The credit rating agency analyzed the growth path for the region amid high interest rates and confirmed which companies have the greatest potential.

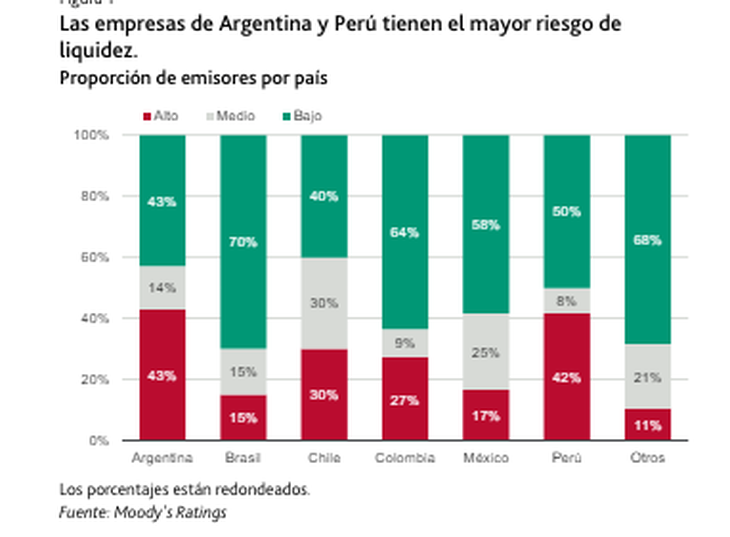

Moody’s, One of the world’s most important risk rating agencies noted that the companies in Latin America will be affected by the global interest rates damaging its financing capacity. For this entity, the rating downgrades will continue to exceed the upgrades of Latin American companies throughout the year and the Liquidity risk remains high in Argentina and Peru. The report also highlighted the risks faced by local energy companies and highlighted Telecom as a good company in the telecommunications sector.

The content you want to access is exclusive for subscribers.

For the entity, Credit conditions will improve for some Latin American non-financial firms in 2024 following a tight 2023 amid moderate economic growth. Both interest rates and inflation are declining in the region’s major economies, but still-high interest rates will continue to weigh on the economy. debt affordability. However, the slowdown in growth in China could reduce growth in commodity demand. Presidential elections in Mexico, Uruguay, Panama and the United States (US) will also determine the political environment. Economic growth in Latin America will be uneven in 2024 and will remain below trend across the region.

Warning over growth in Argentina

In one part of the report, Moody’s highlights that economic growth in Latin America will be uneven in 2024 and will remain below the trend across the region. Argentina (Ca stable) remains the only country in recessioneven among the major economies of the Group of Twenty (G20).

Economic expansion is set to accelerate in Peru, Chile and Colombia in 2024, but slow in Mexico and Brazil after unexpectedly strong growth in 2023. Some major economies, such as Mexico, have shown particular strength, with private consumption boosting domestic demand and nearshoring driving investment and economic growth. However, the sThe situation in Argentina is much more delicate.a, as it faces an economic downturn as the government struggles to end two decades of fiscal and economic distortions. After 2025, the Strong agricultural exports and shale gas production in Argentina will offer some relief.

moodys.PNG

For Moody’s, the situation is more delicate in Argentina than in the rest of the region

Argentine companies that Moody’s pointed out

- Telecom Argentina: According to the analysis, Telecom Argentina’s low leverage (Caa3 stable) and its solid financial history alleviate the refinancing risk of US$1.3 billion in 2024-2025 in a context of capital restrictions.

- Most Latin American utilities have low to medium liquidity riskexcept in Argentina, where they are found four of the six high-risk utilities in the region. Electricity generation in Argentina depends on a public monopoly managed by Cammesa, a highly subsidized electricity distribution company. This arrangement means that distribution companies and the government make partial payments or present delays in payments to power generating companies. However, both companiess have demonstrated strong market availability and ability to refinance their debts.

Genneia (Caa3 stable) and YPF Electric Energy (YPF EE (Caa3 stable) derives around 35% of its revenues from Cammesa. As of December 2023, Genneia held USD155 million in short-term debt but only USD115 million in cash, while YPF EE had USD102 million in cash to cover USD167 million in short-term debt.

Source: Ambito