Latest Industrial Activity Report of the sector electronic, electromechanical and lighting revealed that eight out of 10 companies decreased its production level in the second quarter of the year, with an average drop of 39% and a greater effect of the economic recession in lighting and electronics.

The work prepared by the Argentine Chamber of Electronic, Electromechanical and Lighting Industries (CADIEEL) also indicated that only the 21% of the companies in these sectors maintained a “stable” production, while No companies were registered that have managed to increase their activity in the quarters of April, May and June.

The universe of companies surveyed can be categorized by the number of employees: 42% of those surveyed have a staff of 11 to 50 employees; 17% have fewer than 10 employees; 13% have 51 to 100; and 29% have more than 100 employees.

From this sample, it is observed that the 46% currently exportwhile the remaining 54% do not participate in the international market. Of this last group, a significant majority of 77% indicated that the main reason for not exporting is cost issues. “This data underlines the importance of addressing financial barriers to encourage participation in the global market and promote growth in the sector,” highlighted the report, which was accessed by Ambit.

But in addition, 46% of respondents indicate that they currently export, 64% indicate that the share of total sales remains concentrated in the range of 1% and 10%with this percentage remaining stable compared to the previous quarter. In other words, exports are not growing.

Regarding the use of the installed capacitya considerable decrease is observed in recent quarters, reflected in an increase in those ranges corresponding to a lower percentage.

image.png

Considering a shift as 100% of the installed capacity, a significant decrease is observed as the quarters go by. In the fourth quarter of 2023, the ICU was between 41% and 100%; in the first quarter of 2024, the range was 21% and 80%, and in the second quarter of 2024, the highest percentage was between 21% and 60%.

In this context, the CADIEEL report indicated that the employment level It remained stable for 63% of companies, while 25% indicated that it decreased (17% on average) and the remaining 12% indicated that it increased (12% on average). “It is worrying that 25% of industries reported a decline in their employment levels, which could indicate economic challenges or structural changes”the statistical work warned.

What expectations do entrepreneurs have?

According to the study, Only 54% of entrepreneurs expect to invest in the third quarter. The reasons for not investing include a drop in sales and the current political and economic uncertainty. This is true for both companies that intend to invest and those that choose not to invest during the third quarter of the year.

In contrast, companies that express interest in investing mostly indicate that they will do so with the aim of develop new products and increase installed capacity.

Another of the data that is worrying refers to the production expectation for the coming months. 50% of respondents expect their production to remain stable, suggesting a certain stability in the market. On the other hand, 29% anticipate an increase in production, which could be interpreted as a positive indicator of economic growth and demand. However, it is important to mention that 21% of respondents project a decrease, which could indicate fluctuations in demand or market conditions.

The expectations on domestic demand For the third quarter, the forecasts are as follows: 38% believe that the market will not change, 37% estimate that it will recover, and 25% on average that activity will fall.

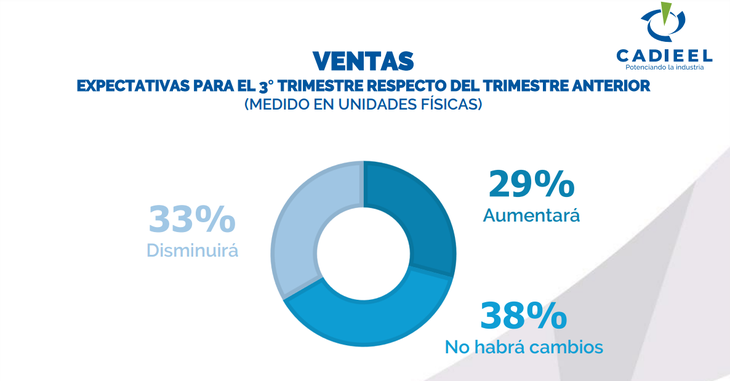

As for the sales expectations The forecasts for the third quarter are not very encouraging, as they suggest a decline in the sector. 38% of respondents expect sales to remain stable. “It is worrying that only 29% expect an increase in their sales, which reflects a decrease in optimism compared to the previous quarter”the report noted. It is also important to note that 33% anticipate a decrease in sales, which indicates an economic slowdown in the short term.

image.png

It is worth noting that only 12% believe that employment will increase and 21% expect a decrease in staff.

Finally, 73% of respondents expect exports to remain stablesuggesting a solid foundation in established trade relations. Furthermore, it is promising to see that 18% anticipate an increase in their exports, indicating potential growth in foreign markets and greater demand for Argentine products on the global stage. And only 9% foresee a decrease in their exports.

“In short, a large majority anticipates stability or even growth in foreign sales, which underlines the importance of continuing to strengthen Argentina’s position in international markets,” the business chamber concluded.

Source: Ambito