“Countries are undergoing reverse processes regarding the value of their currencies. While Brazil devalued the real to the lowest levels in 20 years, the Argentine peso has accumulated, since the devaluation in December, a rapid and very significant appreciation of around 75%,” he recalled in dialogue with Ambit the director of the EPyCA consultancy, Martin Kalos.

BRAZILIAN BILATERAL REAL EXCHANGE RATE

For its part, Sebastian Menescaldidirector of EcoGo, said that the current exchange rate at the local level “is not the equilibrium rate” and emphasized the fact that the appreciation of the currency has nothing to do with a strengthening of the same, since the capital account is closed and there is no sign of economic growth.

For the economist, today the Central Bank (BCRA) can buy dollars because the activity is stable, but he warned of a possible problem ahead for foreign trade, and particularly for trade with Brazil.If activity picks up, you may have an invasion of imports from Brazil“, he warned.

Argentine products become more expensive

In this context, Kalos stressed that for products in which there is competition, “Brazil is cheaper”. “A particular case is that of soybeans, where Brazil is selling stocks very quickly, unlike Argentina, which is accumulating stocks.“, he pointed out.

Along the same lines, a report from the consultant 1816 He stressed that, of 46 surveyed assets (including food, clothing, electronics, automobiles and fuel) In 38 cases the price in dollars measured at the official exchange rate in Argentina is above the international average.

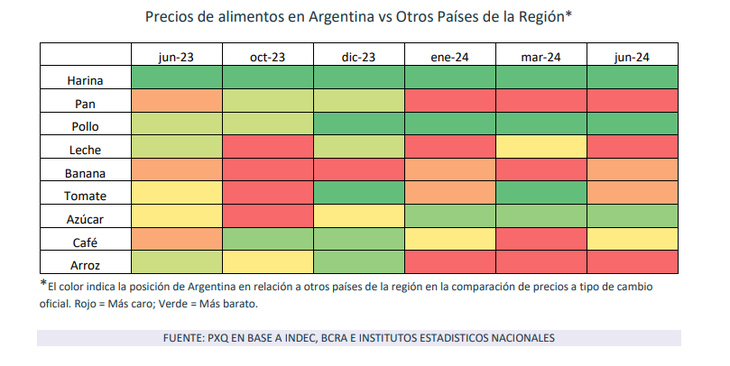

As an example, the work highlighted that, while in December 2023 foods that were relatively cheap compared to the rest of the countries in the region, such as bread, milk, tomatoes and rice, are now more expensive.Food prices at the official exchange rate are 20% above the average of the last 13 years“, he reflected.

Food prices in dollars

The TCRB with Brazil is already below the November level

According to data from the BCRA, the TCRB with the country that has the largest economy in South America gave an average of 83.5 in the first 12 days of July.

The devaluation approved by President Javier Milei in December of last year brought the figure to 135.6, the highest value since 2018; however, since then prices have increased well above the 2% monthly “crawling peg” set by the monetary authority for the evolution of the wholesale dollar, which is why The number is already 2% lower than in Novemberwhich was the lowest mark of Alberto Fernández’s administration.

Kalos projected that The cheapening of Brazilian goods will continue in the futureregardless of what the neighboring country does, since the Argentine Government, far from moving towards a change in exchange rate policy, publicly announced that it will continue to appreciate the exchange rate.

The multilateral real exchange rate, at “Macrista” appreciation levels

The TCRB measures the relationship between nominal exchange rates between two countries, adjusted for changes in the Consumer Price Index (CPI) of each of them.

On the other hand, based on a weighted average of the TCRB of the main trading partners, the BCRA builds the Multilateral Real Exchange Rate (MRER)which serves as one of the broad measures of competitiveness. Brazil has the largest share in this index, with almost 30%, followed by the Eurozone countries (21.5%), China (15.5%) and the United States (13.7%).

Currently the TCRM It is at levels similar to those of December 2017when the Argentine peso was going through a period of appreciation, which ended in the worst possible way, with a series of currency runs that boosted the price of the dollar, increased inflation and poverty, and led to the agreement with the International Monetary Fund (IMF) and the return of capital controls.

“I think it is a challenge for the Government to achieve an exchange rate that is not only competitive for agriculture, mining and oil, but competitive for the entire economy,” said Menescaldi.

Characteristics of bilateral trade with Brazil

At the moment Brazil is Argentina’s main trading partneraccounting for 16% of exports and almost 23% of imports.

Kalos explained that For Argentine foreign trade, Brazil remains very important, but Argentina is not as important for Brazilian foreign trade.“When Mercosur was created, our country accounted for around 13% of its imports and now it only accounts for around 4%,” he said.

In 2024, trade with Brazil yielded a deficit of US$9.8 million, much lower than the deficit of US$2,803.68 million that had been verified in the same period of 2023. This “improvement” in the balance It was mainly due to a 31.7% drop in imports.while exports increased by 7.8%.

About, Federico Vaccarezzaa master’s degree holder in international trade relations, estimated that, beyond the loss of competitiveness of national products, the trade gap with neighbors “will narrow because the use of installed industrial capacity fell 13 percentage points year-on-year.”

“The June data may possibly show a balance or slight surplus in Argentina in the first half of the year. But this balance is the result of a sharp drop in industrial activity and consumption in Argentina. There is little to celebrate,” he said.

Source: Ambito