The Central Bank ends June in red. This is the worst month for the dynamics of reserves of the Milei era. The problems, which were anticipated and arrived in a month that should have left a positive balance in terms of foreign exchange due to the heavy harvest, overheated the pressures on the dollar and the market warns of an exhaustion of the exchange rate scheme. However, Luis Caputo and Santiago Bausili ruled out a devaluation and reaffirmed the continuity of the blend dollarwhile confirming that there is still no date for the lifting of the restrictions.

This Friday, the BCRA He had to sell another US$38 million. So, Throughout June, it accumulated a negative balance of US$84 million. The number raised concern. Before starting the month, the expectation was that the result would be clearly positive and would be at a level not much lower than the US$2,532 million it bought in May. Gross reserves, meanwhile, ended at US$29,016 million, just US$352 million above the level of May 31, despite the fact that the International Monetary Fund disbursed around US$790 million in the meantime.

At the City tables, among operators and analysts, comments this week focused on the signs of exhaustion of the exchange rate scheme that the economic team implemented up to now: crawling peg of 2% monthly that led to almost completely eating up the effect of the December megadevaluation, support of the blend dollar that transfers 20% of the settlement of exports to the cash market with settlement (CCL) and continuity of the bulk of the exchange restrictions due to the insufficient reserves to guarantee a smooth exit from the stocks. But the Government, which announced this Friday a change in monetary policy, ratified the continuity of the exchange rate policy.

One of the symptoms perceived by the market was the stop in the recomposition of reserves. This was influenced by the pressures from the agricultural sector for a higher exchange rate, the progressive closing of the window that had opened by trampling on the payment of imports based on the quota access to the official dollar, the continuity of the blend and the stagnation of loans in foreign currency, which had skyrocketed since March and had inflated the supply of foreign currency in the previous months (since by regulation they must be liquidated).

The market puts pressure on the dollar

Another manifestation occurred in the dynamics of parallel dollars. The blue rose 11.4% in June, while the CCL rose by nearly 9% and the MEP by more than 10%. This brought the exchange gap to the edge of 50%, a level that has not been seen for five months and that adds complexities to a commercial panorama that is about to enter the most unfavorable time of the year for the BCRA’s coffers. This was reflected in the last International Monetary Fund reviewwhich included in the recalibration of goals the perspective that In the second half of the year, net reserves will lose US$2.2 billionIn fact, in an unusual statement, the President himself said this Friday, in an interview with La Nación +, that they are in a position to lose up to US$4 billion in the coming months.

He dollar futures market The exchange also echoed the expectations of economic agents. This Friday, prices rose again for all terms starting in July and Matba-Rofex contracts (one of the exchanges that offers this type of exchange coverage) have already They price a significant acceleration of the pace of devaluation that will leave behind the 2% monthly crawl: For July, these numbers predict a 5% rise in the official exchange rate; for August, 5.5%; for September, 4.8%; for October, 5.2%; for November, 5.3%; and for December, 5.3%. “The rise in futures is very eloquent. The market seems to read that the current exchange rate scheme is exhausted,” a trader told Ámbito.

Dollar: Government ratifies its exchange rate policy

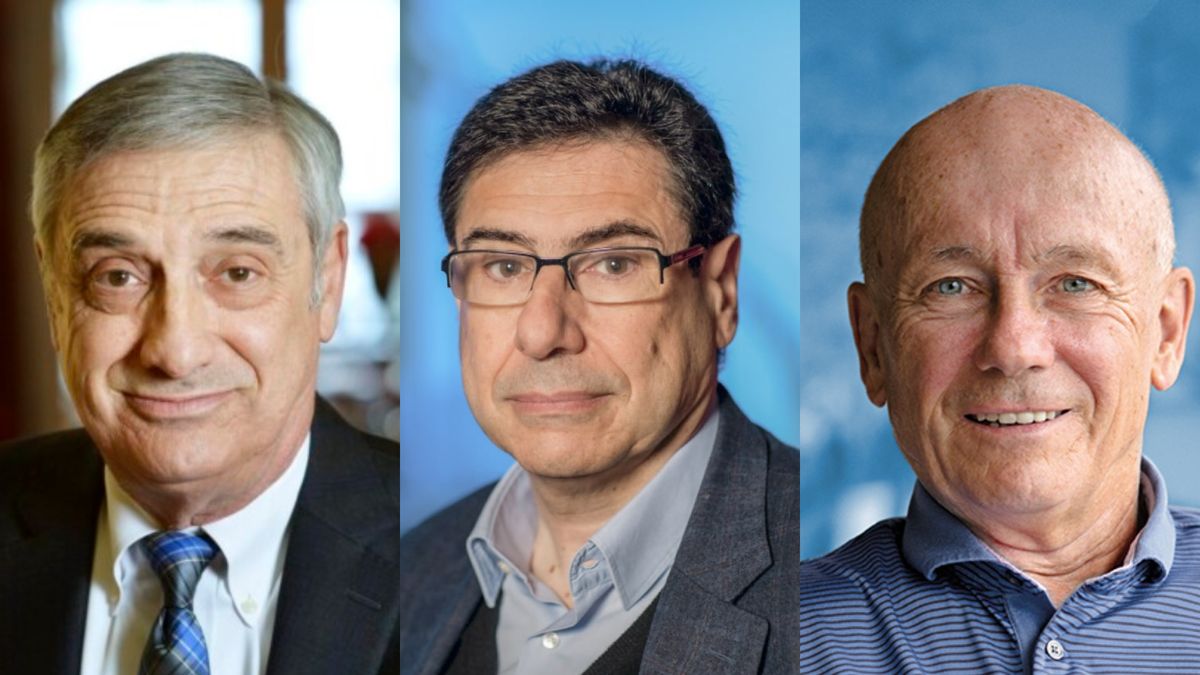

However, the Government does not echo this perception of exchange rate unsustainability. In a press conference, Caputo and Bausili ratified the current exchange rate policy and attempted to anchor the expectations of economic agents with the announcement of a change in monetary policy: The remunerated liabilities of the BCRA will be completely eliminated to end the issuance that implies the payment of interest and this debt (about $17 billion) will be transferred to the Treasury account, which will have to face the higher cost with an additional fiscal adjustment.

In the exchange rate arena, nothing new under the sun. The Minister of Economy and the president of the BCRA ruled out a devaluation (“it makes no sense,” said Caputo), They reaffirmed the continuity of the crawling peg of 2% monthly and also the continuity of the blend dollar. Despite the Fund’s demands to the contrary, as set out in the latest Staff Report, officials assured that the organization had not made any requests in this regard. IMF sources limited themselves to expressing their satisfaction with the monetary policy announcements.

Furthermore, they pointed out that The exit from the stocks will be left for a third stage of the program, without a date, which will occur when they consider that the conditions are in place for a smooth opening. Caputo limited himself to estimating that the rollback of the tax rate PAIS tax at 7.5% (which rose this same administration to 17.5%) could materialize between August and September.

There were two arguments. That The Government does not have a real exchange rate targetthat is, they do not see signs of exchange rate delay. AND that the negative balance for June reservations does not worry them: Bausili stressed the negative seasonality of the liquidation in the third quarter, anticipated that US$3 billion will be lost until September and attributed the fact that the problem had been brought forward to June to the greater energy imports (which the Government had to urgently contract in May due to the unpredictability of the arrival of low temperatures).

Next week will be key to see how the market reacts to the official message. The evolution of the exchange rate gap and future dollar quotes will be a good thermometer to see if the perceptions of unsustainability of the exchange rate scheme dissipate or, on the contrary, devaluation pressures continue.

Source: Ambito