Why did revenues fall in June?

According to the OPC, the drop in CPI-adjusted revenue was around 14.1% a/a. Although this performance was worse than that of the previous two months, a number of administrative issues that affected the collection of the sixth month of the year must be taken into account. Among them, the postponement to August of the payment of the balance of the annual sworn declaration of the Tax on Personal Assets and the Income Tax for Individuals stands out.

Last year, the due date was in June, as usual. Correcting the collection for that effect, A real fall of around 9.5% y/y is estimated, in line with what had been observed in the first four months. It is recalled that the performance in May was better (+11.8% YoY in real terms) due to the payment of the corporate income tax return by companies with a December balance sheet closing.

The collection of June was also attenuated by the fact that the last due date of the PAIS Tax was moved to July and that there were three fewer days of collection than in the same month last year. These specific issues in June were added to others that have been operating structurally, such as the implementation of the Tax on Taxes and the modification of the scheme of perceptions for consumption in foreign currency.

In turn, it is observed that in the accumulated to June, the Income Tax shows a fall of 8.7% y/y; in a sense The positive impact was the increase in nominal corporate profits, and the negative impact was the Cedular Tax, the postponement of the due date for individuals and the lower perceptions linked to the demand for foreign currency. For its part, VAT has accumulated a decrease of 8.8% year-on-year, due to the contraction of the level of activity and the higher tax credits generated by the increase in customs perceptions since April of last year. The resources of the Social Security System have accumulated a real contraction of 18.5% year-on-year due to the reduction in employment and real wages.

budget execution.PNG

A real fall of around 9.5% year-on-year is estimated, in line with what had been observed in the first four months.

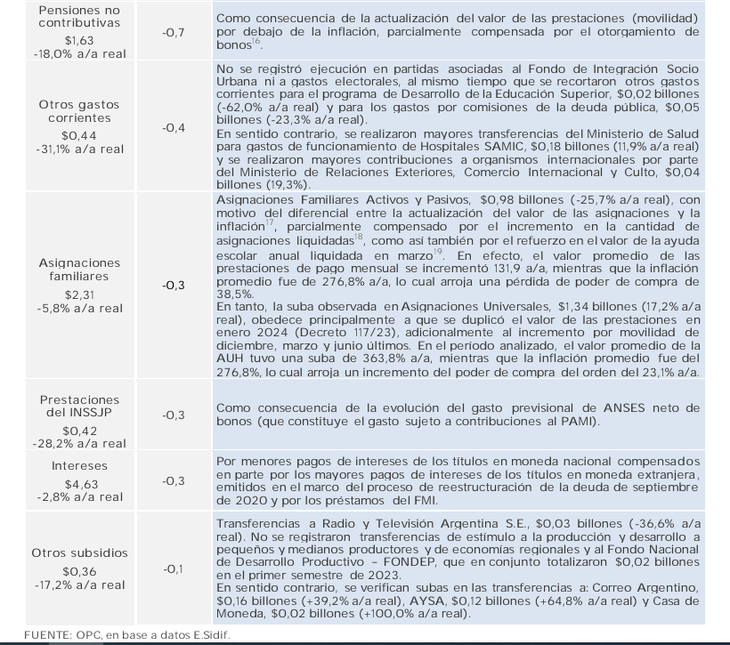

How the Government cut back in June

According to the OPC estimate, the Government reduced spending the most on Capital Goods (-81.3%), followed by Goods and Services (-46.2%), Economic Subsidies (-39.9%) and maintained the cuts on social benefits (-23.7%).

- Retirements and pensions: : as a consequence of the update of assets below inflation, partially offset by the application of bonuses granted to retirees and pensioners with lower incomes: the average assets for six months of 2024 had an increase of 163.3% y/y, while the average inflation was 276.8%, which results in a loss of purchasing power of around 30.1% YoY; meanwhile, salaries with bonuses lost on average 19.0% YoY. The expenditure executed by ANSES totaled $12.95 billion (-24.5% YoY in real terms), of which $11.54 billion correspond to regular settlement (-27.8% YoY in real terms) and $1.40 billion (20.0% YoY in real terms) to income supplements for the lowest salaries (bonds). Benefits for retired personnel of the Armed Forces and Security Forces, $1.48 billion (-13.9% YoY in real terms).

- Capital expenditures:

–Real Direct Investment, $0.18 trillion (-83.9% YoY in real terms): This reduction is driven, firstly, by lower expenditures on public works by the National Highway Directorate, $0.05 trillion (-93.3% YoY in real terms). In addition, there is a notable decrease in investment in the Education Secretariat (-98.2% YoY in real terms), mainly due to the lack of execution in the acquisition of computers within the framework of the Conectar Igualdad program and in the Public Works Secretariat (-96.7% YoY in real terms), due to the decrease in investment in programs related to the Development of Hydraulic Infrastructure (-96.2% YoY) and to Sustainable Transport and Mobility (with no execution in 2024).

