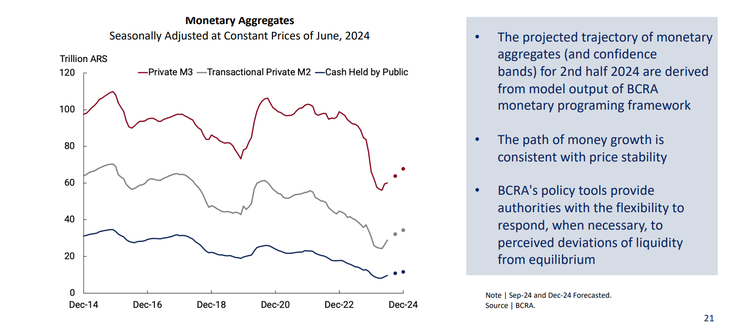

The vice president of the organization led by Santiago Bausilli, Vladimir Werning, addressed several key issues. He spoke about the inflation expected for July and how the competition between currencies will be.

The vice president of the Central Bank of the Argentine Republic (BCRA), Vladimir Werninggave the presentation “Argentina Phase II: Establishing an Orthodox Monetary Framework,” at several meetings with international investors in New York City. What data did he provide on the Inflation, the dollar and the currency controls that are key to the market?

The content you want to access is exclusive for subscribers.

Following the release of the June inflation data, which came in at 4.6%, Werning announced that the Central Bank’s forecast for core inflation in July will be 3.2%.

Regarding imports, he stated that in Q1 2024, imports worth $9.3 billion were paid via CCL and $16.4 billion via the foreign exchange market, which continues to show that there is still a significant flow in the financial dollar.

bcra4.png

Exiting the currency exchange rate and currency competition

Apart from this, Werning detailed the next stage of the economic plan, in which currency competition will take place, along with a “prudent exit” from the exchange rate cap and the “dollar blend” currency settlement scheme, but maintaining the crawling peg at 2% per month. He also acknowledges that During this stage, salaries measured in dollars will be low.

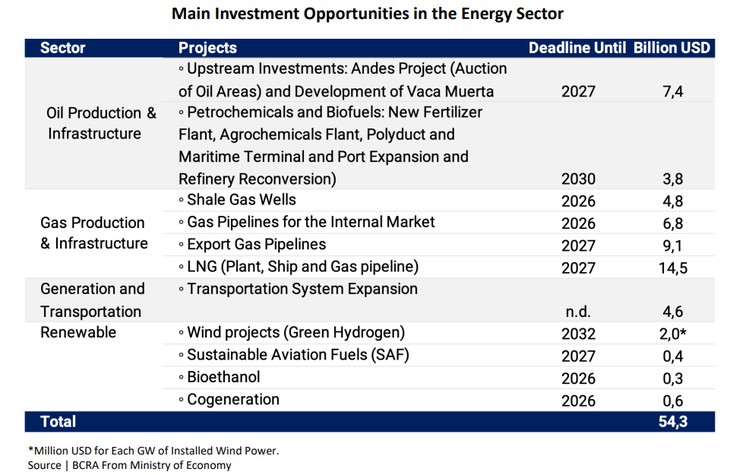

On the other hand, Werning explained that the BCRA projects a energy trade balance with significant improvements, with exports expected to increase and imports to decline steadily from 2023 onwards, leading to a positive balance for 2025 and beyond.

Due to the energy sector’s push, investments of $14.5 billion are expected by 2027

The presentation mentions the main investment opportunities in Argentina’s energy sector. For oil production and infrastructure, investment of $7.4 billion is projected by 2027. Gas production and infrastructure anticipates investment of $3.8 billion by 2030 and $4.8 billion by 2026, with additional investments totaling $14.5 billion by 2027.

The renewable generation and transportation sector plans to invest $4.6 billion, with a completion target date yet to be determined, $2 billion by 2032, $0.4 billion by 2027, $0.3 billion by 2026, and $0.6 billion by 2026. In addition, Several important announcements in various sectors include Posco with $800 million for lithium, SIDERSA with $300 million, Genneia with $250 million and technology companies with $1 billion.

bcra5.png

Source: Ambito