that “that the public accounts “They have a lot of seasonality and the last part of the year is the most complex.”

The economist then stated that, “If the gap falls below 10% in the next 9 months, Argentina will have a staggering surplus and will not achieve fiscal balance.”

In that case, he said that a “deficit of 1.3% of GDP” is estimated. According to Cohen’s calculations, if the gap falls below that mark, the primary surplus would be just 0.2%.

In Cohen, they propose that, if income fell at the same speed as spending this year, Argentina could have a primary fiscal deficit of 1.5% of GDP and a financial deficit of 3.3%.

For this reason, Polo indicated that “to have a consolidated fiscal balance “The difference between income and expenses cannot fall below 17%” in the remainder of 2024. The economist considered that if the gap falls below that mark “there will be problems.”

The employees who will pay the remainder of the adjustment

If there is a problem for the Government on the fiscal front, It is not the reduction in spending but the fall in tax collection. Last month, the Value Added Tax (VAT) fell 28% in real terms. Profits plummeted 40% year-on-year in real terms due to the elimination of the so-called “fourth category” and its replacement with a scheduled tax that less than 1,000 people pay.

Now, with the Bases Law, Congress is preparing to approve a fiscal package that has, among other things, the recovery of the Income Tax, which will include some 800,000 people who had stopped paying taxes last year.

The Government estimates that this measure can provide income in the year equivalent to 0.4% of the GDP that may result from the differential. Single people without children who receive a gross salary of $1.8 million married people with children who earn a gross salary of $2.2 million would be on the list.

The Government also hopes to recover income from the Moratorium, which is expected to have a high level of acceptance because SMEs and small businesses are being seriously affected by the drop in activity. The special tax on money laundering would go one step lower. The fate of the new asset regularization plan is uncertain, although accounting firms are recommending their clients join in.

However, the government faces the dilemma of raising taxes further, in case “the other gap” narrows, which could deepen the decline in activity, or to seek income policies that stimulate consumption so that the production of SMEs does not go down too far and lose fiscal resources in that way.

Source: Ambito