To give you a benchmark, using data from the first half of the year, the Government should have cut primary spending by another 5% to maintain the surplus achieved. Who will keep the resources from the tax that the GCBA had created to make up for the claimed shortfall?

After more than three years of discussion between the national Government and the City of Buenos Aires over the Buenos Aires co-participationfinally the administration of Javier Milei agreed to return the funds. Amidst the chainsaw and the blender, the Treasury Palace negotiated that the funds would be returned on a daily basis. 2.95% of funds to CABA, in order to comply with the precautionary measure of the Supreme Court of Justice.

The content you want to access is exclusive for subscribers.

However, the Refund of extra co-participation from 1.4% to 2.95% to CABAwould not alter the distribution of resources to the other 23 provinces, but would imply less participation by the central administration. How much will this cost the public purse and what spending adjustments should the government make to pay for it?

According to a report by the Argentine Institute of Fiscal Analysis (IARAF)between August and December of this year, CABA would receive between 0.073% and 0.081% of the GDP, between increase in co-participation and the Income taxwhich in silver means between $450 billion and $500 billion.

“This revenue will imply a lower national fiscal surplus to the extent that the national government does not obtain additional revenue or does not reduce other planned expenditure by the same amount. When annualized, the amount can rise to 0.17% or 0.19% of GDP.”IARAF said.

Co-participation of CABA, adjustment and surplus

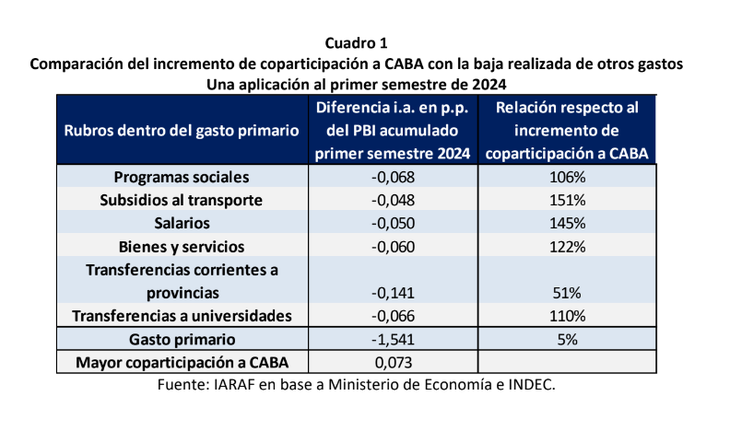

He IARAF estimated what should have been the Primary spending cuts in the first half of 2024 In the event that the Government gave him the co-participation of the 2.95% daily to CABA, from which it emerged that an additional 0.073% of GDP should have been turned over, which is equivalent to $450 billion and would in turn imply a 5% extra trimming.

“These resources are equivalent, for example, to 106% reduction in spending on social programs During the first semester, 151% reduction in spending on transport subsidiesto the 145% of the reduction in wage billsto the 122% of the decline in spending on goods and servicesto the 51% of the decrease in spending on current transfers to provinces and to 110% of spending on transfers to universities“, IARAF indicated.

IARAF.png

CABA: who will keep the additional resources

In this way, it is important to highlight that the additional co-participation to the City will involve a transfer of funds from the Nation to CABA. But IARAF also included the transfer of income to whoever appropriates the elimination of the gross income tax on interest on remunerated monetary liabilitiesthat is to say banks either depositors.

“If the elimination of the tax is transferred to interest rates, the beneficiaries will be the depositors. If it is not transferred, it will remain in the hands of the banks”IARAF pointed out. It should be noted that this tax was created to offset the reduction of funds from 2.95% to 1.4%.

Source: Ambito