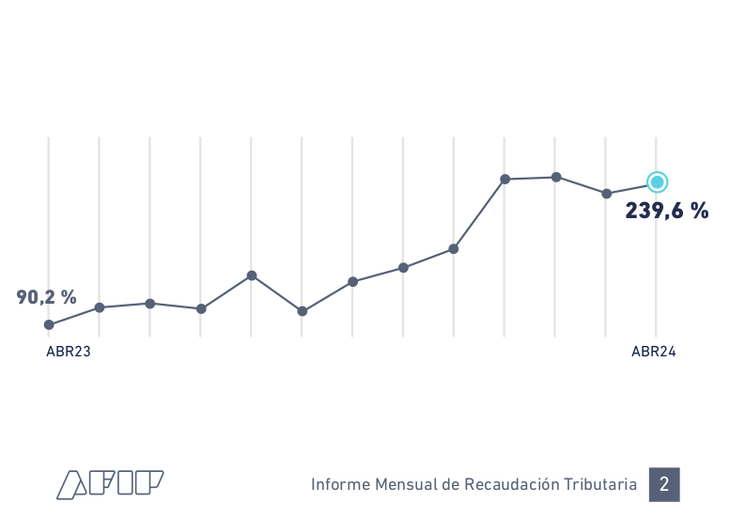

The tax collection reached $8.67 billion in April, with an interannual variation of 239.6%, which implies a real drop of 13%, According to data reported by the Federal Public Revenue Administration (AFIP). What was entered into the treasury thus shows the impact of the drop in activity in the first stage of the year.

Official data reveal that the VAT revenues totaled $3.2 billion, which implied a nominal annual growth of 256%, which reflects a real drop of 9%, discounting the effect of inflation.

On the other hand, the other important tax because it is shared with the provinces, Profits, recorded revenues of $1.24 billion, which means a nominal improvement of 150% but a drop of 35.8% in real terms.

April collection.jpeg

The Argentine Institute of Fiscal Analysis (IARAF) analyzed that, by excluding from the collection that produced by taxes linked to foreign trade “the drop would be 19%”.

“For the first time After 27 months, the fuel tax had a positive real interannual monthly variation”, says the entity headed by economist Nadin Argañaraz. It is because this year the Government began to collect taxes deferred from last year. This tax raised $157,884 million, with a nominal 300% increase, which in real terms is 2.6%.

The entity also recalls that “in April the placement of the bond BOPREAL generated extra revenue in the PAIS tax.”

reca.abril-afip.png

When doing a detail, the collection that would have fallen the most would be the income tax. Personal Assets, which would have increased by 65.7% in real terms year-on-yearfollowed by Profits with 35.8% and internal co-participation with 19.5%.

The only ones three taxes that would have increased in real terms they would be imposed COUNTRY with 209.9%, export duties with 61.8% and fuels with 2.6%.

Other income reported by the AFIP

On the other hand, according to AFIP, The Tax on Debits and Credits received $611,963 millionwith a year-on-year increase of 227.7%.

The income from Social Security increased 217.3%, to $1.94 trillion. The increase in collection is mainly due to the increase in average gross remuneration. The drop in jobs attenuated the year-on-year variation.

In Export Rights were obtained $318,428 million and an interannual variation of 529.8%. According to AFIP, the rise in the exchange rate and two more business days of collection compared to the previous year had a positive impact. On the import tariffs side, $280,144 million were obtained and a variation of 284.5%.

In Personal Assets, reached $80,089 million with a year-on-year variation of 33.6%. This month the fifth advance payment for human persons corresponding to the 2023 fiscal period expired.

Meanwhile, for PAIS Solidarity Tax was collected $510,247 million with a variation of 1,106.5%. It is favorably affected by the expansion of its tax base with the income of the payment applied to foreign currency purchase operations for the payment of certain imports. In addition, it rose because the exchange rate increased compared to last year.

Source: Ambito