The latest movements in Congress shook the hornet’s nest. Market operators seek advice on legislative issues. The honeymoon has already lasted longer than expected and governance continues to be delayed. Banker explained what the strategy is to get the Bases Law.

The market was restless and Deputies worried it more

The half-sanction of the UCR project presented in the Chamber of Deputies to modify retirement mobilitywith the accompaniment of other blocks of the considered moderate opposition and UxP, shook the hornet’s nest. There were 160 deputies who voted in favor out of 240 present, which is exactly two-thirds. It is estimated that the fiscal cost is around almost half a point of GDP. Now the project goes to the Senate, whose composition favors the opposition even more, so it is very likely that it will be approved, say those in the know when asked by the table operators. In the market the question is whether, faced with the threat of a presidential veto, Congress has the votes to insist. That is, if he can ratify the law against the will of the President. This forced operators and investors to turn to specialists in legislative disputes. and, above all, how to interpret the constitutional limits in case the chambers insist on possible presidential vetoes.

The content you want to access is exclusive to subscribers.

What does article 83 of the Magna Carta say?: that if a President vetoes a law, then Congress can insist and ratify the initiative if it confirms it by a two-thirds majority of the votes. However, the article is not explicit about whether two-thirds of the votes cast or two-thirds of the Chambers are necessary, but it would be interpreted as referring to two-thirds of those present. The concern generated in the market, which had already been restless for several days, is that in the Senate the UxP and UCR blocs together have 64% of the Chamber and if they get other allies they could also show a number greater than two-thirds. This concerns the issue of governanceat a time when the libertarian administration had turned towards greater political pragmatism, above all, by appointing Guillermo Francos in the Chief of Staff and wait for the approval of the Base Law to be unlocked. What happened in the lower house disorients investment decision-making.

Breakfast, Missions and dining rooms (with indentation of bonds and actions)

In an early reserved meeting between one of the main consultants in the market and a small group of businessmen, it was clear that The honeymoon has already lasted longer than expected and governance continues to be delayed. In this regard, an experienced political analyst explained at said breakfast that what happened in Misiones was a warning sign and that, thank God, for now, it did not spread, but he highlighted the risk that the police force would be the one leading the social unrest. Where is the key? That President Milei is prepared for when, probably towards the end of the year, opinion polls show a drop in his level of popularity and positive image. One of those present, a friend of the president with whom he shares weekly lunches, anticipated that Milei in that case what he would do is surely double down, he will not be easily defeated. But this does not mean that they have been concerned about the salary conflict in Misiones, that the Buenos Aires governor in his case anticipated and deactivated potential movements in this regard by offering a salary increase, especially because the federal forces sent to establish order had to withdraw and allowing the provincial police to continue leading the pickets and camps joined by other state unions.

Obviously, the case of food to the canteens also crept into the various meetings, while the prices of bonds and stocks continued the bleeding. A person close to Olivos commented that the Minister of Human Capital was under great pressure, and alleged family threats from her had destabilized her. She has the presidential endorsement but the doubts, today, are whether she will resist the pressure. The issue, said an old market wolf, is that this type of complaints spreads transversally, because the mechanism used in Pettovello’s portfolio is not exclusive to him, they are practices rooted for decades in public management, in reference to the payment of salaries through contracts with international organizations.

Flows to emerging markets stagnated in the fourth quarter

Investment funds specialized in emerging markets began to rearrange their portfolios.

