In it first half of 2024 (from January to June of this year) 21 “confirmed” M&A transactions were recorded for a reported amount of US$1.1 billion.

The volume of M&A deals is at low values in historical terms. In the first half of the year, a 75% decrease in dealflow in the number of operations is observed, compared to the same period in 2023, according to a report by First Capital Group (FSG).

The dynamics of the economic outlook, the Uncertainty about the Government’s progress on macro stabilization and regulatory changes, make the negotiations in transactions are very complex and many operations are on standby, in a year of volatility and transition that awaits definitions and effects in relation to the change of direction and the future of our country in the medium and long term.

What is the M&A trend in the region?

Argentina records a historic dealflow of close to 100 transactions per yearcurrently ranking as the fifth country in relevance in M&A operations in Latin Americaled by Brazil with 780 annual transactions, followed by Chile and Mexico with 210 and then Colombia with approximately 130 transactions, based on historical records.

In this first half of the year, except for Colombia, which has maintained its level of operations, the rest of the Latin American countries are seeing an adverse outlook, with falls in transactions in the order of 20% / 30%.

If the current trend continues, There is a high probability of ending this year with a number of transactions between the lowest in the last decade, closer to the levels seen in the 2013 to 2016 cycles and during the pandemic, where global and regional dealflow was also considerably affected.

Beyond the local situation and transition, there are strategic and long-term drivers that, if aligned with a recovery cycle, as has historically occurred in other countries in the region, Argentina remains one of the main economies in Latin America and is positioned as a place that continues to present opportunities in strategic assets, both in natural resources and human capital. Mining and natural resources have a lot of potential for growth in M&A operations, mainly with foreign investors seeking to position themselves strategically.

mine.png

There is a high probability of ending this year with a number of transactions among the lowest in the last decade.

Capitals interested in investing in Argentina

If we analyze the data based on the origin of the buyer, Argentina’s ratio is quite balanced, historically recording ~55% Crossborder operations (Foreign Buyers) and ~45% National (National Buyers). In the last 6 months, this indicator is located at levels of ~57% Crossborder (Foreign Buyers) and ~43% National (National Buyers), showing that, despite the complexity and local volatility, the International investors continue to be the protagonists with increased activity.

The origin of buyers is concentrated between Investors from countries in the region (Uruguay, Chile, and Brazil), followed by North America (mainly the United States and Canada) and then European countries (mainly Spain and the Netherlands), changing the trend of previous years where investments from Europe and North America dominated over investors from Latam.

Businesses for sale: the big picture

In relation to sellers, although the targets are companies based in the country, many have foreign investors or are subsidiaries of multinational companies. In recent years, there have been announcements of restructuring of operations and exits of multinational companies from the country.

In the last few 6 months foreign sellers went from 43% in 2023 to 14% in the first 6 months of 2024, indicating a decrease in interest in selling or outflowing foreign investments in national assets.

On the other hand, the indicators also show the purchase of national assets by groups and companies that already have local investments, representing 86% of the transactions in the period.

Sectors with the greatest movement

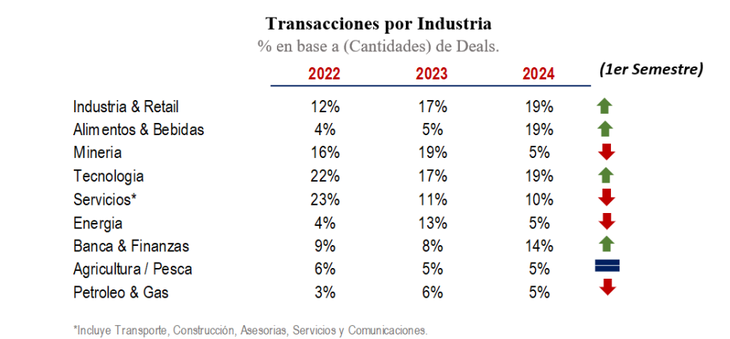

The most active sectors in terms of the number of Deals in the first half of the year are Food & Beverage, Technology, Banking & Finance and Industry, Together, these sectors represent 65% of all transactions.

Compared to the statistics for 2023, the Mining sector reports a decrease in operations. Let us remember that this sector was the most active in the previous period.

In recent months, transactions were observed in the financial sector in which the main private banks participated, the most relevant being the sale of the operations in Argentina of HSBC Bank.

mia3.png

Which sectors have the most M&A potential in Argentina?

Source: Ambito