Jane Stock is a technology author, who has written for 24 Hours World. She writes about the latest in technology news and trends, and is always on the lookout for new and innovative ways to improve his audience’s experience.

Menu

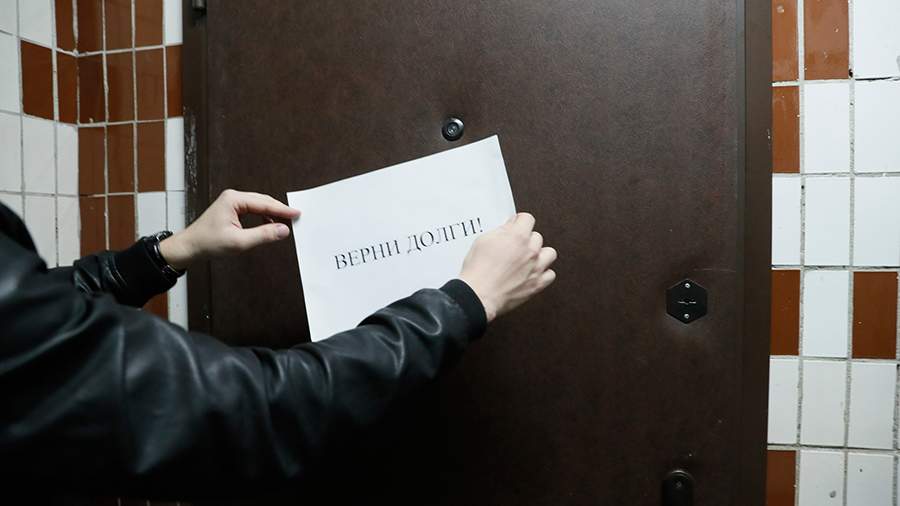

Debt sales to collectors dropped sharply in 2021

Categories

Most Read

In order to strengthen an industrial structure, dialogue is needed

October 5, 2025

No Comments

sugars and baked, the largest items

October 4, 2025

No Comments

The five provinces that received ATN from the Government in September

October 4, 2025

No Comments

market demands definitions; The lack of signals will accelerate the pressure on the dollar

October 4, 2025

No Comments

Trouble in the job: which ten sentences quickly bring unrest into the team

October 4, 2025

No Comments

Latest Posts

Minister wants to send ICE agents to the Super Bowl “with God’s blessing”

October 5, 2025

No Comments

Appearance by Bad Bunny Minister wants to send ICE agents “with God’s blessing” to the Super Bowl Copy the current link Add to the memorial

MotoGP: A week after the title triumph: Márquez injured after falling

October 5, 2025

No Comments

PierceI am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five

The Attersee-Attachée from Hanslmann in Steinbach

October 5, 2025

No Comments

Gina Brandlmayr Walk through the fruit and herb garden in the Hanslmann It is cozy in the room in the Hanslmann. A glass of wine

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.