In In Argentina, 155 taxes are paid between national, provincial and municipal taxes. Is about seven more than there were in 2023. This is indicated by the 2024 version of the Tax Vademecum that prepares the Argentine Institute of Fiscal Analysis (IARAF).

In principle, the data would indicate that there is a contradiction that during the First year of Javier Milei’s governmentwho comes to the highest office with the promise of reducing the legal tax pressure, this has risen.

“From the analysis of the 2024 tax legislation, the existence of 155 different types of taxes throughout our country was identified,” says IARAF.

The report states that these include taxes, fees, contributions and duties. But it clarifies that In the case of municipal taxes, which are formally a price in exchange for a service provided by a commune, In recent years they are showing the imprint of a tax-

This is because what taxpayers pay far exceeds the cost of the service they receive. In the province of Buenos Aires, for example, most districts charge the Health and Safety Tax (TISH) based on a rate based on the Gross Income tax base.

vademecum.png

“Indeed, what can be said is that There are at least 61 clearly defined taxes. “considering the three levels of government,” the report says. The rest are rates.

Compared to 2023, IARAF analysis finds that Three national taxes have been added and two have been repealed. At the municipal level, seven taxes have been introduced and One was eliminated and the provinces did not register any variation.

At the national level, the following were added: Telecommunications Subscriber Rate, the Telecommunications Universal Service Trust Fund and the Telecommunications Control, Inspection and Verification Rate. And they are gone: the Extraordinary Contribution on Savings Cooperatives and Mutuals, and the Tax on Real Estate Transfers.

At the municipal level, the Tree Maintenance Fee was withdrawn, but new ones were created Fuel Rate, Local Monitoring Rate, Health Booklet for economic activity, Rate for Fixed Positions in Private Neighborhoods, Right to transfer properties in industrial parks, and mandatory contribution to the maintenance of the heavy traffic network.

“Regarding 2023, lThe national taxes surveyed went from 45 to 46, the provincial taxes remained at 25, and the municipal taxes grew from 78 to 84,” the report states.

vademecum-tax-2024.png

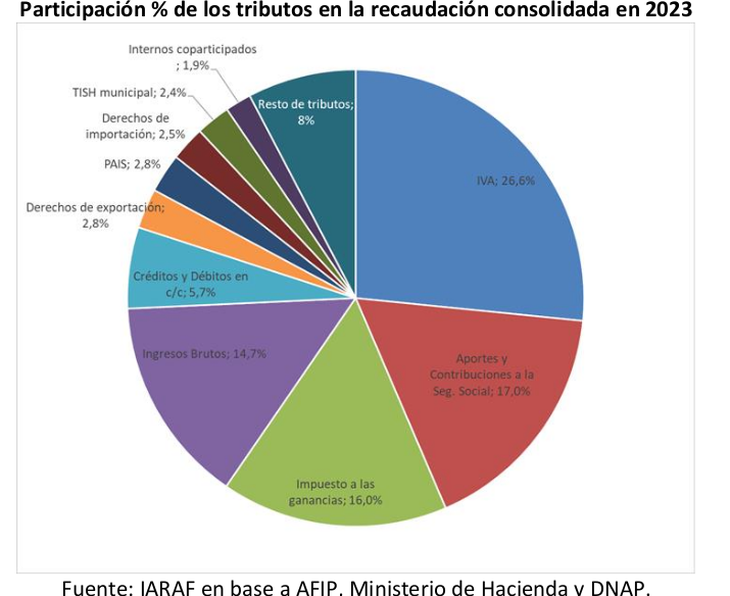

The work points out that “regardless of the diversity of taxes identified, “The effective collection of taxes at all levels of government in Argentina is concentrated in relatively few taxes.”

The IARAF states that “considering the collection of VAT, Contributions and Contributions to Social Security, Personal and Corporate Income, the provincial tax on Gross Income, the tax on bank debits and credits and Export Duties, 83% is obtained of Argentina’s consolidated tax collection.”

“If the 6 taxes mentioned are added the PAIS tax, Import Duties, the Municipal Safety and Hygiene Tax (TISH) and shared internal taxes, we have 92% of Argentina’s consolidated tax collection is concentrated in 10 taxes, 8 of which are national, one provincial and one municipal,” the report says.

It should be noted that although the legal tax burden is increasing, the real tax burden is falling due to the higher taxes. At the national level, the government expects the ratio between tax collection and GDP to fall from 21.6% to 21.16%.

Source: Ambito