Menu

Overdrawing a credit card: Is that even possible?

Categories

Most Read

the discount with which you can save $6,000 on your next ride

October 26, 2025

No Comments

Scott Bessent assured that aid to Argentina will not result in losses for US taxpayers

October 26, 2025

No Comments

The US and China reached a preliminary agreement after two days of trade negotiations

October 26, 2025

No Comments

Sale Sunday! This supermarket launched exclusive promotions for its anniversary

October 26, 2025

No Comments

How much do I earn if I deposit $500,000 from home banking in 30 days

October 26, 2025

No Comments

Latest Posts

Formula 1: marshals run in front of Liam Lawson’s car

October 27, 2025

No Comments

PierceI am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five

There is already euphoria in the markets due to LLA’s electoral failure: ADRs fly up to 16% on Wall Street

October 27, 2025

No Comments

October 26, 2025 – 9:50 p.m. Before the result was known, after 9 p.m., Argentine ADRs were already beginning to gain strong bullish momentum this

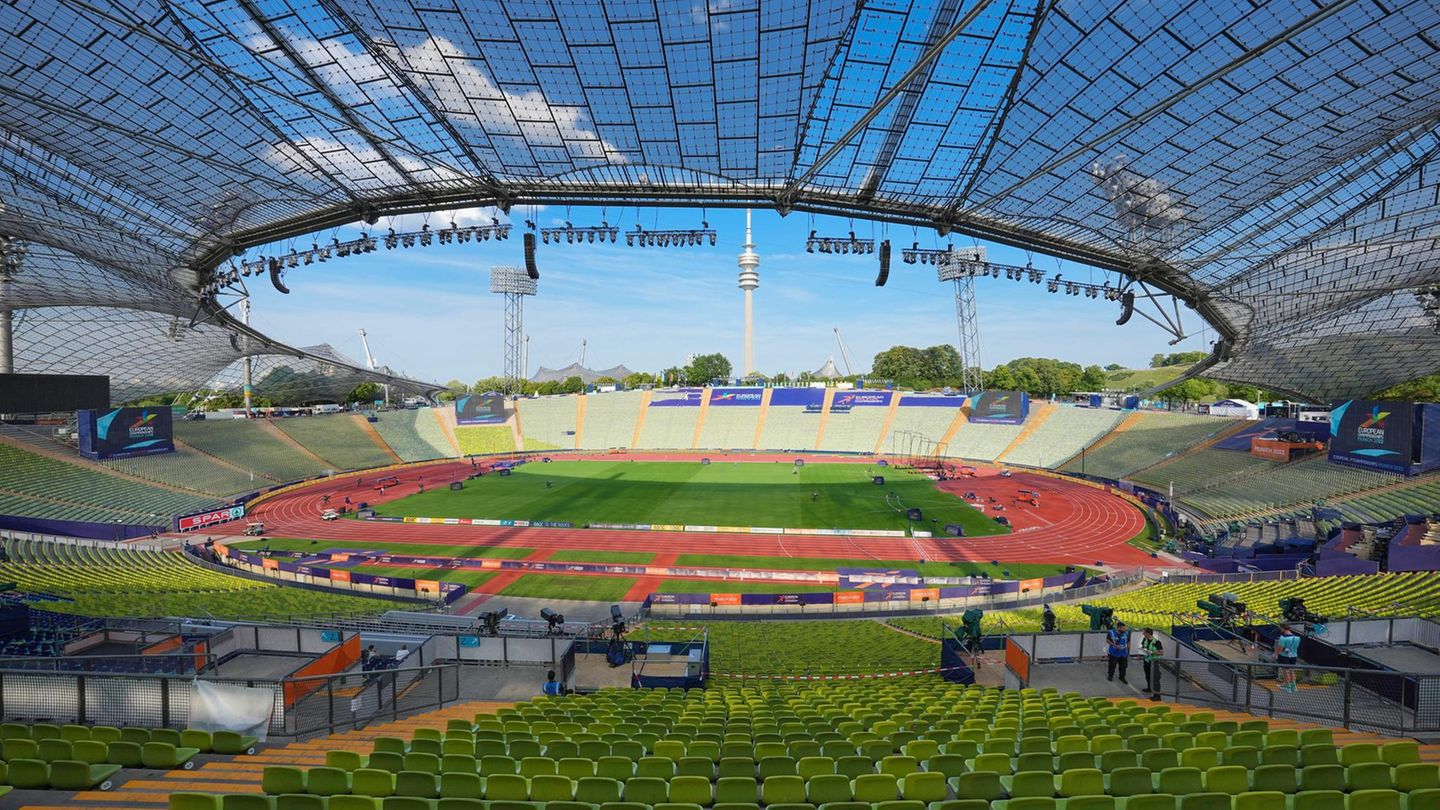

Munich: Citizens vote for Olympic bid in 2036, 2040 or 2044

October 26, 2025

No Comments

Citizens’ decision Munich votes for Olmypia application Listen to article Copy the current link Add to wishlist There was record participation in the Munich referendum

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.