After receiving by decree a billion-dollar authorization to expand emissions of debtthe Ministry of Economy announced this afternoon the conditions for the tender this Wednesday, in which it will aim to deepen the migration of liabilities from the Central Bank to the National Treasury. This time, Luis Caputo will try to give the banks $3.5 billion through three very short-term bills that will pay a rate higher than that of the BCRA and which is operated in the secondary market.

As the maturities scheduled for the end of May are small, almost the entire placement will be destined to continue with the debt handrails from the Central to the Treasury. This is a strategy that, through different measures, the Government proposed to accelerate this month in search of a drastic reduction in the remunerated liabilities of the monetary authority in exchange for a sharp increase in the treasury’s debt at higher rates.

With this objective, Caputo and his Secretary of Finance, Pablo Quirno, will put three capitalizable fixed rate bills on the table (LECAP). The shortest will be only 14 days in advance: it is the reopening of the LECAP that expires on June 14, which will have a maximum amount to be placed of $1.5 billion.

On this occasion, you will pay a Minimum monthly effective rate (TEM) of 4.2%. This is a performance equivalent to that already validated in the auction two weeks ago, but it is higher than that operated on the secondary market: this same LECAP closed on Monday at a TEM of 3.6%. It is an incentive for the banks to agree to dismantle their holdings of repos (for which the Central Bank pays them 3.3% or 3.06% if the impact of Gross Income is netted) and enter the Caputo tender.

In addition, there will be two other new LECAPs with a term of 42 and 77 days, which will be released without a minimum rate (the yield will be determined in the auction). Economy will seek to place $1 billion with each one.

Debt: what does the billion-dollar expansion mean?

This same Monday, The Government made official by decree a significant expansion of the authorization for Luis Caputo to issue Treasury debt. Through DNU 459/2024, it was decided to allow the placement of additional $35 billion, or its equivalent in other currencies, in short-term bills maturing during this same year. Of that amount, article 2 leaves room to, towards the end of the year, renew maturities until 2025 for a maximum amount of $30 billion and through instruments that do not exceed a term of 90 days.

As the recitals of the decree themselves point out, the measure is part of the decision to accelerate the debt handrail from the BCRA to the National Treasury.

The expansion by DNU occurs in a context in which the Government works with an extended budget, which gave it maximum discretion when applying the fiscal adjustment. Now, it decided to strongly raise the debt ceilings that had been set two years ago and that had already been expanded last year. “The amount is influenced by the inflationary dynamics itself and by the objective of moving towards the migration of repos to Treasury instruments,” said Ramiro Tosi.former Undersecretary of Financing for Martín Guzmán and current director of the consulting firm Suramericana Visión.

Debt migration: the official strategy

Two weeks ago, the economic team made a series of decisions to accelerate the debt migration process from the Central Bank to the treasury. The entity chaired by Santiago Bausili once again lowered the rate of passive repos, which are held by the banks, to 40% nominal annual rate, which implies a monthly effective rate (TEM) of 3.3% or 3. 06% if the impact of gross income is netted. At the same time, Economía offered in the last tender short-term bills with minimum fixed rates higher than those of repos. In addition, the BCRA established that these bills do not count toward the limits of financing to the Treasury that banks have for up to the amount they reduce from their repos holdings.

As a result, Caputo placed debt in pesos for $11.7 billion on that occasion against maturities of about $3 billion, which implied new debt for the Treasury for $8.63 billion. Simultaneously with the settlement of that auction, the stock of Central Bank passes fell by $10.9 billion (or 33%), although in the following three days it rebounded by around $2.3 billion.

image.png

The strategy responds to the fact that Javier Milei considers that the drastic reduction of the stock of remunerated liabilities of the BCRA (one of the endogenous emission factors that continues to operate) is one of the steps to be taken before moving forward in lifting exchange control. The exit from the stocks does not yet have a date concrete implementation: on the one hand, the President and the Minister of Economy want to limit the potential avenues of demand for foreign currency as much as possible and, on the other, Caputo admitted days ago that the level of reserves is still far from what is necessary to avoid an opening with exchange shocks.

The measures from two weeks ago and the extension of the debt issuance limits this Monday were read by some market players as confirmation that the Government seeks to move towards a definitive elimination of the Central Bank’s remunerated liabilities.

Tosi qualified the reading: “As long as there is no change in the design and execution of monetary and exchange policy, the BCRA will always have to have a sterilization instrument. When the fiscal emission is ‘turned off’, the amount necessary to accumulate reserves will remain.”

On this point, there is a lack of details from the Government. Milei usually suggests that, in the face of its “currency competition” proposal (which also has no specific date of application), all means of issuance will be eliminated, that the amount of pesos will be fixed and that the only way to monetize the economy will be the dollars that come out of the “mattress.” Caputo, meanwhile, said last week at the IAEF congress that in this scheme “there will be no issuance for deficits and there will almost be no issuance for remunerated liabilities.”

For now, $24.2 billion remain in the stock of passes of the BCRA held by the banks. Although, according to official data, Only a third of that total is held by private banks. Thus, the dismantling of remunerated liabilities “depends mostly on public banks bidding for LECAP in one of the biweekly auctions” of the Economy, the consulting firm 1816 highlighted in its latest report.

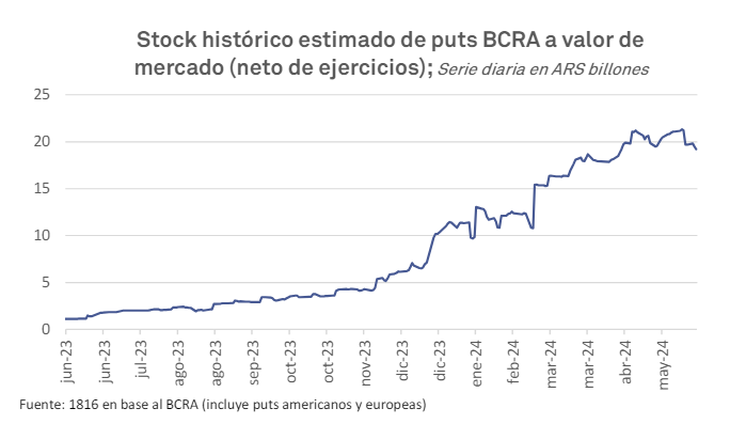

According to 1816, there is a more challenging point in the official strategy: liquidity insurance (known as puts) that the Central Bank paid a large amount to the banks in the first part of the current administration to stimulate the migration process towards Treasury tenders. “There are puts for just over $19 billion at market value and of that there are ‘old’ puts (those that can be exercised at any time) for $17 billion. Of this last number we calculate that 49% corresponds to securities for 2026 and 2027,” estimated the consultant.

These insurances constitute a kind of “latent debt” for the BCRA: the contract implies that, when the bank wants to get rid of the insured Treasury security, it can execute the put and the monetary authority must appeal to the issue to buy it back.

image.png

Source: Ambito