-Capital transfers$0.51 trillion (-79.6% YoY in real terms): the reduction is driven by lower execution of financial assistance to: 1) provinces and municipalities, $0.014 trillion (-96.9% YoY in real terms); 2) public enterprises, $0.34 trillion (-71.2% YoY in real terms); and 3) trust funds, $0.15 trillion (-67.9% YoY in real terms). In the case of public enterprises, the decreases in transfers to ENARSA, $0.25 trillion (-63.2% YoY in real terms), and to AYSA, $0.07 trillion (-66.6% YoY in real terms), stand out. In the case of trust funds, the transfers to the Procrear Trust Fund, $0.08 trillion (-7.8% YoY in real terms) and the Social Housing Trust Fund, $0.06 trillion (-77.0% YoY in real terms), stand out in the cumulative total to June. The National Productive Development Fund (FONDEP) did not receive any transfers during the first half of the year ($0.016 trillion as of June 2023), contributing to the drop in transfers to trust funds.

- Energy subsidies: Transfers to ENARSA, $0.94 billion (-51.7% YoY in real terms), mainly to cover the purchase of imported gas. Transfers to CAMMESA, $1.76 billion (-33.4% YoY in real terms), to address the gap between costs and rates for electricity generation. In June, the decrease in transfers to CAMMESA stands out, totaling $42,344 million (-95.5% YoY in real terms).

- Other social programs:

– Food Policiess, $0.86 billion (-17.9% YoY in real terms), among whose initiatives the Food Benefit stands out ($86 billion, -13.1% YoY in real terms). The average value of the benefits shows a loss of purchasing power of around 12.6% YoY in real terms in six months, despite the increases granted so far this year.

While, There were almost no transfers to community kitchens and snack bars (-99.1% YoY real). Boosting Work and its continuators (Return to Work and Social Support), $0.61 billion (-56.6% YoY real), mainly explained by the loss of purchasing power of benefits.

Medical care for non-contributory pension beneficiaries, $0.20 billion (-24.6% YoY in real terms); Progresar Scholarships, $0.15 billion (-60.2% YoY in real terms); and Acompañar Program, $0.02 billion (-81.6% YoY in real terms).

In the opposite direction, VAT refund to vulnerable sectors, $0.10 billion (458.6% real y/y) and Unemployment Insurance, $0.09 billion (93.9% real y/y), Nutrition Actions – 1,000 Days Program, $0.04 billion (42.0% real y/y) and Educational Vouchers, $0.03 billion (new program).

- Transfers to provinces: The reduction is mainly driven by the National Teacher Incentive Fund (FONID) 8, with an accrual of $0.056 billion (-85.0% YoY) of which only $0.013 billion was paid, within the National Teacher Salary Compensation Program. They also exhibited Transfers to school canteens have fallen$0.04 billion (-19.5% YoY), to the universalization program for full or extended day primary education, $0.076 billion (-10.7% YoY) and those made within the framework of the National Treasury Contributions to the provinces (ATN), $0.026 billion (-38.9% YoY real)10. Additionally, No transfers were made to the Provincial Pension Funds ($0.47 trillion as of June 2023) nor to the Fiscal Strengthening Fund of the Province of Buenos Aires ($0.91 trillion as of May 2023).

- Personnel expenses: National Executive Branch, $3.64 trillion (-16.3% YoY in real terms), Judicial Branch, $0.59 trillion (-16.6% YoY in real terms), Public Ministry, $0.24 trillion (-14.5% YoY in real terms) and Legislative Branch, $0.20 trillion (-19.1% YoY in real terms). The salary guidelines agreed during the period analyzed were below inflation.

Regarding the variation in the positions occupied in May 2024 compared to the annual average of occupation during 2023: Executive Branch: 0.9% in the permanent and temporary staff and -13.6% in the contracted staff. Judiciary and Public Prosecutor’s Office: 1.6% in the permanent and temporary staff.

- Transfers to universities: Funds for the payment of salaries of teaching staff and senior authorities, $0.75 billion (-30.6% YoY in real terms), for salaries of non-teaching staff, $0.44 billion (-27.0% YoY in real terms). Financial Assistance for the Operation of Universities, $0.08 billion (-36.4% YoY in real terms). Financial Assistance to University Hospitals, $0.03 billion (-23.5% YoY in real terms).

Goods and services: Expenditures on goods and services for management and administration activities of National Administration bodies, $0.11 billion (-45.2% YoY in real terms). Expenditures on services for Conicet research grants, $0.5 billion (-15.0% YoY in real terms). Expenditures related to food purchases within the framework of the Food Policies program, $0.04 billion (-51.5% YoY in real terms).

In the opposite direction, increases are seen in thes expenses associated with calendar vaccines, $0.09 trillion (7.9% YoY real).

- Transport subsidies: Transfers to Operador Ferroviario SE, $0.32 billion (-37.8% y/y in real terms), intended to cover the difference between the operating cost of public passenger rail transport in the AMBA and that covered by the fares paid by users. Transfers to the Trust Fund of the Transport Infrastructure System, $0.44 billion (-30.0% y/y in real terms), through which tariff compensation for passenger motor transport in the AMBA is covered, and which until last year also included assistance to the Compensation Fund for Motor Transport in the Interior.

opcr4.PNG

Source: Ambito