The Government enacted the fiscal package, which was approved together with the Bases law, which includes changes in the Income TaxThe amendment again taxes wage income over $1,800,000 for single people and $2,100,000 for married people.

The restoration of the fourth category Income Tax will imply that something more than 800,000 employees are once again forced to pay cuts by their employers every month.

The new law, however, has some improvements over the previous one, such as greater progressiveness of aliquots and a significant increase in deductions.

Below are the tax keys prepared by the CEO of SDC Tax Advisors, Sebastián Domínguez:

Repeal of the Cedular Tax

This tribute hhad been left alone for salaries of more than $2 million per month. The repeal of this tax is effective retroactive to January 1. Since workers below this salary did not pay throughout this year, the new law contemplates a special deduction so that they do not incur debt. “It is not reasonable that a measure of this type generates a debt for employees who have already received their wages and given them a destination, especially in the current economic context,” said Domínguez.

If the law is published in the Official Gazette by June 30, 2024, the special deduction will apply to wages received between January 1, 2024, and May 31, 2024. However, if it is published in July 2024, the special deduction will apply to wages received until June 30, 2024.

Personal deductions are improved

The new law increases thepersonal deductions between 183.75% and 186.65%. There are no changes regarding the special deduction for certain retirees and pensioners, which remains at 8 guaranteed minimum wages. In addition, a special deduction is incorporated to include the Christmas bonus.

deductions-box.png

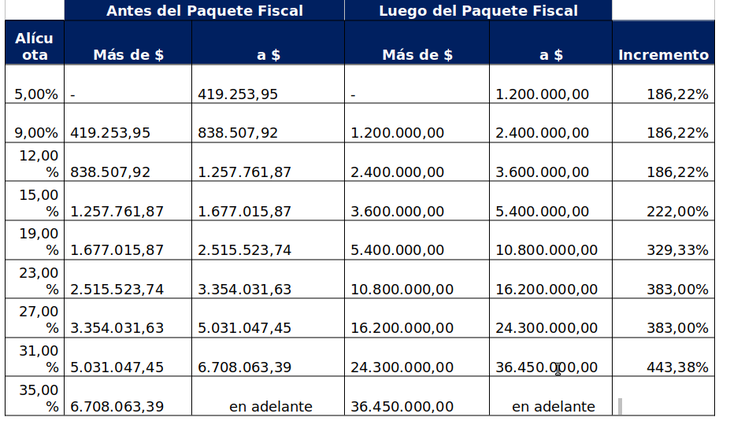

Scales are updated

The scale sections are increased by between 186% and 443% compared to the scales currently in force.

box-scales.png

How scales and deductions will be updated

The tax package establishes that personal deductions and tax brackets will be reduced.They will be adjusted semi-annually, starting in 2025, in January and July due to the variation in the Consumer Price Index (CPI) prepared by INDEC corresponding to the calendar semester that ends in the month immediately preceding the update that is carried out.

Exceptionally, in September 2024, they will be adjusted personal deductions and the tax scale sections for the variation in the CPI corresponding to the months of June to August 2024, inclusive.

On the other hand, the Executive Branch is empowered to increase them exclusively for the fiscal period 2024.

Special treatments are eliminated

The new law removes all special treatments. The bonus will be reached, as well as travel expenses or cash shortages or any type of component from the income that the unions managed to negotiate with the employers to cancel out the effect of the tax discount on salaries.

Debt solution for 2023

Last year the Minister of Economy, Sergio Massa ordered the AFIP to modify the income tax scales even without a law from Congress. As a result, employers stopped deducting the tax from their employees, which means that this year the workers technically had a debt with the agency.The current law confirms what was done last year.

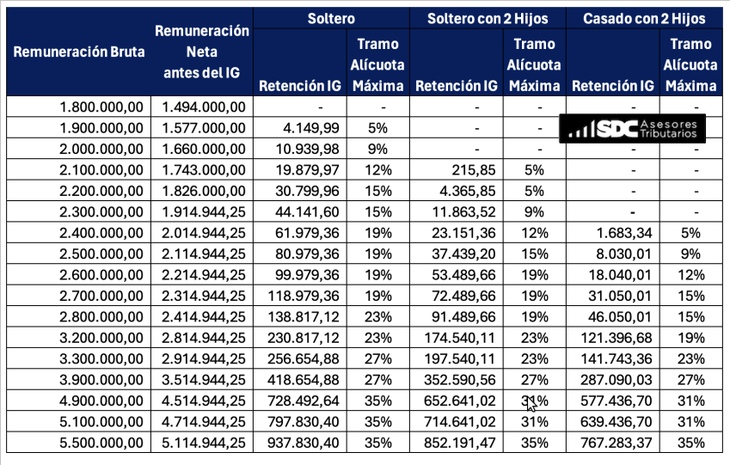

From how much do you start paying?

By June 2024, the maximum taxable base is $2,265,033.81. Domínguez uses this parameter to make tax estimates, considering that the law could be published in the Official Gazette before the end of the month.

table-salaries.png

Source: Ambito