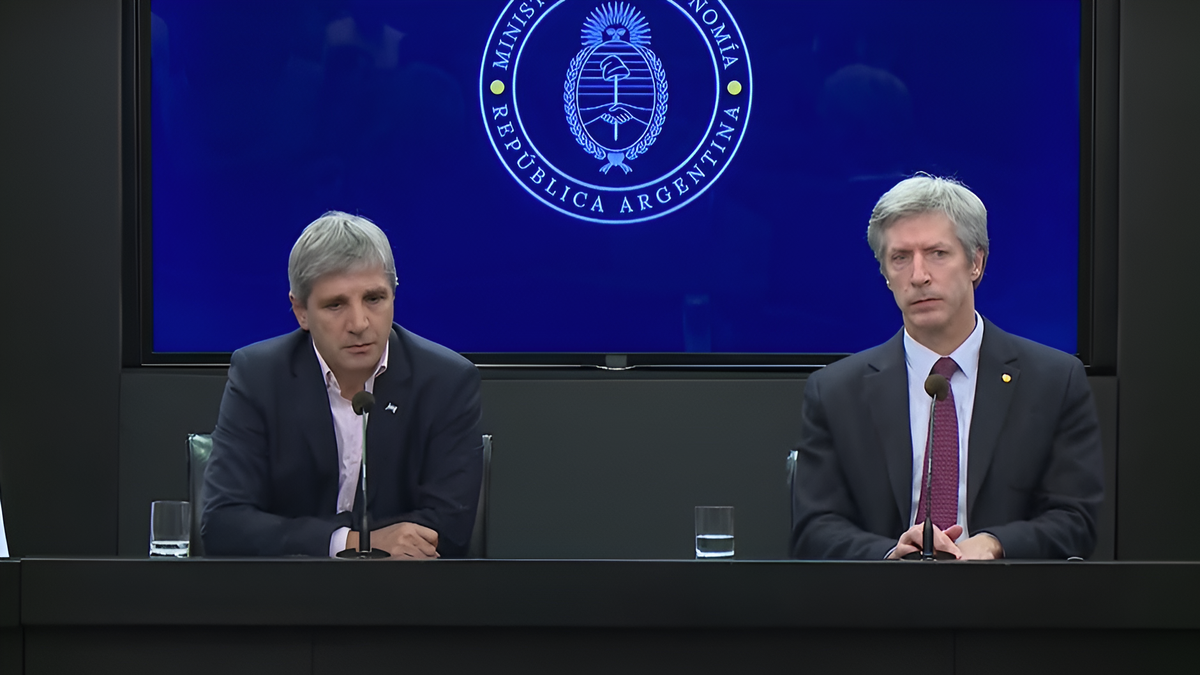

In turn, Caputo added: “What does it mean for people? It’s a deepening of what we have been doing. There will be fewer problems with the dollar, as the amount of pesos will be fixed.. Exchange rate volatility is reduced and the disinflation process is supported, which implies a lower risk of moving on to the third stage, the end of the currency controls.”

Following the announcement by the economic team, initial versions were circulated regarding what the additional financial need would be to entrust the Treasury with the remunerated liabilities of the BCRA. The estimated amount that was released is close to the equivalent of 0.3% of the Gross Domestic Product (GDP), or US$ 1.8 billionwhich can be obtained under greater fiscal adjustment in public spending, a better performance of collection or financing in the local debt market.

This medium consulted official sources if the previous estimate comes from the Government or is a private calculation, to which they responded: “No, because there is rollover”. “Debts are meant to be settled, not paid. “They continue with the same discourse despite what they experienced in 2018,” assessed a market source.

According to sources in the sector, the call is agreed to Ten O’clock in the morning in it Bosch Hall of the Central Bank. The head of the BCRA stressed to this media that the acceptance of the Letter will be “voluntary”. However, a source within the financial world stated the following: “The expectation is that Banks will come to listen to something that has already been decided”.

So far, the banks have not had any further details of what the Caputo-Bausili tandem had announced. In fact, a voice-over says that the call “They sent it the same moment it aired”.

The expectation regarding the technical conditions that will be presented is maintained, since what was said “not enough to evaluate” the initiative. However, the sector confesses that they expected at the conference some concrete contribution on a topic that also “is of great interest”: clear the problem of the puts.

Milei has recently said that the last hurdle to lift the restriction are the puts, that is, insurance contracted by the banks to the Central Bank to lend money to the Treasury.

According to the consultant’s estimates 1816the stock of American puts – these that can be exercised at any time – represents a total market value of around $16.5 billionnot counting the puts already exercised, which would total $19 billion.

The consultant understands that “One of the major drawbacks of these liquidity options is that they do not mature in the short term.”: According to their numbers, half of the current puts expire in 2026 and 2027essentially due to the options tied to the TZX26 bonds AND TZX27securities issued by the current administration.

“In our opinion, Puts are not an obvious impediment to lifting exchange controlsin the sense that depositors – the real demanders of pesos – might want to dollarize their portfolios regardless of whether banks have their bonds covered or not with puts. Instead, It is clearer that puts are a limitation to going to the “currency competition” scheme that Milei proposes in which the stock of pesos remains fixed, because that would require eliminating all sources of printing money, including the issuance by exercising these options,” he argues. 1816.

In any case, the Government confirms that the meeting will also raise the search for alternatives to end the putsas well as discussing money laundering, recently approved in the Fiscal Package.

For a member of the BCRA, who served until 2023, it would have been preferable for the banks to have had a minimum anticipation of the announcement made by the economic team: “It is not normal that they have not spoken before, it is played” indicates the source.

“The market remains anxious about the real problem, the lack of accumulation of dollarsand the Government responds by eliminating the monetary issue, generating a burden of debt huge and growth due to interest that will be offset by adjustment in the primary result”, warns the former official of the monetary entity.

In this sense, he argues that the market will react to two variables. The first, the implementation of this second phase and the conditions presented to the banks. The second, the reaction of deposits, which, in the event of a decrease, could generate a greater widening of the exchange rate gap.

The announcements came at the end of a month marked by exchange noise, partly due to a dynamic of dollar accumulation that the market understands slowed down sooner than expected.

According to the consulting firm F2 Financial Solutions, the BCRA ended the week with a selling balance in MLC of US$ 109 millionwhich removes the negative record from the US$ 74 million of the previous week under the Milei era, while in the month the monetary authority ends with a negative balance due to interventions in MLC of US$ 84 million.

Gross reserves, for example, end with a positive variation of US$353 millionthe new lowest value for a month no payment to IMF under this government, says the person responsible for the report, Andrés Reschini. “In addition, this is happening after having received a disbursement from the agency of some US$ 800 million,” highlights F2.

On this point, Bausili stated that it was contemplated that from June to September had reserve losses, by ensuring that “Within the stipulated program, a loss of 3 billion dollars was foreseen“, which he defined as “normal” and estimated that “in the third quarter they will recover“.

Meanwhile, the market estimates that cereal companies and rural producers They retain about US$ 15,000 million in silobagswaiting for better settlement conditions or increases in international prices.

For the head of the BCRA, tomorrow’s call is a “normal exercise with the benches” which should not generate any surprises or shocks. However, the Government assures that tomorrow attention will focus on the market reaction, especially the behavior of the shares of banking entities.

Source: Ambito