The former Minister of Economy took stock of the Government’s economic plan and proposed imitating the monetary system that works in Peru.

Former Economy Minister Domingo Cavallo assured that the Government of Javier Milei “shows no hurry” to lift the exchange rate restrictions and proposed as an alternative adopt the monetary system that works in Peru.

The content you want to access is exclusive to subscribers.

Domingo Cavallo’s comments on the Government’s economic plan

“To move towards the unification of the official exchange rate and the free exchange rate, the pace of the crawl with which the official exchange rate and the interest rate are adjusted should be managed in such a way that the gap tends to close. Starting of the meeting of the two types of changes, the monetary system would begin to function as currency competition and managed flotation, imitating the monetary system that has worked very well in Peru,” said the economist.

Likewise, Cavallo said that as the Minister of Economy Luis Caputo “denies that these changes will occur during the current year unless a new agreement is reached with the IMF that means the contribution of fresh funds to reinforce the reserves”, it is unlikely “that he will find a favorable climate for this type of negotiation with the Fund if it does not first adopt measures to increase reserves“.

“What is undoubtedly not going to happen is that in the coming months all exchange restrictions will be completely eliminated and the unification and liberalization of the exchange market will be decided. admitting a significant devaluation of the peso“, wrote the man who was head of the Treasury on two occasions on his personal blog.

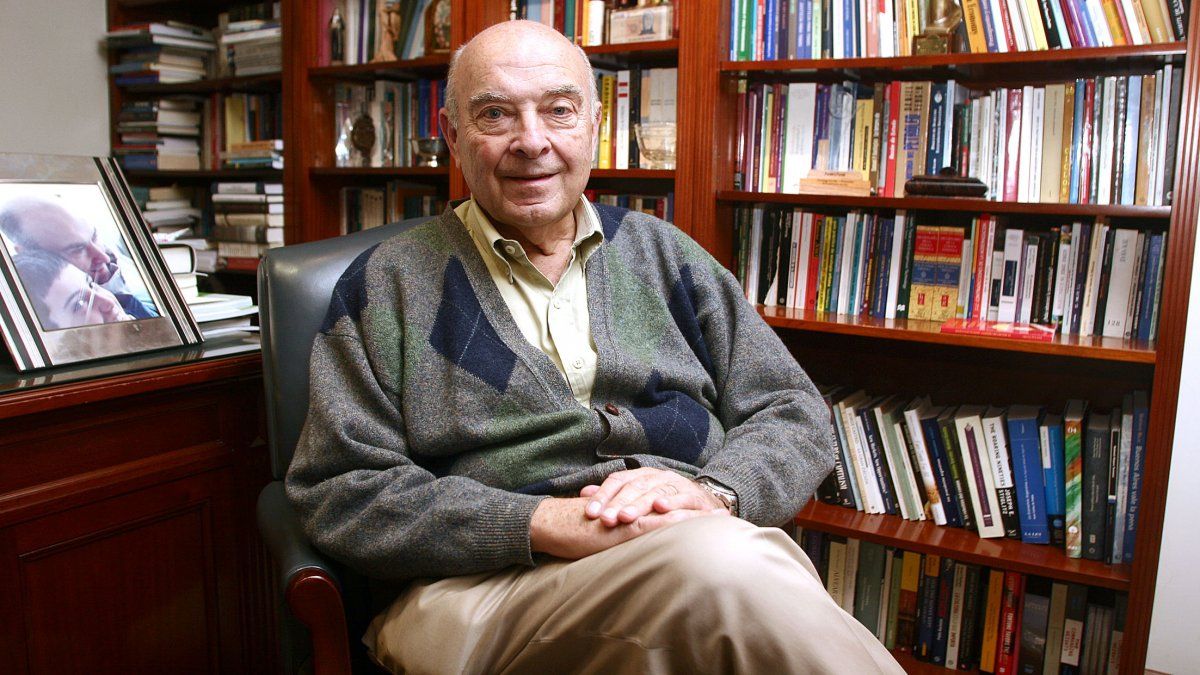

Domingo Cavallo Former Minister of Foreign Affairs of the Argentine Nation

“The monetary system would begin to function as a competition of currencies and managed flotation, imitating the monetary system that has worked very well in Peru,” explained Domingo Cavallo.

Mariano Fuchila

Cavallo said that the economic team “shows no rush to remove exchange restrictions on both trade in goods and trade in services and the movement of capital.” because he fears that doing so could cause an exchange rate jump capable of destabilizing the macroeconomy again.“, something that according to him could happen next year.

For the economist, the IMF, orthodox economists and investors “expect important changes in exchange and monetary policies.”

“The main objection to the simple continuation of these policies lies in what is considered an exaggerated real appreciation of the peso in the official market and in the low net purchase of reserves by the Central Bank that is expected from June due to the derivation of 20% of export income to the CCL market,” he added.

In line with that, he commented that the report from the Monetary Fund staff suggests “eliminating this derivation towards the CCL market of that 20% and offset its effect on the effective export exchange ratefor an adjustment of the official exchange rate of around 10%”.

“It would mean placing it close to $1,000 per dollar.. If, at the same time, the country tax were reduced from 17.5 to 7.5%, the inflationary impact of the increase in the cost of imports could be avoided. “It would be a perfectly compensated devaluation that would allow the Central Bank to buy the reserves that until this change were derived from the CCL market,” he concluded.

Source: Ambito