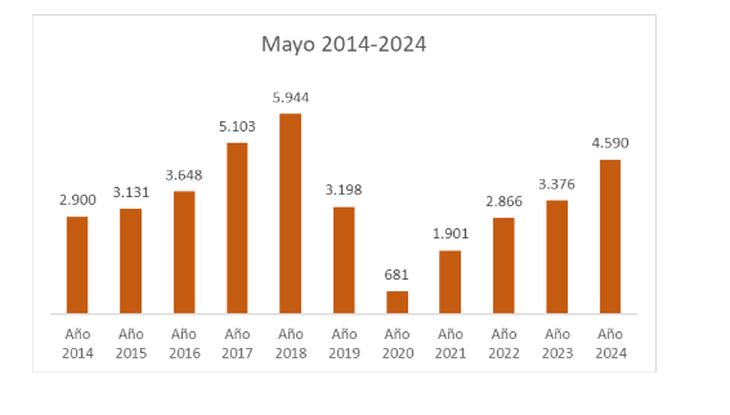

The total amount of real estate sales registered an annual increase of 36% in May and the amount of transactions also grew. The sector highlights that it is the best record in 65 months.

The total amount of the deeds of real estate purchase and sale registered in May an increase of 36% with respect to the level of a year before, by adding 4,590 recordswhile the total amount of transactions carried out amounted to 400.3%, with $346,713 million. Compared to April, acts climbed 26.2% (April 3636 writings). The data was reported by the College of Notaries of the City of Buenos Aires.

The content you want to access is exclusive to subscribers.

The average amount of the acts was $75,536,614 ($81,430 according to the average official exchange rate): it grew 268% in one year in pesos, and in US currency it fell 4.4%.

In May, There were 141 deeds formalized with a mortgage. Therefore, the increase in that sense is 5.2% compared to the same month last year. And the first 5 months, with 509, represents a decrease of 1.2%.

The best month in a long time

“We have two reasons to see a better outlook. May was the best in the last 65 months, after the peak of the mortgage boom in 2018. But at that time there was still an influence of credits and today that still has no impact. But if We are expectant due to the number of banks that have already launched their mortgage proposalsso we are convinced that – if they are carried out – with this push the market would have a clear growth effect,” explained Jorge De Bártolo, President of the College of Notaries.

purchase and sale.PNG

The real estate market considers that there may be more sales with the boost of mortgage loans

Mortgage loans: inquiries are growing

The resurgence of mortgage credits UVA – named after the acronym “Purchasing Value Unit” – aroused great interest, and so it was that in the first month alone more than 64,500 queries and today, a little less than two months after launching, the queries exceeded 250,000. Without a doubt, this line of credit became hope for a future economic recovery and for all those who dream of owning their own home.

There are already 15 banks that grant these lines of credit: the Mortgage, the Nación, Supervielle, Macro, Santader, Ciudad, Galicia, BBVA, Del Sol, ICBC, Brubank, Bancor (Córdoba), Banco de Corrientes, Banco Provincia del Neuquén and Patagonia. Employees and self-employed workers can access it, whether they are registered responsible persons or monotributists. In it National Bank Also included are retirees and pensioners who receive their salaries in that entity.

Payment times are around 20 years, but there are some entities that offer up to 30, so it is important to consult the different proposals for these loans that can also be taken to buy a second home.

Source: Ambito