At the conference on Friday between the Minister of EconomyLuis Caputo and Santiago BausilliPresident of the Central Bank (BCRA), both made reference to the The Government will lose US$2 billion in reserves in the second half of the year. That, added to the poor numbers of currency accumulation in the month of June, set off market alarms. Now, a new one has been added Official data of agricultural exporters which strengthens the thesis that the liquidation of the agricultural sector was not only late but that international prices impacted the decision to sell.

According to the Agroindustrial Monitor for June, conducted by CIARA-CEC, after discounting the soybeans delivered physically and sold at price, the soybeans delivered to be fixed and those pending to be fixed and the physical soybeans in the possession of producers that have not yet been sold, there remain 34.954 million tons of soybeans, equivalent to 73% of total production. If corn is added, 42.192 million tons are available for settlement.

“Producers protect their soybeans as a reserve of value because the demand from the oil industry is active every day of the year, while Soybean exporters are active buyers mainly in the first three months of the harvest,” they explained.

In the case of corn, producers sold the highest percentage of corn in relation to the volume of production. In the opposite analysis, it can be seen that the percentage of unsold corn in this harvest reaches 39%, the lowest percentage in the last 5 years. This reflects the producer’s strategy of selling more available corn to gain liquidity.

ciara.png

In soybeans, there are 34.954 million tons of soybeans left, equivalent to 73% of total production.

In conclusion, Between soybeans and corn there are 42,192 million tons unsold and without setting a price. Of that total 83% corresponds to soybeans with a total of 34,954 million tons Of which 26,367 million are in the hands of producers in their own or third-party storage silos and 8,597 million have been delivered to be fixed and are pending price fixing.

In the case of corn, there are 7.238 million tons, equivalent to 17% of the total of both products, of which 5.754 million are in the hands of producers and 1.484 million are delivered to be fixed and pending price fixing. The importance of soybeans is reflected in the fact that the unsold volume, 34.954 million tons, They account for 83% of the total unsold volume of both products.

“This table clearly reflects that the producer decided to have liquidity, or to make money, by selling corn, while he decided not to sell the available soybeans or to sell the minimum, and deliver the largest amount of PAF (Price to be Fixed) soybeans. We await a future improvement in soybean prices,” CIARA-CEC stated.

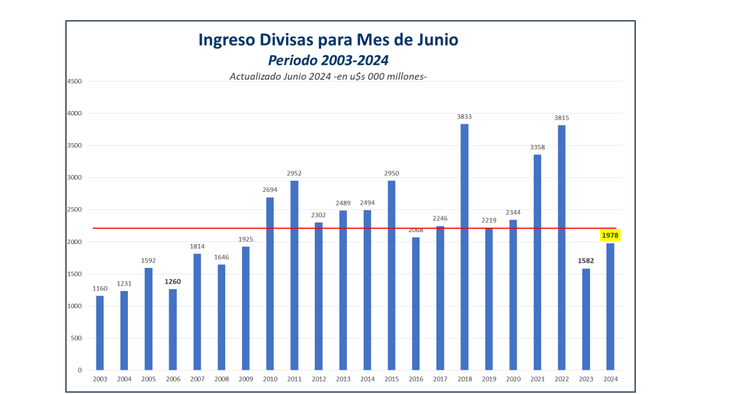

How much did foreign currency income fall in June?

According to these official data, iUS$ 1,978 million were received, versus US$ 2,613 million in the month of May.

In the cumulative period from January to May 2024, the total is US$9.044 billion. While in the same period in 2023, the inflow of foreign currency was US$9.450 billion and during 2022, the inflow of foreign currency was a record US$15.330 billion.

“The drop in foreign currency earnings during the month of June is a consequence of the lower supply of soybeans available in the last month of the harvest. This lower supply was reflected in the sharp 56% drop in the number of soybean trucks entering ports. Foreign exchange earnings in June were the second lowest in the last 5 yearss”, they added.

Screenshot 2024-07-04 084406.png

“Lower supply,” explained the agro-exporters as to why they liquidated less

Source: Ambito