Rearrangements in emerging market funds

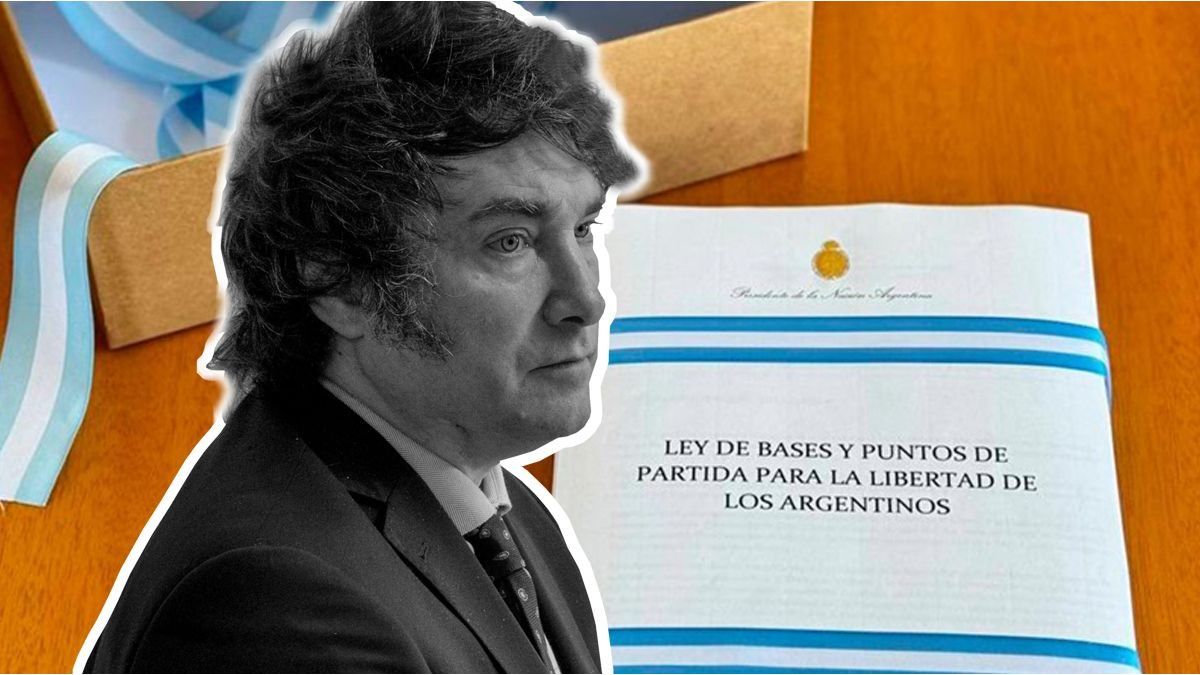

At a very financial lunch, the political issue also crept in and a banker, upon arriving at the economic team, outlined that The official strategy could be to remove the Base Law by any means possible and then with the renewal of the Court, more aligned to the libertarian, begin to move forward with the big changes. At that point the table suffered a tsunami of skepticism. The market wants to see the governance test with at least a pass. Another banker, very active with international funds, pointed out that the external context was not helping now either because the results of the elections in India and Mexico had an unfavorable impact and this explained the outflow of capital from emerging markets in recent days. Not only was Modi a winner, in the Indian case, but by a smaller margin that forces him to negotiate power and form a coalition, which is why there are fears for the continuity of the reforms. While in the case of Mexico, where the official candidate triumphed, not only do the funds fear for the new president’s agenda but also for what the current president does before leaving power, because the legislative numbers now give him the margins necessary to carry out a constitutional reform to accentuate the populist bias. The issue is, as the banker explained, that the newly elected legislators take office a month before the new president, so López Obrador could attempt what he did not achieve in his mandate.

The truth is that investment funds specialized in emerging markets began to rearrange their portfolios. In this sense, another diner contributed the vision of Robeco strategists who remember that in the first decade of the 21st century profitability was exceptional due to unique circumstances and now they identify three trends that will mark emerging markets in the next decade: technological innovation, urbanization and sustainability, and geopolitical changes and global trade dynamics. They highlight that rated emerging bonds have had a higher performance than their US counterpart and in the case of equities, the improvement in the purchasing power of the new generation of consumers is favorable for companies that pay dividends. According to him, this vision and analysis of Robeco is shared by Generali and Abrdn about emerging markets and their opportunities.

Clues and trading ideas

But there was also time to throw out some trading clues and they started with one of the people from Neix: the rearrangement of rates in the long tranche of Lecaps, even above the rate at which they came out in the case of S31M5, is part of a generalized nominal adjustment (rise in Rofex, expected inflation, financial dollars); But the dynamics of reserve accumulation and volatility on the political front also play against a long position in fixed-rate bills that came to be quoted practically as the BCRA debt net of taxes. So, For the short section of 2025 they continue to prefer CER or Badlar debt (PBA25, link) but they believe that the parity of the March Lecap is already at a fair price or fair value. That is why they began to close the S31M5 short trade, although rather than taking an exposure in that part of the curve they prefer to wait for the Finance tender in conjunction with the May inflation data. In turn, they open a trade in the BPY26 bond, taking advantage of the recent decline against parity, giving a return 7 points below the AL30 bond, but with a shorter maturity and partial amortizations that begin in November of next year.

The other trading idea started from a question: Is there value in the PBA25 bond (Buenos Aires Badlar due April 2025)? The strategists explained that with a peso curve at a fixed rate until March of next year it is possible to build a fair price for short Badlar bonds. In particular, they analyzed the value of PBA25. To do this, they consider not only the structure of fixed rates but also the trajectory of expected inflation in the market. It must be taken into account that the Badlar is mainly affected by the Pass rate and not by the Lecaps rate, so the Badlar is currently at a level below the Lecaps reference rate. The difference is approximately 1 monthly point which is equivalent to a little more than 12 points in TNA. The Badlar in real terms is located at approximately -3.5% monthly, if in the future the real rates of the shorter instruments begin to be positive (post cleanup of BCRA liabilities and lifting of exchange controls), as is happening in the longer instruments, inflation should fall more than the Badlar moves. So, given the Lecaps rates in the market, the PBA25 is slightly expensive (less than 1%) according to the fair price My dear. However, if inflation is added to this analysis breakeven current situation, it may already be convenient to be positioned in a variable rate instrument as of April 2025. This triggers a trader idea to open a bought position in PBA25 and on the other hand, still maintain two open trades (long AL30 and short S31M5). The longer-term Lecap trade is maintained despite the rise in the entire curve, betting that a position in CER is better for that section.

Source: Ambito