President Javier Milei went out this Friday to the intersection of economists who propose a delay in the exchange rate. The president differs from those who, from both the orthodoxy and the heterodoxy of the profession, warn about the need to accelerate the crawling peg of 2% per month and tends to coincide with the vision of analysts such as Ricardo Arriazu who considers that “The key to the program is to leave the dollar stable,” as discussed in the Casa Rosada.

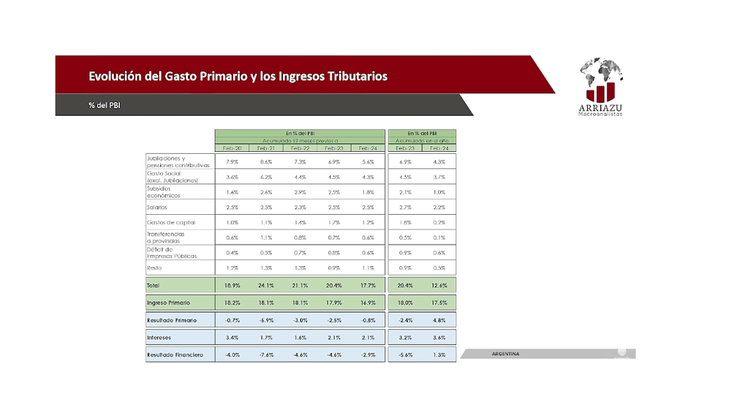

This economist pointed out in a recent conference that “someone is understanding what is happening” in defending the establishment of two anchors that must operate simultaneously. The fiscal one because “it is the mother of all problems” and the exchange rate “because if the exchange rate is not stabilized, prices will not be stabilized.” According to Arriazu, if the policy is maintainedinflation will drop to less than 5% in the second part of the year.

1.PNG box

box 2.PNG

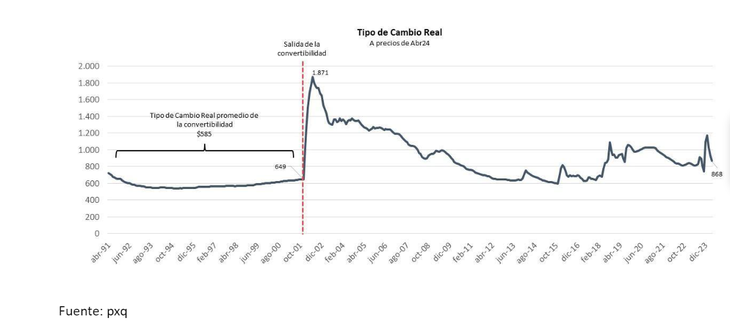

Disagree with other colleagues such as Emanuel Álvarez Agis whose consulting firm pxq today released a report in which it points out that the multilateral real exchange rate appreciated by 21% from December 2023 to April 2024.

picture 3.PNG

Through a post on his By chance, a human being could determine the vector of equilibrium prices and with this speak of the deviation, at least briefly we could ask ourselves if a certain policy framework implies a path in that direction.

For Milei, There are five reasons why it should be understood that the exchange rate has an adequate level: the Treasury surplus, the stability of the monetary base, the almost zero gap with the purchase of net reserves, the sanitation of the Central Bank and the “lifting of restrictions in the exchange market every day until one day it ends up leaving the stocks”.

Embed – https://publish.twitter.com/oembed?url=https://twitter.com/JMilei/status/1786388063997861949&partner=&hide_thread=false

EXCHANGE DELAY?

Although it is impossible to know the deep parameters (preferences, technology and endowments) for all humanity in the present and the future, so only by chance could a human being determine the vector of equilibrium prices and thereby speak…— Javier Milei (@JMilei) May 3, 2024

Reaffirming his position, the president later reposted a publication Federico Furiaseadvisor to Ministry of Economy. This economist maintained: “What the President sets is key. The real appreciation is the result of the fiscal and monetary anchor and the sanitation of the BCRA. The collapse in the gap, country risk and inflation reflects that consistency. Real rate rises, nominal rate falls and real appreciation moderates with the crawling peg of 2%”.

These expressions are in line with what was already indicated this week by the Minister of Economy, Luis Caputo. In a presentation offered by the Mediterranean Foundation, the minister noted that the appreciation of the exchange rate “is here to stay.”

Inflation

The lower rate that inflation has been showing contributes to maintaining the exchange rate scheme. According to Ecolatina, andIn the last week of April, mass consumption inflation showed a slowdown compared to the previous week, standing at 0.4%, which is equivalent to a monthly inflation of only 1.8%. According to this consulting firm, it is the fifth week in a row with increases that do not exceed 1%.

However, private analysts consider that you will have to follow carefullyforeign exchange settlement of the coarse harvest. It is considered that the contribution of the countryside will be essential for the recovery of international reserves and the stability of the exchange gap.

The liquidation of agricultural currencies during the second quarter usually shows an increase of 60% compared to the first quarter thanks to the commercialization of the thick harvest. It is evaluated that This seasonal rise will be key to matching the growing demand for foreign currency from importssince the payment of 25% of the purchases of the month and those made during the previous quarter (January-March) will converge.

Adjustment

With a seven-point GDP adjustment “they went mambo”, Arriazu said when referring to the magnitude of the fiscal correction. In his opinion it was not necessary so much, “But it turned out well.”

This economist highlights the reversal of external accounts. In his opinion, if they continue with confidence and the fiscal surplus continues By the end of the year they will have purchased US$13 billion more reserves.

In this regard, it is estimated that the recovery of crops will contribute US$16 billion more this year than in 2023, while the energy sector will have an improvement of US$7 billion.

In this way it calculates that It will be possible to go from a current account deficit of US$21.5 billion last year to a surplus of US$11,000 today.

However, consider that They are not in a position to open the trap now. He added that “It could be in the second part of the year, if we do things well.”

According to Arriazu, there are four conditions to stop inflation. Stop issuing, stabilize the exchange rate, stop indexation and create an anti-cyclical fund to address the variation in international prices.

In his projections, The consumer price index will approach 5% monthly in June and, if current guidelines are maintained, it will be below this level in the second part of the year..

He also anticipates that The fall in activity already hit its bottom in March or April and consumption in April or May.

Source: Ambito