According to a document circulating among economists and leaders of the Renewal Front -headed by Sergio Massa– exchange rate policy evidence ”signs of fatigue”as well as ensuring that the real exchange rate of the dollar official based on inflation is 4% below the average purchasing power of said currency, in the months of 2023 before he takes office Javier Milei.

The writing explains that “the Central Bank of the Argentine Republic (BCRA) concluded May with reservation sales, which meant the lowest weekly purchase balance since the beginning of Milei’s management. At the end of this week, he had to intervene in the market selling USD 52 millionthus marking the second sales period in the week.

Furthermore, it includes that during the month, ‘‘the BCRA only managed to acquire a total of USD 2,522 million, a decrease of 24.6% compared to the previous month. This monthly income is the lowest in the last three months and the second lowest during the president’s administration. Javier MileiFebruary being the only month that recorded an even lower volume.”

graphic.avif

The factors that show the ”fatigue” of the exchange rate scheme

Along these lines, the text assures “that the exchange scheme implemented last December with the purpose of recovering the reserves of the BCRA has shown signs of fatigueinfluenced by various factors.

These factors can be divided into, on the one hand, that the liquidation of the coarse harvest ”has been slower than expected, which has impacted expectations”, and that ”these have not reached the projected levels ” despite an increase during the weeks of May.

”With banks offering loans to the countryside with rates of 3% monthly or even less, and with a crawling peg(official dollar increase guideline) of the BCRA of 2%, producers prefer to retain their harvest, especially in a context of expectations of rising soybean prices in Chicago,” he details.

graphic-.avif

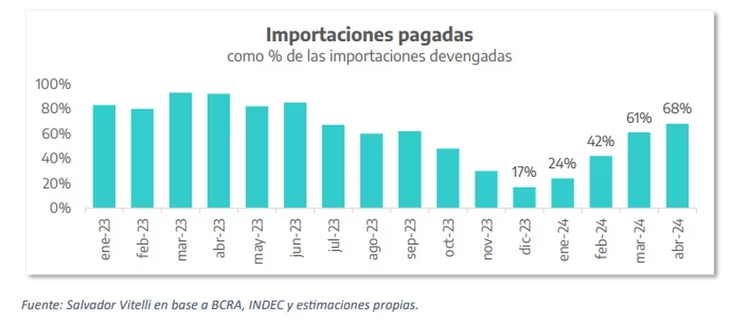

The second point speaks of ”a healthy recovery in import demand”, where it mentions that in April 68% of imports were paid, which marked ”a slight improvement compared to March 2024 and reaching the highest level high from July 2023”.

In any case, ”around USD 1,490 million remained pending payment in April, which adds an unpaid debt of USD 9.1 billion in the first quarter”. In any case, the analysis that shows a graph from a report by Salvador Vitelli, an economist at consulting firm F2, warns: “It is crucial to normalize Foreign Trade to address this situation.”

Looking ahead to what’s coming

Finally, a balance is made regarding what happened between the December devaluation and the access scheme to the Single and Free Exchange Market (MULC) for importers, which in the first quarter paid only 41.7% of imports accrued, generated savings of USD 7,600 million and allowed the BCRA to purchase USD 17,274 million.

Although in the second semester, they foresee a situation ”more challenging”which “could affect the supply of foreign currency if the Government maintains its crawling-peg strategy at 2% monthly.”

Source: Ambito